Thriving in the Forex Market: Selecting the Ideal Trading Session

The fast-paced world of forex trading presents a dynamic landscape where timing is everything. Determining the optimal trading session is the key to unlocking a world of opportunities and maximizing profits. Let’s delve into the intricacies of each session, empowering you to make informed decisions and elevate your trading strategy.

Image: dailypriceaction.com

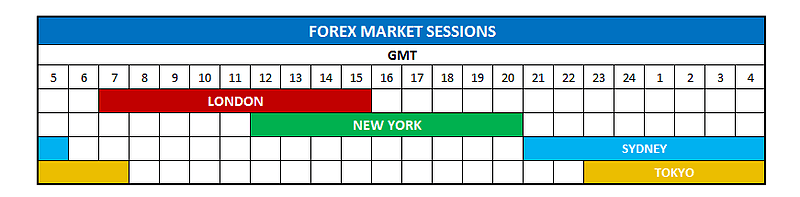

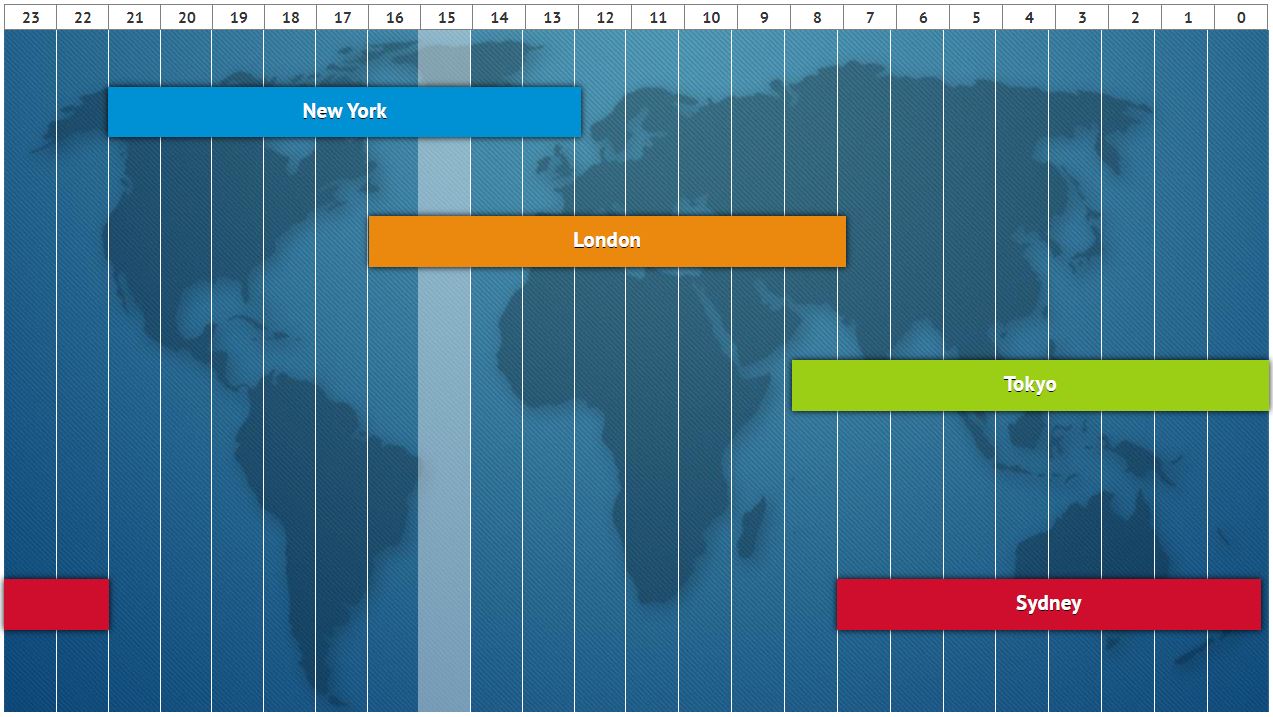

The Essence of Forex Trading Sessions

The forex market, being a global enterprise, operates seamlessly 24 hours a day, 5 days a week. However, the market’s activity and volatility fluctuate depending on the time of day. This is why traders have divided the market into distinct sessions, each characterized by unique trading patterns and behaviors.

1. Asian Session (10 PM – 7 AM EST)

The Asian session marks the start of the forex day, encompassing traders from Tokyo, Hong Kong, and Singapore. This session’s activity typically centers around the major currency pairs involving the Japanese Yen (JPY). Due to the prevalence of large Japanese banks, this session often exhibits high liquidity.

2. European Session (7 AM – 2 PM EST)

The European session is where the bulk of retail and institutional trading occurs. With the participation of London, Frankfurt, and Zurich, the euro (EUR) pairs occupy the spotlight. High volume and significant volatility often characterize this session as European economic data announcements have the potential to trigger market movements.

Image: nlvx.com

3. American Session (1 PM – 10 PM EST)

The American session is the final leg of the forex trading day, presided over by traders from New York City. The US dollar (USD) dominates this session, heavily influenced by economic news from the United States. High liquidity and volatility are the hallmarks of this session, often presenting ideal opportunities for short-term trades.

Factors Influencing Session Selection

The choice of the optimal trading session hinges on several crucial factors, including:

-

Risk Tolerance: Different sessions exhibit varying levels of volatility. Traders with higher risk tolerance may prefer the European or American sessions, while those with lower risk tolerance may find solace in the Asian session.

-

Trading Strategy: Scalping, day trading, and swing trading suit different sessional characteristics. Scalping and day trading thrive in high-volume sessions, while swing trading plays well in slower-paced sessions.

-

Time Zone: Trading during your local trading hours ensures optimal focus and flexibility. For example, if you are located in the United States, the American session might be a better fit.

Expert Insights and Tips

Master traders often impart invaluable advice to aspiring forex enthusiasts. Let’s examine a few:

-

Study Session Patterns: Analyze historical data to discern the prevailing trends and characteristics of each session. This knowledge will arm you with the understanding necessary to make informed decisions.

-

Diversify Trading Sessions: Instead of limiting yourself to a single session, consider diversifying your trading activities across different sessions. This approach broadens your opportunities and mitigates risk by exploiting the strengths of each session.

-

Utilize Economic Calendars: Economic events and data releases can significantly impact market volatility. Use economic calendars to identify potential catalysts and adjust your trading strategy accordingly.

Frequently Asked Questions (FAQs)

– What is the best session for beginners? The Asian session often suits beginners as it tends to be less volatile and allows for a more gradual entry into the market.

– What is the most profitable session? The European and American sessions typically experience the highest volume and volatility, presenting ample opportunities for skilled traders.

– Can I trade forex during the weekend? While the forex market is closed on weekends, retail traders can still access over-the-counter (OTC) platforms that offer weekend trading.

Which Session To Trade Forex

Embark on Your Forex Trading Journey with Confidence

Understanding the intricacies of each trading session empowers you to craft a comprehensive trading strategy that aligns with your goals, risk tolerance, and time schedule. Whether you’re a seasoned trader or just starting your forex adventure, mastering the art of session selection will undoubtedly elevate your profitability and transform your trading experience.