Prologue:

In the fast-paced realm of foreign exchange, a mastery of concepts is paramount. As a trader, you may have encountered the term “lot.” But what exactly is 1 lot in forex? Delve into this comprehensive guide to unravel the significance of this standard contract size and empower your trading endeavors.

Image: forexbee.co

Understanding the Forex Lot:

Definition:

A lot in forex trading represents a standardized contract size, indicating the number of base currency units involved in a particular transaction. It serves as a fundamental unit of trade, ensuring transparency and liquidity within the market.

History and Meaning:

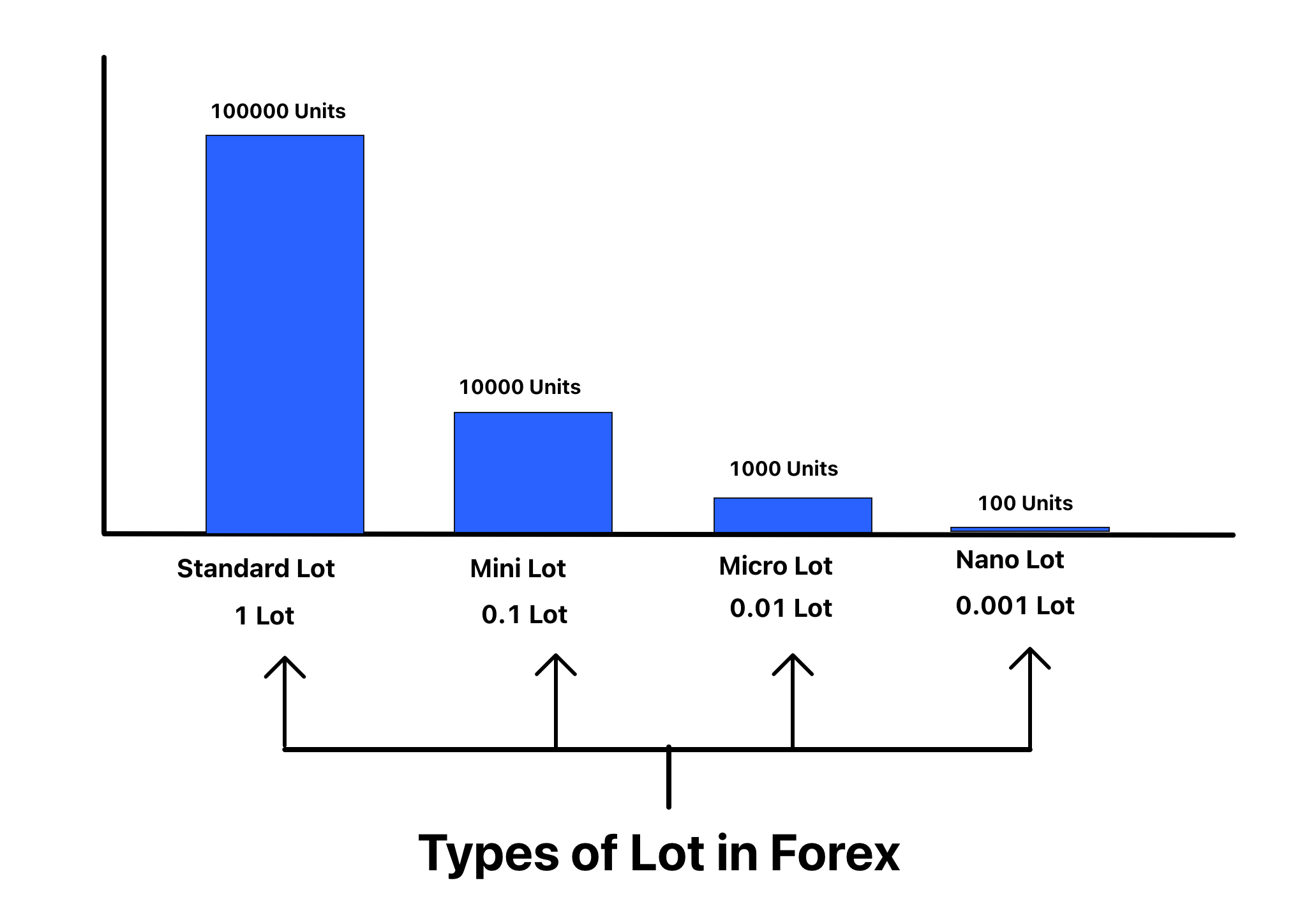

The concept of the forex lot emerged from the need for a uniform measurement system in currency trading. Over time, different lot sizes have been introduced to cater to traders with varied capital and risk appetites. 1 lot, often referred to as “standard lot” or “round lot,” remains the most commonly traded size, amounting to 100,000 base currency units.

Image: www.forex.academy

Specifics of 1 Forex Lot:

In the global forex market, 1 lot is typically equivalent to the following:

- 100,000 units of the base currency (e.g., EUR, USD, GBP)

- 100 micro lots

- 10 mini lots

- 0.1 standard lots

Examples:

- When you trade 1 lot of EUR/USD, you are buying or selling 100,000 euros.

- If you have a trade position of 0.5 lots of GBP/JPY, it means you are trading 50,000 British pounds.

Latest Trends and Developments:

The forex market is constantly adapting to technological advancements and evolving trading patterns. Smaller lot sizes, known as “micro lots” and “nano lots,” have gained popularity among retail traders due to their accessibility and lower capital requirements. These smaller lot sizes allow traders to enter the forex market with a more manageable risk exposure.

Tips and Expert Advice:

When trading with 1 lot in forex, it’s crucial to understand your risk tolerance and trading strategy. Here are some tips to consider:

- Determine the appropriate lot size based on your account balance and risk appetite.

- Use leverage cautiously and consider your ability to withstand potential losses.

- Implement a sound risk management strategy, including stop-loss and take-profit orders.

- Stay updated on market news and economic indicators that can impact currency values.

FAQ:

Q: Why is it important to trade in standard lot sizes?

A: Standard lot sizes ensure market liquidity and facilitate easier order execution, reducing the risk of slippage.

Q: Can I trade less than 1 lot in forex?

A: Yes, you can trade less than 1 lot using fractional lot sizes or micro lots. This allows for greater flexibility and reduced capital requirements.

Q: How do I calculate the value of 1 lot in forex?

A: To determine the value in USD of 1 lot in EUR/USD, you multiply the lot size (100,000 euros) by the current EUR/USD exchange rate.

1 Lot In Forex Is

Conclusion:

Understanding the concept of 1 lot in forex is essential for successful trading. By mastering this standard contract size, traders can optimize their risk management, navigate the market effectively, and increase their chances of profitability. Remember, trading foreign exchange requires a deep understanding of the market, discipline, and a commitment to continuous learning. Are you ready to embark on the captivating journey of forex trading?