Introduction:

Image: howtotrade.com

Forex trading, a global marketplace for currency exchange, offers vast opportunities for traders worldwide. However, navigating the complex world of financial leverage is crucial for maximizing profits while minimizing risks. Understanding how to determine the right leverage for your trading strategy can be the key to success in this dynamic market.

Leverage Defined:

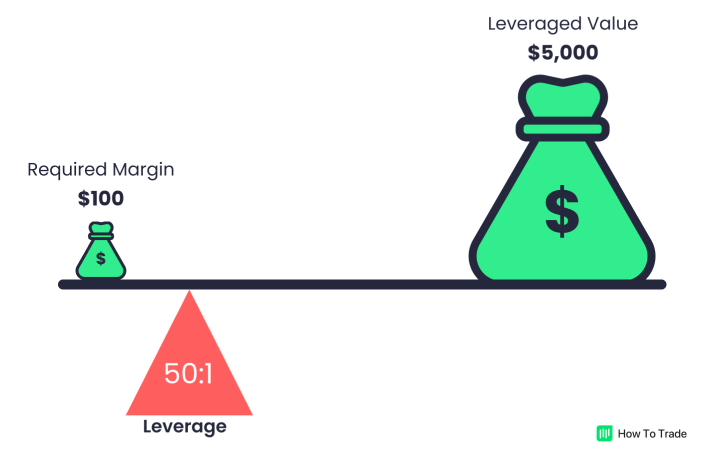

Leverage, in essence, acts as a magnifying glass for your trading capital. It allows you to amplify your exposure to a currency pair without increasing your initial investment. Forex brokers provide leverage ratios that multiply your account balance, enabling you to control a more substantial position in the market.

Finding Your Optimal Leverage:

Choosing the appropriate leverage is a delicate balance between maximizing your profit potential and managing risk. Here are some factors to consider when deciding your ideal leverage:

1. Trading Style and Risk Tolerance:

Your trading style and risk tolerance play a crucial role. Conservative traders with a preference for lower risk may opt for lower leverage to limit potential losses. On the contrary, aggressive traders seeking more significant gains may utilize higher leverage, assuming greater risk.

2. Account Balance and Margin:

The size of your trading account and the margin requirement for the currency pair you trade are important considerations. Higher leverage may strain your account if margin calls occur, leading to forced liquidations and substantial losses.

3. Currency Pair Volatility:

Currency pairs exhibit varying degrees of volatility, affecting the potential risks and rewards. Choosing lower leverage for volatile currency pairs or during periods of market instability is prudent to mitigate losses.

4. Economic Conditions:

Global economic conditions and geopolitical events can significantly impact currency value. Understanding these factors and adjusting leverage accordingly can help traders navigate market uncertainty.

5. Experience and Skill Level:

Experienced traders with proven risk management strategies can leverage higher ratios with greater confidence. Beginners or less skilled traders may consider lower leverage until they refine their trading techniques.

Benefits of Optimal Leverage:

Leverage can be a powerful tool when used wisely:

1. Increased Profit Potential:

By magnifying your trading capital, leverage multiplies potential profits significantly. Even small price movements can result in substantial gains if the market aligns with your trade.

2. Efficient Capital Allocation:

Leverage allows traders to control a significant market position with a limited amount of capital, enabling them to allocate resources effectively across multiple trades.

3. Enhanced Trading Flexibility:

Optimal leverage provides flexibility by tailoring risk exposure to align with your trading style, allowing you to pursue opportunities that suit your objectives.

Risks Associated with Leverage:

While leverage offers great advantages, mishandling it can lead to severe consequences:

1. Magnified Losses:

Just as leverage amplifies profits, it magnifies losses as well. If the market moves against your position, the losses can exceed your initial investment, potentially wiping out your account.

2. Margin Calls:

When using leverage, traders are required to maintain a minimum account balance known as the margin level. If the market moves against your position and your account balance falls below this level, you will receive a margin call. Failure to meet a margin call can result in forced liquidation of positions and substantial losses.

3. Psychological Traps:

The potential for outsized gains and losses can trigger psychological traps, leading to impulsive trading and risk-taking beyond your tolerance. Controlling emotions and making informed decisions is paramount when leveraging.

Conclusion:

Determining the ideal leverage for forex trading is an ongoing process that requires a keen understanding of personal risk tolerance, trading style, market conditions, and the risks associated with excessive leverage. By considering these factors and adopting a prudent approach, you can harness the power of leverage to maximize profit potential while managing risks effectively in the dynamic world of forex trading.

Image: forexontoast.com

What Leverage Should I Use For Forex