In the ever-evolving tapestry of finance, the foreign exchange market, fondly known as forex, stands as a colossus, eclipsing all others in terms of sheer volume and global reach. But when did this behemoth take its first fateful steps into the realm of currency trading? Join us on an enthralling expedition as we trace the origins of the forex market, uncovering its humble beginnings and charting its remarkable ascent to dominance.

Image: www.onenewspage.com

From Humble Roots to Global Prominence

The genesis of the forex market can be traced back to the late 19th century, when technological advancements and globalization prompted businesses to seek efficient ways to exchange currencies for international trade. Prior to this, currency conversions were often cumbersome and time-consuming endeavors conducted through banks or brokers.

The dawn of the 20th century witnessed the advent of the so-called “gold standard,” where currencies were pegged to the value of gold. This led to increased stability in exchange rates, paving the way for greater international trade and investment.

Simultaneously, the advent of the telegraph and later the telephone revolutionized communication, enabling traders to swiftly execute trades across vast distances. These technological advancements served as catalysts for the nascent forex market to flourish.

The Birth of Interbank Trading

A pivotal moment in the history of the forex market occurred in the aftermath of World War II. In 1944, the Bretton Woods Accord established the International Monetary Fund (IMF) and the World Bank, which played a crucial role in stabilizing the post-war global economy.

Furthermore, the introduction of interbank trading platforms, such as the Foreign Exchange and Currency Market (FOREX) in 1971, facilitated direct trading between banks, eliminating the need for intermediaries. This innovation brought about greater transparency and efficiency, contributing to the rapid expansion of the forex market.

A Paradigm Shift with the Floating Exchange Rate Regime

Another significant milestone in the evolution of the forex market came in 1971 when the United States abandoned the gold standard, effectively ushering in a floating exchange rate regime. This decision granted central banks greater autonomy in managing their respective currencies, which in turn led to increased volatility in exchange rates.

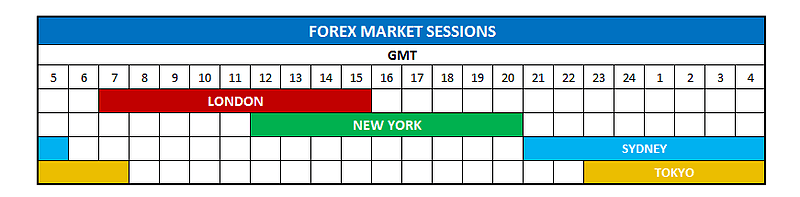

Foreign exchange traders seized this opportunity, recognizing that fluctuations in currency values presented lucrative trading prospects. The advent of round-the-clock trading in the 1990s further spurred the growth of the forex market, allowing traders to participate at any time of day or night.

Image: dailypriceaction.com

A Myriad of Participants and Instruments

Initially dominated by financial institutions, the forex market gradually opened its doors to a diverse range of participants, including individual retail traders, hedge funds, multinational corporations, and central banks. This diversity of market participants contributed to the market’s resilience and liquidity.

The forex market also witnessed a proliferation of financial instruments, such as spot contracts, forward contracts, futures, and options. These instruments allowed traders to engage in a wider array of trading strategies, catering to varying risk appetites and investment horizons.

Embracing Technological Advancements

As technology continued to reshape the world, the forex market embraced cutting-edge innovations to enhance trading efficiency. The advent of electronic trading platforms in the late 20th century significantly reduced transaction costs and execution times.

More recently, the rise of algorithmic and high-frequency trading, powered by sophisticated computer programs, has transformed the way traders analyze and execute trades. These technological advancements have not only increased market liquidity but also enabled traders to exploit fleeting market opportunities.

The Forex Market Today

Today, the forex market stands as the undisputed behemoth of financial markets, facilitating the exchange of trillions of dollars daily. It is a 24-hour, globally accessible marketplace where traders from all corners of the globe participate in the buying and selling of currencies.

The market’s liquidity and depth provide traders with unparalleled opportunities to profit from exchange rate fluctuations, while also serving as a hedging tool for businesses and investors navigating the complexities of international trade and finance.

When Was The Forex Market Created

Conclusion

The foreign exchange market has traversed a remarkable journey from its humble beginnings in the late 19th century to its current position as the world’s largest and most liquid financial marketplace. Its evolution has been shaped by technological advancements, economic policies, and a diverse range of participants, transforming the way currencies are traded and impacting the global economy. As the world continues to evolve and technology marches forward, the forex market stands poised to adapt and flourish, remaining an indispensable pillar of the global financial system.