The foreign exchange (forex) market, the largest financial market in the world, plays a pivotal role in global economic activity and provides opportunities for diverse participants, including central banks, commercial banks, institutional investors, and retail traders. Forex trading volume serves as a critical indicator of market liquidity and activity levels, providing insights into the overall health of the market and the sentiments of market participants.

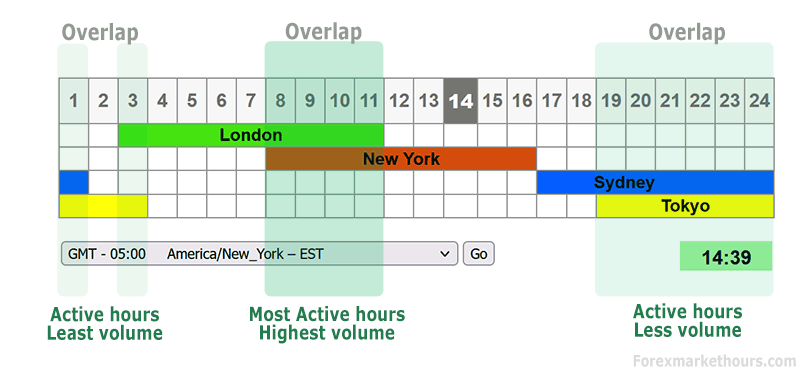

Image: www.forexmarkethours.com

Understanding Forex Trading Volume

Forex trading volume refers to the total amount of currencies traded in the foreign exchange market over a specific period, typically measured in US dollars. This volume reflects the total turnover or value of all forex transactions executed during that time frame. High trading volumes indicate a liquid market with increased participation, while low volumes may suggest a relatively inactive or illiquid market. A liquid market provides better execution prices, reduced transaction costs, and improved order fulfillment for traders.

Forex Trading Volume on 10-Aug-2019

On August 10, 2019, the global forex market witnessed an average daily trading volume of approximately USD 6.6 trillion, indicating a relatively high level of activity. This volume represents a significant increase compared to the previous month, highlighting growing participation and interest in the forex market. The major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, accounted for the majority of this trading activity.

Factors Influencing Forex Trading Volume

Various factors influence forex trading volume, including:

- Economic Events: Significant economic events, such as interest rate decisions, employment data, and geopolitical developments, can lead to increased volatility and higher trading volume as market participants react to the news and adjust their positions.

- Market Sentiment: Bullish or bearish market sentiment towards a particular currency or currency pair can drive trading volume, as traders seek to capitalize on perceived opportunities or protect against potential losses.

- Speculation: Speculation is a significant factor in forex trading, with many traders attempting to profit from short-term price movements. Speculative activity can contribute to increased trading volume, particularly during periods of market uncertainty.

- Trading Strategies: Different trading strategies employed by market participants, such as scalping, day trading, or long-term investing, impact trading volume. High-frequency trading, for instance, involves numerous small trades executed at rapid speeds, which can significantly increase overall volume.

- Seasonality: The time of year, day of the week, and time of day can also influence forex trading volume. Market activity tends to be higher during the European and American trading sessions and may slow down during holidays or periods of reduced liquidity.

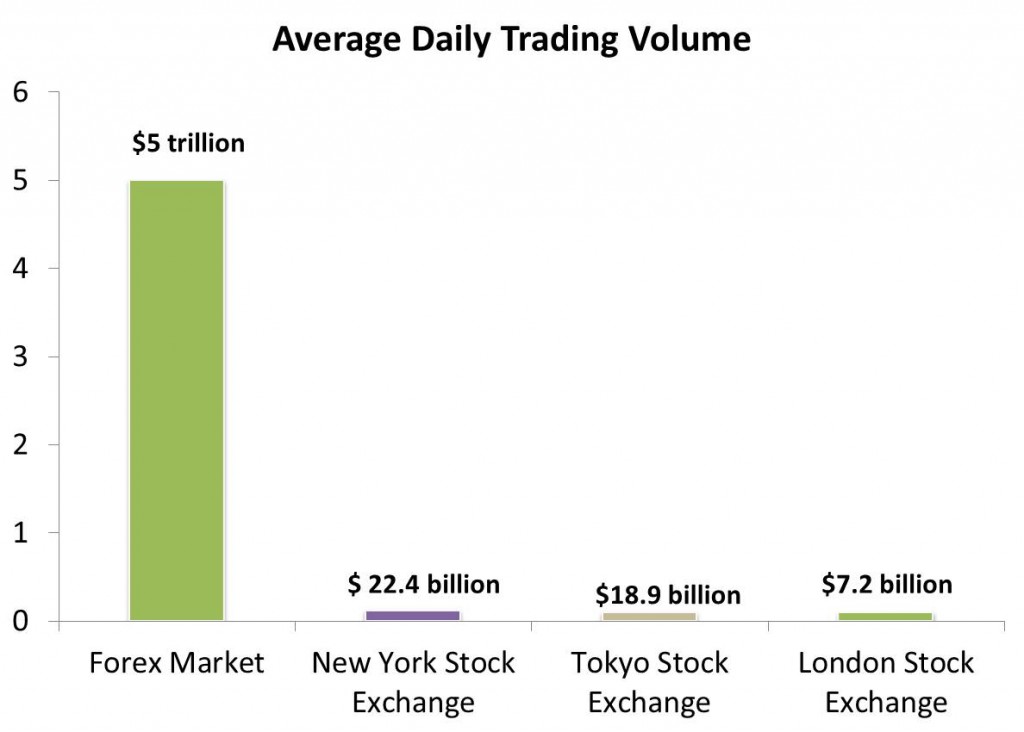

Image: www.educba.com

Importance of Forex Trading Volume

Forex trading volume provides valuable insights for market participants, serving several important purposes:

- Assessing Market Liquidity: Trading volume is a key indicator of market liquidity, indicating the ease with which traders can enter and exit positions. Higher volumes reflect a more liquid market, while lower volumes may suggest a less liquid environment.

- Identifying Market Trends: Volume analysis can assist traders in recognizing potential trends or reversals. Rising volume during a particular market move often suggests growing momentum and the potential for further movement in the same direction.

- Evaluating Market Sentiment: The level of trading volume can provide clues about market sentiment. High volume during a particular price move may reflect strong support or resistance, indicating that the market is in agreement with the prevailing trend.

- Timing Trades: Volume analysis can assist traders to better time their trades. Identifying periods of increased volume can suggest potential opportunities to enter or exit positions, while low volume may indicate a more challenging trading environment.

10-Aug-2019 Forex Market Trading Volume

Conclusion

Forex market trading volume is a crucial metric that provides invaluable insights into the liquidity, activity, and sentiment of the market. By understanding the factors influencing trading volume and how to analyze it, traders can make more informed decisions and navigate the complexities of the forex market more effectively.

Are you interested in learning more about forex trading volume and its impact on market dynamics?