Immerse yourself in the captivating world of foreign exchange, where the ebb and flow of currencies shape global economies and countless lives. As a seasoned currency trader, I’ve witnessed firsthand the immense influence of the forex market, a realm where trillions of dollars exchange hands daily. In this comprehensive guide, we embark on a journey to unravel the currencies that command this vibrant marketplace.

Image: www.forex.academy

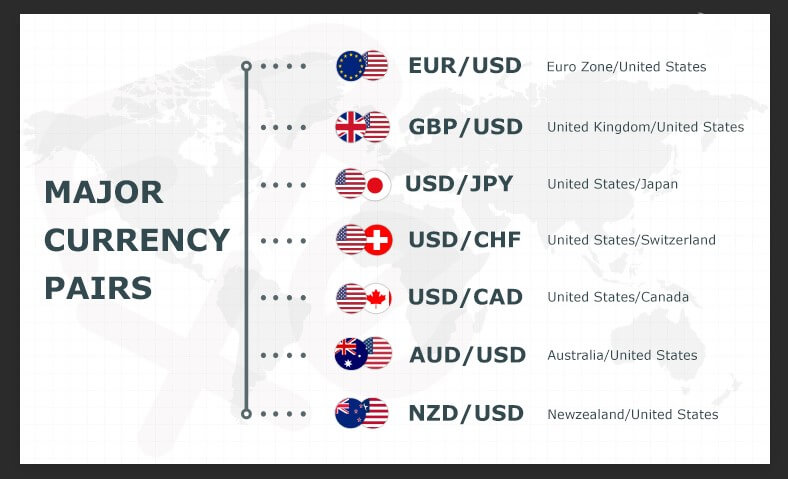

Currency Pairs: The Lifeblood of Forex Trading

At the heart of forex transactions lies the exchange of currency pairs. These pairings pit two currencies against each other, representing the buying and selling of one currency in relation to another. Understanding the dynamics of currency pairs holds the key to successful trading.

The forex market is dominated by three major currency pairs, known as “majors”: the euro versus the U.S. dollar (EUR/USD), the U.S. dollar versus the Japanese yen (USD/JPY), and the U.S. dollar versus the British pound (USD/GBP). Together, these pairs account for the lion’s share of forex trading volume, reflecting their economic significance and global influence.

Beyond the Majors: The Minor Currencies

While the majors reign supreme, a plethora of minor currencies also play vital roles in the forex market. These include currencies from developed economies, such as the Swiss franc (CHF), the Canadian dollar (CAD), and the Australian dollar (AUD), as well as currencies from emerging economies, such as the Brazilian real (BRL), the Indian rupee (INR), and the Chinese renminbi (CNY).

Minor currencies offer traders unique opportunities due to their volatility and potential for growth. However, entering these markets requires a deeper understanding of the underlying economies and geopolitical factors that influence their value.

Safe-Haven Currencies: The Bastion of Stability

During periods of economic or political turmoil, investors flock to safe-haven currencies, which are perceived as stable and reliable. These currencies typically include the U.S. dollar, the Swiss franc, and the Japanese yen. Their value tends to increase during times of uncertainty, providing refuge for investors seeking to preserve their wealth.

Understanding the role of safe-haven currencies is crucial for navigating volatile market conditions and making informed trading decisions. By incorporating them into a well-balanced portfolio, traders can mitigate risk and safeguard their investments during turbulent times.

Image: www.forexstrategieswork.com

Emerging Market Currencies: The Promise and Peril

Emerging market currencies present both tantalizing opportunities and inherent risks. Their rapid growth potential and undervalued nature attract many traders seeking high returns. However, these currencies also face significant volatility due to political instability, economic downturns, and currency fluctuations.

Trading emerging market currencies requires a keen eye for risk and a deep understanding of the underlying economic and political dynamics. By carefully weighing the potential rewards and risks, traders can harness the potential of these markets while mitigating their inherent volatility.

Tips and Expert Advice for Forex Traders

Navigating the forex market successfully demands a combination of knowledge, strategy, and experience. Seasoned traders have honed their skills and developed invaluable tips that can guide aspiring forex traders.

Stay Informed: Keep abreast of global economic news and geopolitical events that can influence currency values. Monitor interest rate decisions, monetary policies, and economic indicators to anticipate market movements.

Manage Risk Wisely: Forex trading is inherently risky, so risk management is paramount. Determine your risk tolerance and implement a sound risk management strategy, such as stop-loss orders and position sizing.

Frequently Asked Questions (FAQs)

Q1. What are the benefits of trading forex?

Forex trading offers several benefits, including high liquidity, accessible leverage, the ability to speculate on both rising and falling markets, and the potential for significant returns.

Q2. How do I get started with forex trading?

To get started, you will need to open an account with a reputable forex broker, learn the basics of forex trading, and develop a trading strategy. Practice your trading skills using a demo account before investing real capital.

Which Currencies Are Traded In The Forex Market

https://youtube.com/watch?v=TeKStgi_1ig

Conclusion

Mastering the ins and outs of the forex market empowers traders to navigate currency fluctuations and tap into its vast potential. Armed with an understanding of major and minor currencies, safe-haven assets, emerging market currencies, and expert tips, traders can make informed decisions and seize profitable opportunities. Remember, the world of forex is a dynamic and ever-changing landscape, so continuous learning and adaptability are key to long-term success.

If you are passionate about the financial markets and eager to deepen your understanding of currency trading, continue exploring the resources available online and immerse yourself in the thrilling world of forex.