Unlock the Secrets of 1m Forex and CFD Data: Your Gateway to Informed Trading

Image: www.forex.com

In the fast-paced world of financial markets, making informed trading decisions is crucial. 1m Forex and CFD data provide invaluable insights, empowering traders with the knowledge to navigate market movements and potentially achieve their financial goals. This comprehensive guide will unravel the intricacies of 1m Forex and CFD data, guiding you through their significance, applications, and potential benefits.

The Power of 1m Forex and CFD Data

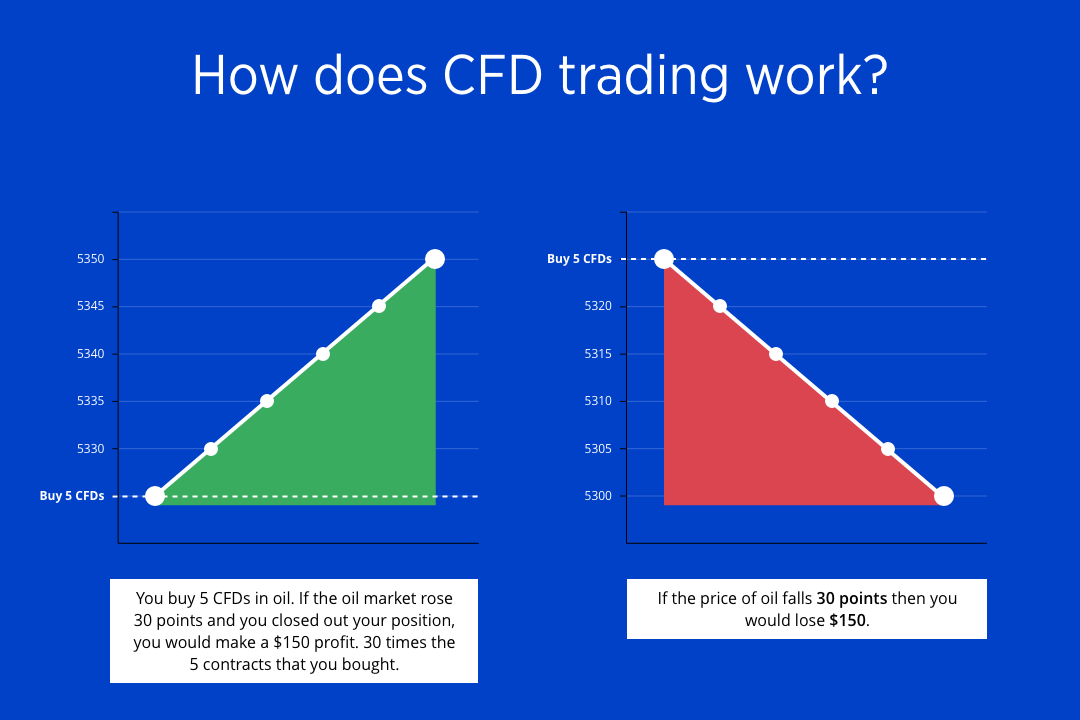

1m Forex data offers a snapshot of real-time foreign exchange rates, updated every minute. This granular level of detail empowers traders with insights into short-term market fluctuations, allowing them to identify potential trading opportunities with greater accuracy. CFDs (Contracts for Difference) complement Forex data by enabling traders to speculate on the price movements of various assets without direct ownership.

Unlocking Market Trends and Patterns

1m Forex and CFD data allow traders to analyze market trends and identify patterns over short periods. By tracking minute-by-minute price changes, traders can detect emerging support and resistance levels, spot breakout opportunities, and predict future market direction with increased confidence. Armed with this knowledge, traders can make timely entries and exits, maximizing profit potential and mitigating risks.

Leveraging Technical Analysis

1m Forex and CFD data serve as the backbone of technical analysis, a popular trading strategy that relies on historical price data to forecast future price movements. By applying technical indicators and chart patterns to 1m data, traders can identify potential trend reversals, consolidate ranges, and determine the strength of market momentum. This in-depth analysis empowers traders to make informed decisions and develop robust trading strategies tailored to their risk appetite and trading goals.

The Importance of Reliable Data Sources

The accuracy and reliability of 1m Forex and CFD data are paramount for effective trading. Ensure that the data provider has a proven track record of accuracy, utilizes reputable sources, and provides real-time updates. Trustworthy data ensures that traders can rely on the information provided to make confident decisions, minimizing the risk of misinterpreting market movements.

Practical Applications: Minimizing Risk and Enhancing Returns

1m Forex and CFD data empower traders to:

- Identify short-term price movements: Detect profitable trading opportunities and avoid sudden market reversals.

- Manage risk exposure: Determine optimal stop-loss levels and set risk management strategies to minimize potential losses.

- Fine-tune trading strategies: Adjust trading parameters based on real-time market behavior, ensuring alignment with market conditions.

- Enhance trading performance: Leverage insights from 1m data to improve entry and exit decisions, potentially maximizing returns.

In conclusion, 1m Forex and CFD data are invaluable tools for traders seeking an edge in the financial markets. By harnessing the power of minute-by-minute data, traders can gain deeper insights into market movements, identify trading opportunities, and fine-tune their strategies. However, it is crucial to prioritize data reliability and utilize insights responsibly to maximize the potential benefits of these data while minimizing risks. Embrace the world of 1m Forex and CFD data today and unlock a world of informed trading possibilities.

Image: binaryoptionsautotradingsoftwa.logdown.com

1m Forex And Cfd Data