Unveiling the Power of Time-Based Charts

Foraying into the realm of forex trading is a captivating endeavor, yet navigating its intricacies can seem daunting. Allow us to guide you through the transformative power of time-based charts, particularly the enigmatic 15-minute chart, a time-tested tool that empowers traders to identify market trends and capitalize on profitable opportunities.

Image: www.tradegoldonline.com

Harnessing the 15-minute Chart

The 15-minute chart is a graphical representation of price data over 15-minute intervals. By tracking price movements within this concise timeframe, traders can discern short-term market patterns and fluctuations with remarkable precision. Its granular nature unveils hidden opportunities often missed by longer timeframe charts. The 15-minute chart empowers traders to:

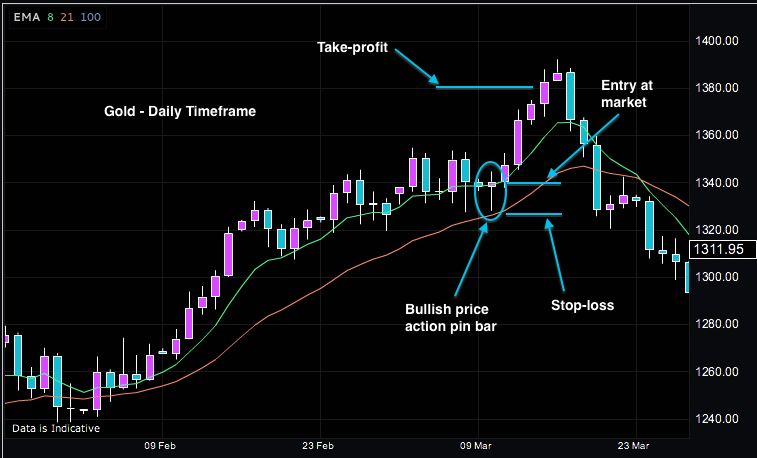

- Identify Trends: Monitor price action to discern prevailing market trends, allowing traders to align their strategies accordingly.

- Gauge Momentum: Analyze the slope and angle of price movements to determine market momentum, providing insight into the strength of market forces.

- Identify Reversals: By identifying candlestick patterns and technical indicators, traders can anticipate potential trend reversals, enabling them to adjust positions strategically.

- Time Entries and Exits: Utilize chart patterns to pinpoint optimal entry and exit points, maximizing profit potential.

- Manage Risk: Set stop-loss and take-profit orders based on market movements within the 15-minute timeframe, safeguarding trading capital.

Cutting-Edge Insights and Expert Guidance

Harnessing the 15-minute chart’s capabilities requires a keen understanding of its nuances. Here are some invaluable tips from seasoned forex traders:

- Identify High-Volume Periods: Focus on trading during market hours with high liquidity, as these periods typically exhibit more predictable price patterns.

- Combine Timeframes: Use multiple timeframes, including higher timeframes like the 4-hour or daily charts, to confirm trends and identify broader market context.

- Utilize Technical Indicators: Employ technical indicators such as moving averages, Bollinger Bands, and RSI to complement your chart analysis, providing additional confirmation of market conditions.

- Practice Risk Management: Implement robust risk management strategies, including proper position sizing, stop-loss orders, and profit targets.

Frequently Asked Questions

- What are the advantages of using a 15-minute chart?

Allows for precise trend identification, momentum gauging, and timely entry and exit points. - How can I identify trends using a 15-minute chart?

Observe the direction and slope of price movements to discern current market trends. - How do I set stop-loss and take-profit orders on a 15-minute chart?

Use technical indicators and chart patterns to determine appropriate stop-loss and take-profit levels.

Image: forexpops.com

15 Min Chart Forex Trading

https://youtube.com/watch?v=j8ZwZMfe304

Conclusion

Embarking on the path of 15-minute chart trading opens up a world of possibilities for forex traders. By harnessing its power, traders can unlock the secrets of market timing, identify profitable opportunities, and navigate market complexities with newfound confidence. The time to embrace this transformative tool is now. Are you ready to elevate your forex trading game with the 15-minute chart?