Introduction

For savvy traders and aspiring investors, navigating the labyrinthine world of foreign exchange (Forex) can be both exhilarating and daunting. The Forex market, the largest financial market globally, operates around the clock, 24 hours a day, 5 days a week, spanning different time zones and continents. Understanding the intricacies of Forex trading hours is crucial to optimize trading strategies, manage risks, and maximize profitability. In this comprehensive guide, we will delve into the intricacies of Forex trading hours, unlocking the knowledge you need to conquer the global currency markets with confidence.

Image: howtotradeonforex.github.io

Forex Trading Hours: A Global Perspective

Unlike traditional stock exchanges with fixed operating hours, the Forex market unfolds as a decentralized and continuous enterprise. This global market operates in a relay fashion, where trading seamlessly transitions from one financial center to another as different parts of the world enter new trading days. The major trading hubs, namely London, New York, Tokyo, Sydney, and Singapore, each play a significant role in driving market activity during their respective business hours.

Major Trading Sessions and Their Timings

-

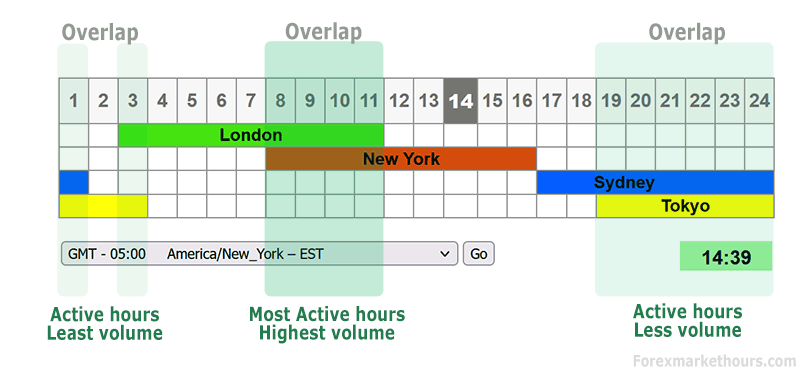

Sydney Session (00:00 – 08:00 GMT): The day commences in the Forex world with the opening of the Sydney session in Australia. This session is characterized by relatively lower volatility due to the absence of major economic news releases, creating a favorable environment for trend-following strategies.

-

Tokyo Session (02:00 – 10:00 GMT): As the sun rises over Tokyo, the market picks up pace with the commencement of the Tokyo session in Japan. This session often exhibits increased volatility, fueled by the release of key economic data from the world’s third-largest economy.

-

London Session (08:00 – 16:00 GMT): The financial epicenter shifts to London, the world’s largest Forex trading hub, as the London session opens its doors. With various central banks releasing economic data during this session, volatility and trading volume surge, presenting ample opportunities for active traders.

-

New York Session (13:00 – 21:00 GMT): The baton passes to New York as the city that never sleeps awakens to commence trading. This session boasts the highest volume and volatility, making it the preferred trading window for many professional traders.

-

Cross-Over Periods: Intermission periods between the major sessions, known as cross-over periods, offer unique opportunities. Reduced trading volume during these times often results in tighter spreads and potentially higher profitability for savvy traders.

Exceptions and Holidays

While the Forex market generally adheres to the上記のスケジュール, there are exceptions and holidays to consider. Market closures during national holidays in significant trading centers can lead to reduced liquidity and volatility, influencing trading decisions. Staying abreast of these closures is essential to avoid potential trading disruptions.

Image: www.forexmarkethours.com

What Time Does Forex Open

Conclusion

Navigating the dynamic world of Forex trading hours is a key element in achieving success in the foreign exchange markets. Understanding the global trading cycle, identifying major trading sessions, and being aware of market closures empower traders to optimize their strategies, manage risks effectively, and seize trading opportunities as they arise. By mastering the rhythm of Forex trading hours, you can unlock the full potential of this global marketplace and embark on a journey toward financial success.