Introduction

Image: www.asktraders.com

In the ever-evolving world of financial markets, the path to successful forex trading hinges upon the selection of a dependable and versatile broker. As a trader embarking on this transformative journey, navigating the labyrinth of available options can be daunting. To guide you towards informed decision-making, we present a comprehensive analysis of the crème de la crème of forex brokers, empowering you to embark on a prosperous trading expedition.

Defining the Essence of an Ideal Forex Broker

A stellar forex broker is more than a mere order executor; they are a multifaceted partner committed to your financial well-being. They provide a secure trading platform, competitive spreads, and unparalleled customer support, enabling you to confidently navigate the dynamic market landscape. Before entrusting your hard-earned capital to any broker, it is paramount to meticulously evaluate their offerings, ensuring they align seamlessly with your trading objectives.

Navigating the Anatomy of a Leading Forex Broker

The foundation of an exceptional forex broker lies in the convergence of several fundamental pillars:

Regulatory Compliance: A Shield Against Risk

Unwavering adherence to regulatory parameters is an indispensable hallmark of a trustworthy broker. Regulatory oversight ensures the broker operates within a structured framework, safeguarding your funds and promoting transparency in all dealings. Seek brokers licensed by reputable authorities such as the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), or the Australian Securities and Investments Commission (ASIC).

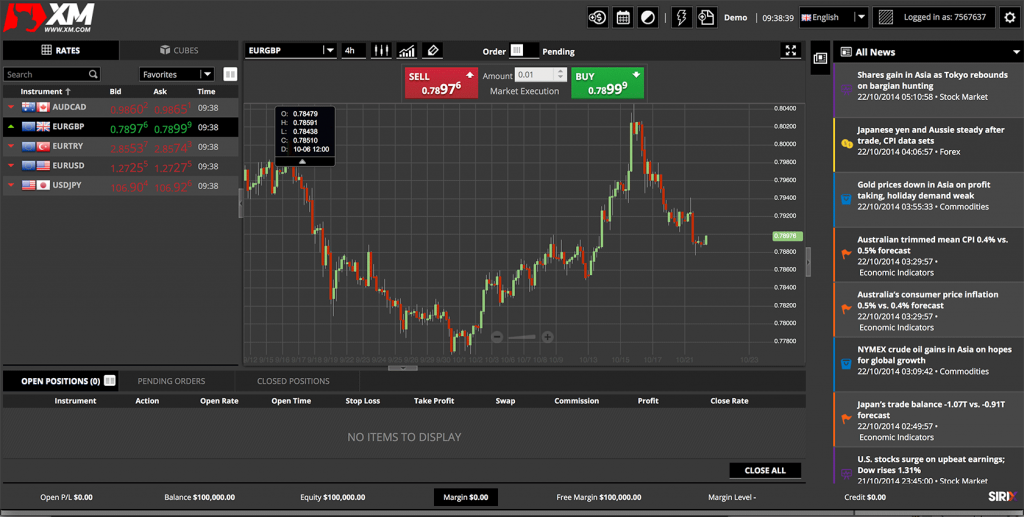

Trading Platform: The Gateway to Market Access

The trading platform serves as the cockpit of your trading endeavors. Opt for brokers who provide cutting-edge platforms offering advanced charting tools, real-time market data, and user-friendly interfaces. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) have long been industry standards, offering robust functionality and a vast ecosystem of plugins and indicators.

Assets and Instruments: Catering to Diverse Trading Needs

A diverse range of tradeable assets is essential for portfolio diversification and maximizing trading opportunities. Ascertain that your chosen broker offers an extensive selection of currency pairs, commodities, indices, and stocks. Some brokers even provide exotic currency pairs or digital assets, catering to specialized trading strategies.

Competitive Spreads and Commissions: Minimizing Trading Costs

Spreads and commissions are the lifeblood of forex brokers, representing the fees they charge for executing trades. Competitive spreads ensure you retain a greater share of your profits, while low commissions enable cost-effective trading. Compare brokers to secure the most favorable pricing model that aligns with your trading style and frequency.

Customer Support: Your Lifeline in Trading

Exceptional customer support is the cornerstone of a reliable broker. Round-the-clock assistance via multiple channels, including phone, live chat, and email, ensures your queries are addressed promptly and efficiently. Look for brokers with a proven track record of resolving issues swiftly and courteously.

Additional Features: Enhancing Your Trading Experience

Certain brokers offer additional features that can elevate your trading experience. Risk management tools, such as stop-loss and take-profit orders, are vital for managing risk and protecting your capital. Educational resources, webinars, and market analysis can empower you with knowledge and insights, fostering continuous improvement as a trader.

Choosing the Broker That Aligns with Your Trading Goals

Selecting the optimal forex broker is a highly personalized endeavor, dependent on your individual trading needs and preferences. Consider the following factors to guide your decision:

Trading Style: Scalpers, day traders, and long-term investors have varying requirements. Choose a broker that caters to your preferred trading style, offering suitable platforms and account types.

Risk Tolerance: Assess your risk appetite and select a broker that provides appropriate risk management tools and educational resources to mitigate potential losses.

Trading Volume: High-volume traders require brokers with deep liquidity and low commissions to avoid slippage and excessive trading costs.

Customer Service: Prioritize brokers with exceptional customer support that aligns with your preferred communication channels and response times.

Educational Resources: If you seek knowledge and guidance, opt for brokers who offer comprehensive educational materials and trading insights to enhance your trading acumen.

The Quintessential Revelation: Embarking on the Path to Trading Success

Choosing the right forex broker is the cornerstone of a successful trading journey. By adhering to the principles outlined in this article, you will be empowered to select a broker that aligns seamlessly with your trading goals, unlocking the boundless opportunities of the forex market. Remember, the path to financial empowerment lies in informed decision-making, unwavering perseverance, and the unwavering support of a dependable brokerage partner.

Image: www.btcc.com

Which Broker Is Best For Forex Trading