When I first embarked on my forex trading journey, I was brimming with confidence and fueled by dreams of financial freedom. However, as I navigated the volatile waters of the market, I encountered a humbling realization: many traders lose money, and I was not immune to this fate. Determined to decipher the reasons behind my setbacks, I embarked on a quest for knowledge, seeking out experienced traders and delving into market analysis.

Image: medium.com

Through my exploration, I have compiled a comprehensive guide that unveils the most common reasons why forex traders fall prey to financial losses. Understanding these pitfalls will empower you to refine your trading strategies and increase your chances of success in this challenging market.

Overtrading: The Lure of Quick Profits

The allure of quick profits can entice traders to enter too many trades in a short period, often resulting in disastrous consequences. Overtrading places an excessive burden on your trading capital, making it difficult to absorb losses and recover from setbacks. It’s crucial to prioritize quality over quantity and focus on executing well-researched and strategic trades.

Resist the temptation to chase every market fluctuation, and instead, develop a disciplined trading plan that aligns with your risk tolerance and financial goals. Patience is the key to long-term success in forex trading.

Poor Risk Management: The Seeds of Financial Ruin

Inadequate risk management practices sow the seeds of financial ruin for many forex traders. Neglecting to establish clear risk parameters, such as stop-loss levels and position sizing, can expose your capital to excessive volatility. It’s imperative to determine the maximum amount you’re willing to lose on a single trade and stick to it.

Furthermore, employing leverage without thoroughly understanding its implications can amplify both profits and losses. Leverage is a double-edged sword, and it’s vital to use it prudently. Beginner traders are strongly advised to trade with lower leverage levels until they gain sufficient experience.

Emotional Trading: The Peril of Market Amnesia

When emotions cloud our judgment, the consequences can be disastrous in forex trading. Fear, greed, and revenge trading can lead to impulsive decisions that deviate from your trading plan. These emotions often lead to chasing losses and exiting winning positions prematurely.

Successful forex traders maintain a cool head and trade with discipline. They understand that emotions are part of human nature, but they refuse to let them dictate their trading decisions. By controlling your emotions and sticking to your trading plan, you can avoid costly mistakes and improve your chances of long-term success.

Image: tradeciety.com

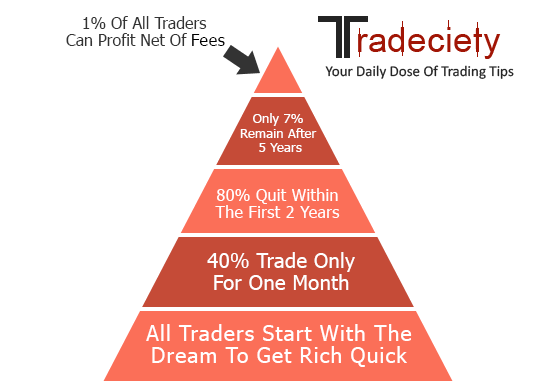

Lack of Trading Education: The Path of Least Resistance

Jumping into forex trading without proper education is akin to navigating a labyrinth without a map. Many traders underestimate the complexities of forex trading and fail to invest in their education. As a result, they fall victim to costly mistakes that could have been avoided with a solid foundation of knowledge.

Take the time to acquire a comprehensive understanding of forex trading fundamentals, technical analysis, and risk management techniques. Seek out reputable sources of education, such as books, online courses, and webinars, and make a commitment to continuous learning. The more you know, the better equipped you’ll be to make informed trading decisions.

Chasing the Holy Grail: The Myth of the Perfect Strategy

The persistent pursuit of the “holy grail” of trading strategies is a common trap that ensnares many forex traders. They tirelessly search for the perfect strategy, believing it will unlock the key to consistent profits. However, the truth is that no single strategy is infallible.

Instead of chasing elusive trading systems, focus on developing your own strategies that align with your risk tolerance and trading style. Practice these strategies diligently on a demo account, and make adjustments as needed. Remember, consistency and discipline are far more important than the specific strategy you choose.

Tips and Expert Advice for Forex Traders

To enhance your forex trading journey, consider the following tips and expert advice:

- Start small and gradually increase your trading size as you gain experience.

- Set realistic profit targets and stick to them.

- Develop a comprehensive trading plan and trade according to it.

- Use stop-loss orders to protect your capital from excessive losses.

- Control your emotions and avoid making impulsive decisions.

Remember, forex trading is a marathon, not a sprint. By adhering to these principles and continuously learning and improving, you can increase your chances of achieving your financial goals.

Why Do Forex Traders Lose Money

FAQs on Forex Trading Mistakes

- Q: Why do I keep overtrading?

- Overtrading typically stems from excessive greed and overconfidence. Traders who overtrade often want to make large profits quickly, leading them to trade too frequently.

- Q: How can I reduce my risk in forex trading?

- Employing stop-loss orders, position sizing, and trading with lower leverage can significantly reduce your risk.

- Q: Is it possible to eliminate emotional trading?

- While it’s impossible to eliminate emotions entirely, successful traders learn to control them and make decisions based on objective analysis rather than emotional impulses.

In closing, understanding the reasons why forex traders lose money is the first step towards becoming a successful trader.

By avoiding the common pitfalls discussed in this article and embracing the principles outlined, you can increase your chances of achieving your financial goals and find success in the challenging yet rewarding world of forex trading.

Do you have any questions or concerns about forex trading? Let’s engage in a dialogue and explore this fascinating topic further.