The world of financial markets is bustling with opportunities for those daring to delve into the realm of forex trading. Amidst the plethora of strategies, one approach has garnered significant attention—the captivating concept of 200:1 leverage.

Image: www.audacitycapital.co.uk

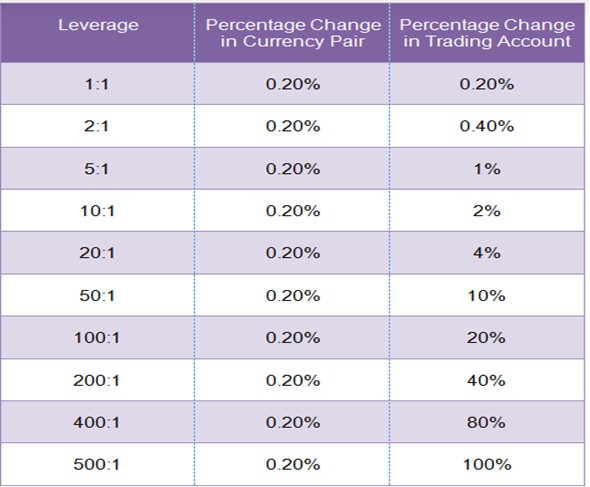

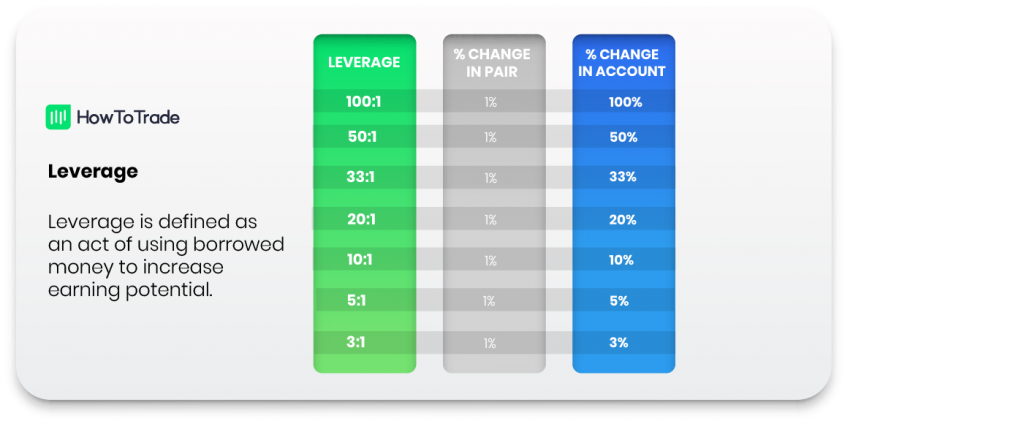

Leverage in forex trading acts as a potent tool that magnifies a trader’s buying power, enabling them to amplify their positions. Imagine having the ability to control an astounding $200,000 worth of currency with a mere deposit of $1,000. This extraordinary leverage opens up a gateway to potentially lucrative profits.

Unleashing the Potential of 200:1 Leverage

200:1 leverage is a double-edged sword that offers both immense promise and potential pitfalls. It’s imperative to wield this tool with caution, adhering to prudent risk management practices. When utilized judiciously, leverage can enhance profit potential, allowing traders to maximize gains from even minor market fluctuations.

To fully grasp the mechanics of leverage, consider the following scenario: With a $1,000 deposit and 200:1 leverage, you open a buy position of $200,000 worth of EUR/USD (1 lot). If the EUR/USD exchange rate rises by just 1%, you’ll amass a profit of $2,000, effectively doubling your initial investment.

However, leverage amplifies not only profits but also losses. If the EUR/USD exchange rate were to fall by 1%, you would incur a $2,000 loss, depleting your $1,000 deposit and potentially triggering a margin call.

Navigating the Risks

Managing the inherent risks associated with leverage requires meticulous planning and calculated decision-making. To trade safely and sustainably, heed these expert recommendations:

- Start Small: Begin with a modest leverage ratio and gradually increase it as your experience and understanding grow.

- Use Stop-loss Orders: Employ stop-loss orders to mitigate potential losses by automatically closing positions if the market moves against you.

- Manage Your Emotions: Trading with leverage can be exhilarating and intimidating. Stay composed and avoid making impulsive decisions under pressure.

- Learn to Hedge: Diversify your portfolio by hedging positions to reduce overall risk exposure.

- Understand the Margin Call Process: Be aware of the margin call process and have a plan in place to respond appropriately.

Frequently Asked Questions

- Q: What is the maximum leverage allowed in forex trading?

A: Leverage levels vary depending on the broker and the jurisdiction. In some cases, leverage as high as 1000:1 may be offered. - Q: Is it advisable to use the highest possible leverage?

A: No, excessive leverage can lead to significant financial losses. It’s prudent to use leverage that aligns with your risk tolerance. - Q: Can I make a lot of money quickly using high leverage?

A: While leverage can magnify profits, it also amplifies losses. Trading with excessive leverage increases the likelihood of rapid financial losses. - Q: How can I calculate my return on investment using leverage?

A: Use the following formula: ROI = (Profit/Initial Investment) * Leverage.

Image: howtotrade.com

200 To 1 Leverage Forex

Conclusion

200:1 leverage in forex trading can be a potent tool for experienced traders seeking amplified profit potential. However, it’s essential to approach this strategy with a deep understanding of its associated risks. Embrace the guidelines and advice presented in this article to harness the power of leverage while mitigating potential pitfalls.

Are you ready to explore the fascinating world of 200:1 leverage and embark on a transformative trading journey? Seize the opportunity and unlock the gateway to enhanced profit possibilities.