In today’s globalized world, frequent international travelers rely heavily on the convenience of forex cards to manage their finances abroad. Amidst the numerous options available, Yes Bank’s forex card stands out as a popular choice due to its widespread acceptance and competitive exchange rates. However, it’s crucial to be aware of the associated charges before using this card to avoid any unpleasant surprises during your travels. In this detailed guide, we will explore the various fees levied by Yes Bank on its forex card, providing you with a comprehensive understanding of the costs involved.

Image: forextradingzim.blogspot.com

Forex Card Basics: A Primer

A forex card is a prepaid card that allows you to load multiple currencies and spend them across the globe. It offers the advantage of locking in exchange rates at the time of loading, thus protecting you from potential fluctuations. Forex cards have gained immense popularity among travelers seeking to avoid high conversion fees and the inconvenience of exchanging currency at airports or local exchange bureaus.

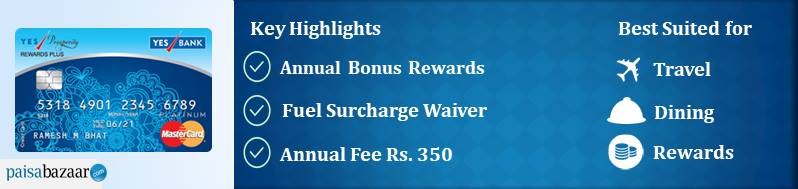

Yes Bank’s Forex Card: Features and Charges

Yes Bank’s forex card comes with a host of features designed to cater to the needs of international travelers. It supports over 20 major currencies, enabling you to easily manage your finances in different countries. Moreover, the card is widely accepted at ATMs and merchant outlets globally, providing you with accessible cash and purchase options.

However, it’s important to be aware of the charges associated with using Yes Bank’s forex card. These charges can vary depending on the transaction type and location. Here’s a breakdown of the most common fees:

1. Currency Conversion Charges

Yes Bank levies a currency conversion charge for each transaction made on your forex card. This charge typically ranges from 2% to 3% of the transaction amount, depending on the currency pair being converted. It’s essential to note that these charges are in addition to the exchange rate markup, which is typically around 1-2%.

Image: forexcurrencytips1.blogspot.com

2. ATM Withdrawal Fees

Withdrawing cash from ATMs using your Yes Bank forex card also incurs a fee. This fee varies depending on whether you’re withdrawing from an ATM within India or overseas. For domestic ATM withdrawals, a charge of ₹150 plus applicable taxes is levied, while international ATM withdrawals incur a fee of ₹500 plus applicable taxes.

3. Card Issuance and Renewal Fees

Yes Bank charges a fee for issuing the forex card upon your initial application. This fee can range from ₹200 to ₹500, depending on the card variant you choose. Additionally, there may be an annual renewal fee charged for continuing to use the card beyond its expiry date.

4. Inactivity Fees

If your Yes Bank forex card remains inactive for an extended period, a monthly inactivity fee may be levied. This fee typically ranges from ₹50 to ₹100 and is charged to cover the maintenance costs associated with keeping your account active.

5. Other Chargeable Services

Yes Bank may charge additional fees for specific services related to your forex card. These services may include balance inquiries, PIN changes, and currency reloading. It’s recommended to check with your bank for a detailed list of all chargeable services and their respective fees.

Minimizing Forex Card Charges

While using a forex card offers numerous advantages, it’s wise to employ strategies to minimize the associated charges. Here are a few tips to help you reduce your expenses:

1. Load Currencies Strategically

To avoid frequent currency conversion charges, load only the currencies you anticipate needing during your trip. This will help limit the number of conversions and minimize the accumulated charges.

2. Use ATMs Judiciously

Withdraw cash from ATMs only when necessary, as each withdrawal incurs a fee. Consider carrying a small amount of local currency for immediate expenses and using your forex card primarily for larger purchases.

3. Maintain Card Activity

To avoid inactivity fees, make sure to use your forex card regularly. Even small transactions or balance checks can help keep your account active and prevent any unnecessary charges.

4. Explore Alternative Options

If you anticipate making frequent international transactions, it may be beneficial to consider a multi-currency account or a global payment platform. These services often offer more competitive exchange rates and lower transaction fees compared to traditional forex cards.

Yes Bank Forex Card Charges

Conclusion

Yes Bank’s forex card provides a convenient and secure way to manage your finances during international travel. However, it’s crucial to be aware of the associated charges to budget effectively and avoid any surprises. By understanding the various fees and implementing cost-saving strategies, you can maximize the benefits of using a Yes Bank forex card and enjoy seamless financial management throughout your global adventures.