Introduction

In the fast-paced and ever-evolving world of forex trading, finding a reliable and profitable strategy is paramount. Among the numerous strategies available, the 3 EMA Away Strategy stands out as a robust and effective approach for traders of all levels. This comprehensive guide will delve into the intricacies of the 3 EMA Away Strategy, equipping you with the knowledge and insights to harness its potential and elevate your forex trading game.

Image: forexearlywarningtrading.blogspot.com

Understanding the 3 EMA Away Strategy

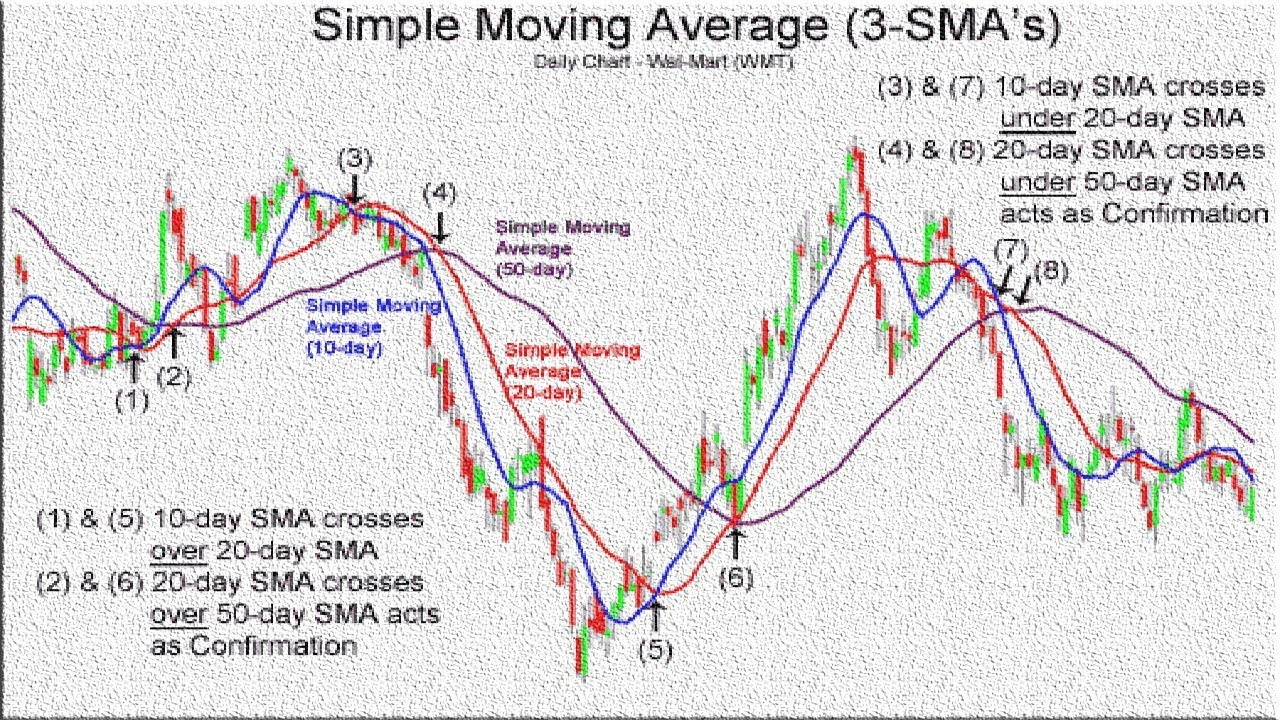

The 3 EMA Away Strategy revolves around the concept of identifying market trends by utilizing three exponential moving averages (EMAs) with distinct periods: 8, 13, and 21. These EMAs represent the average price of a currency pair over a specified number of periods, smoothing out price fluctuations and revealing underlying trends.

The core principle of the 3 EMA Away Strategy lies in the interplay between these three EMAs. When the 8-EMA crosses above the 13-EMA and the 21-EMA, it signals a potential buy opportunity. Conversely, when the 8-EMA crosses below the 13-EMA and the 21-EMA, it suggests a potential sell signal.

Applying the 3 EMA Away Strategy

To effectively implement the 3 EMA Away Strategy, follow these steps:

- Plot the three EMAs (8, 13, and 21) on a forex chart.

- Observe the relationship between the EMAs.

- Identify buy signals when the 8-EMA crosses above the 13-EMA and the 21-EMA.

- Identify sell signals when the 8-EMA crosses below the 13-EMA and the 21-EMA.

- Enter trades in the direction of the identified trend.

Advantages of the 3 EMA Away Strategy

The 3 EMA Away Strategy offers several advantages that make it an attractive choice for forex traders:

- Simplicity: The strategy is easy to understand and apply, making it accessible to traders of all experience levels.

- Reliability: The EMAs provide a robust indication of the underlying market trend, filtering out noise and false signals.

- Timeliness: The strategy provides relatively early signals, allowing traders to capitalize on emerging trends.

- Flexibility: The 3 EMA Away Strategy can be adapted to different time frames and currency pairs, enhancing its versatility.

Image: www.dailyfx.com

Expert Insights and Actionable Tips

To further enhance your understanding and application of the 3 EMA Away Strategy, consider these insights from experienced traders:

- Combine with other indicators: Incorporate additional technical indicators, such as support and resistance levels or stochastic oscillators, to confirm signals and improve accuracy.

- Manage risk: Utilize stop-loss orders to limit potential losses and protect your capital.

- Practice on a demo account: Test the strategy and refine your skills on a demo account before risking real money.

3 Ema Away Strategy Forex Factory

https://youtube.com/watch?v=EmA-nbgvK54

Conclusion

The 3 EMA Away Strategy is a powerful tool that can empower forex traders to navigate market fluctuations with confidence and profitability. Its simplicity, reliability, and flexibility make it an ideal choice for both novice and seasoned traders alike. By embracing the principles and insights outlined in this comprehensive guide, you can unlock the potential of the 3 EMA Away Strategy and transform your forex trading journey.

Remember, the path to forex trading mastery is paved with continuous learning and practice. Embrace the opportunity to explore further resources, engage with fellow traders, and refine your skills over time. With dedication and perseverance, you can harness the transformative power of the 3 EMA Away Strategy and achieve unprecedented success in the dynamic world of forex trading.