In the realm of finance, there exists a dance of currencies, an invisible symphony that orchestrates the ebb and flow of global economies. This is the foreign exchange market, or forex, where traders and investors exchange their currencies in relentless pursuit of profit and opportunity. But what, pray tell, are the enigmatic factors that orchestrate this monetary waltz?

Image: www.forexschoolonline.com

Unveiling the Invisible Hand

To understand the forex market, we must first delve into the clandestine forces that shape its relentless pulse. Like threads in an intricate tapestry, these factors intertwine, creating a harmonious symphony that governs the value of currencies:

-

The Dance of Economies:

GDP, inflation, unemployment, and interest rates are the fundamental rhythmic beats of any economy. Strong economic fundamentals entice investors, increasing demand for a currency and driving its value higher.

-

Political Agitations:

Political stability is a comforting cradle for investments. When political storms brew, investors seek refuge in safe-haven currencies, such as the Swiss franc or the almighty dollar, casting a fear-induced, yet predictable, ripple across the forex market.

-

Image: www.forex.academyCentral Bank Harmonies:

Central banks, like maestros of monetary policy, wield the power to raise or lower interest rates. A quarter-note rate hike can entice investment, attracting buyers for a particular currency. Conversely, a minor key rate cut can dampen enthusiasm, discouraging purchases and driving the currency’s value down.

-

Interest Rate Symphony:

Interest rates are the heartbeat of a currency’s allure. Higher interest rates entice investors to park their funds in that particular currency, seeking higher returns. This heightened demand elevates the currency’s value, attracting the attention of savvy traders.

-

Current Account Imbalances:

The current account is akin to a nation’s monetary ledger, meticulously tracking its exports and imports. A persistent deficit signifies more imports than exports, often exerting downward pressure on a currency. Conversely, a handsome surplus indicates more exports than imports, fueling upward momentum.

Harnessing the Currency Winds

By deciphering the cryptic language of the forex market, astute traders can harness the power of these fundamental factors to make informed decisions, navigating the choppy waters of currency exchange.

-

Economic Indicators:

Keep a watchful eye on economic indicators, such as employment figures or GDP reports. They can provide valuable insights into the health of an economy, influencing the direction of its currency.

-

Political Developments:

Stay abreast of political developments, both domestic and international. Political instability or changes in government can have profound effects on currency values.

-

Central Bank Announcements:

Central bank announcements regarding interest rates or monetary policy shifts can cause substantial volatility in the forex market. Monitor these closely to anticipate market movements.

-

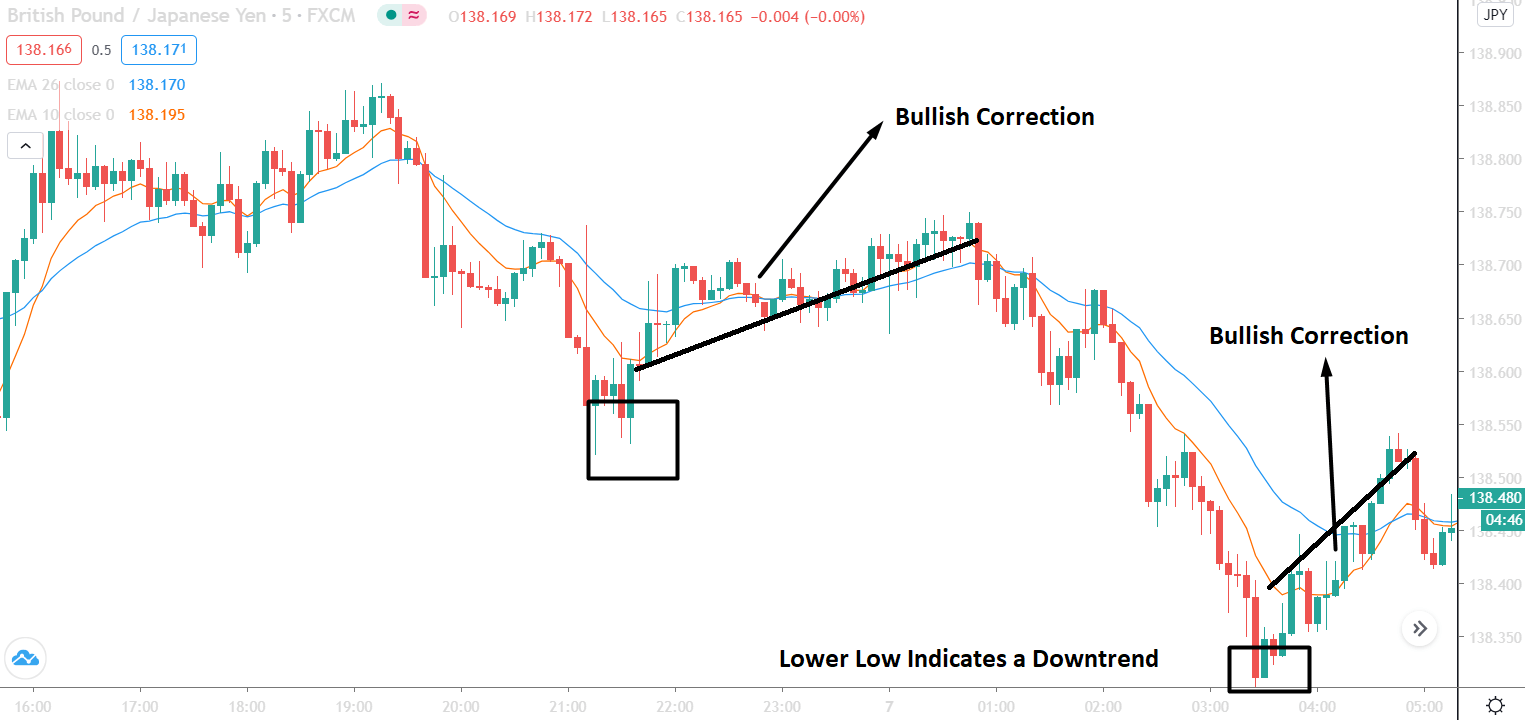

Technical Analysis:

Technical analysis, the art of studying price charts and patterns, can offer additional insights into potential currency movements. While not a substitute for fundamental analysis, it can complement your understanding of market sentiment.

What Moves The Forex Market

A Symphony of Opportunities

The forex market is not merely a battleground for traders; it is a symphony of opportunities for those who understand its rhythm. As you embark on your forex journey, remember:

-

The Power of Knowledge: Educate yourself thoroughly about the factors that move the forex market. Knowledge is the cornerstone of successful trading.

-

The Currency Conversation: Monitor economic and political news diligently. The forex market listens intently to every whisper of change.

-

The Discipline of Risk Management: Remember, risk is an inherent part of the forex waltz. Manage your positions prudently to avoid costly missteps.

-

The Patience of a Maestro: Successful forex trading requires patience and a long-term perspective. Avoid hasty decisions that could disrupt your financial composition.

-

The Constant Evolution: The forex market is a living, breathing entity, constantly evolving. Embrace continuous learning to stay in harmony with its ever-changing nature.

As you master the intricacies of this financial symphony, the forex market will cease to be an enigma and morph into a realm of opportunities—a dance you can join, harmonizing with the ebb and flow of currencies, to create a symphony of your own financial success.