In the labyrinth of financial markets, where the allure of wealth and the fear of loss intertwine, discerning investors seek havens that maximize gains while mitigating risks. This arduous search leads many toward the enigmatic world of forex trading, a realm where the ebb and flow of global currencies dance to the rhythm of economic news, political events, and macroeconomic forces. Embark on an intellectual odyssey as we unravel the tapestry of why forex trading reigns supreme over its stock market counterpart.

Image: www.keenbase-trading.com

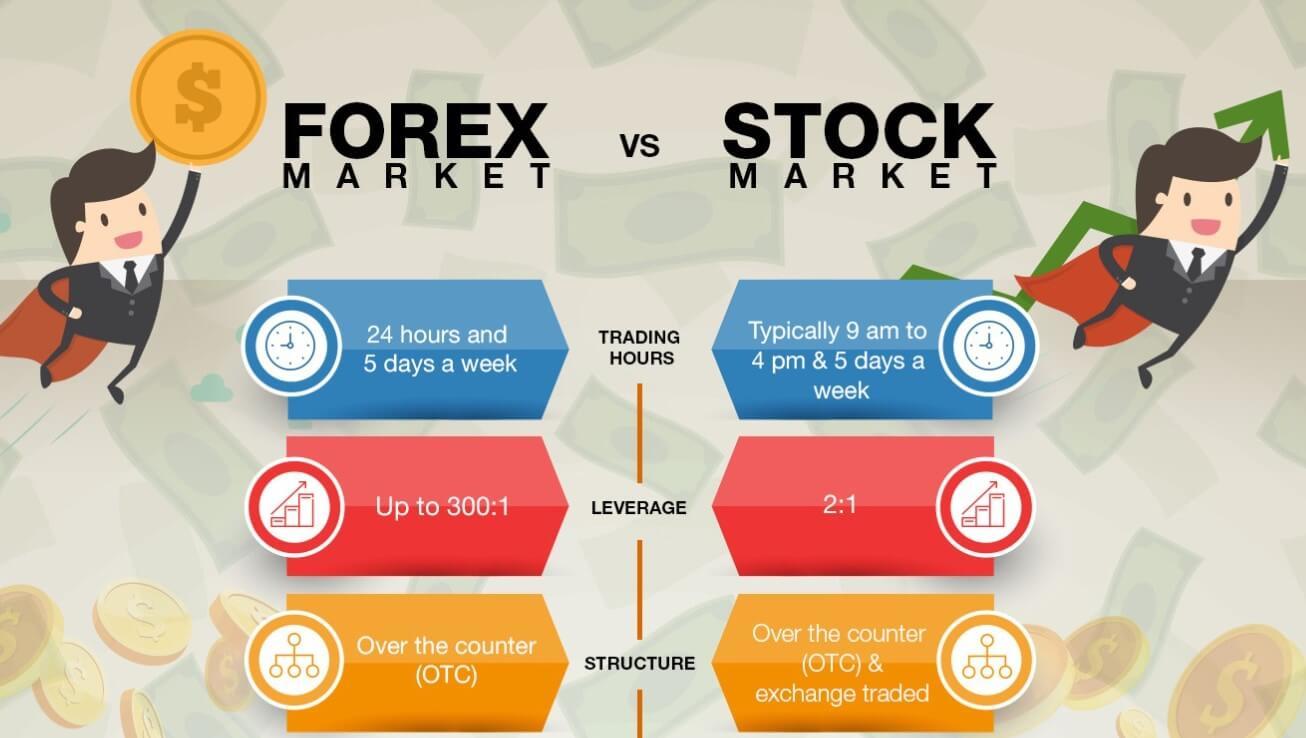

Forex trading, the exchange of currencies between nations, eclipses stocks in several pivotal aspects, empowering savvy investors with unparalleled opportunities for financial growth and stability. Below, we delve into the core advantages that set forex trading apart as the superior investment choice:

1. The Unrivaled Liquidity of Forex Markets

The forex market is an ocean of liquidity, boasting a daily trading volume that dwarfs the combined turnover of all stock exchanges globally. This staggering liquidity ensures that buy and sell orders are executed swiftly and efficiently, minimizing slippage and maximizing profitability. Traders can navigate the currency markets with unmatched confidence, knowing that their transactions will be fulfilled seamlessly.

2. 24-Hour Accessibility: Capture Opportunities When the World Sleeps

Unlike stocks, which are confined to the trading hours of specific exchanges, forex markets operate 24 hours a day, five days a week. This round-the-clock accessibility allows traders to capitalize on market movements and news events around the globe, regardless of time zones. Whether you’re a seasoned night owl or an early morning riser, the forex market beckons you to seize opportunities at your convenience.

3. Leverage: A Double-Edged Sword with Potential for Magnified Returns

Forex brokers offer leverage, a unique feature that amplifies both potential profits and losses. While this financial tool must be wielded with caution, experienced traders can harness its power to maximize their returns. By judiciously employing leverage, investors can multiply their profits without committing substantial capital.

Image: www.slideserve.com

4. Low Transaction Costs: Embrace Savings, Maximize Profits

Forex trading boasts remarkably low transaction costs compared to stock trading. The absence of commissions and exchange fees significantly reduces the overall expenses associated with currency transactions, allowing traders to channel more of their earnings into their portfolio. This cost advantage is particularly advantageous for frequent traders or those who trade large volumes.

5. Currency Pairs: Diversify Your Portfolio, Mitigate Risk

The forex market presents a vast array of currency pairs to trade, each with its own unique risk-reward profile. By diversifying their portfolio across multiple currency pairs, traders can reduce their exposure to any single currency and hedge against potential losses. This diversification strategy enhances the stability of their portfolio, providing peace of mind and resilience during market downturns.

6. Global Economic News: Harness Information, Predict Market Direction

The forex market is inextricably linked to the global economy, with news events and macroeconomic data significantly influencing currency valuations. Traders who stay abreast of economic news, such as GDP reports, interest rate decisions, and political developments, gain an invaluable edge. By discerning market-moving events, they can make informed trading decisions and position themselves to capture profitable opportunities.

7. Forex Trading Platforms: A Gateway to Financial Agility

Modern forex trading platforms empower traders with a suite of sophisticated tools and resources. From advanced charting capabilities and real-time news feeds to automated trading systems and risk management features, these cutting-edge platforms enhance trading efficiency and enable traders to make well-informed decisions.

Why Forex Trading Is Better Than Stocks

8. Educational Resources: Empower Yourself with Knowledge

Numerous educational resources are available to aspiring and seasoned forex traders alike. Books, online courses, webinars, and seminars provide comprehensive guidance on market analysis, trading strategies, and risk management. By embracing these learning opportunities, traders can continuously expand their knowledge and refine their trading acumen.

In conclusion, forex trading presents a compelling value proposition for investors seeking financial growth and stability. Its unparalleled liquidity, 24-hour accessibility, leverage potential, low transaction costs, currency pair diversification options, sensitivity to global economic news, sophisticated trading platforms, and abundance of educational resources collectively elevate forex trading as the superior investment choice. Embrace the world of currencies and witness your financial horizons soar.