Introduction:

Image: www.dailyfx.com

In the realm of financial markets, volume plays a crucial role in deciphering market sentiment and making informed trading decisions. As a seasoned forex trader or an aspiring one, understanding volume is paramount to navigating market complexities and increasing your chances of success. This comprehensive guide will delve into the depths of forex volume, empowering you with the knowledge and insights to make significant strides in your trading journey.

What is Volume in Forex?

Forex volume represents the total number of currency units traded over a specific time frame. It serves as a measure of the activity and liquidity in the forex market. High volume indicates a surge in trading activity, while low volume suggests a lull in market participation. Understanding volume’s dynamics can provide valuable context for your trading strategies.

Significance of Volume in Forex Trading:

Volume plays a multi-faceted role in forex trading:

-

Market Strength Confirmation: High volume often accompanies significant market moves, reinforcing the strength of a trend or reversal. This helps traders validate their trading decisions and minimize the risk of false signals.

-

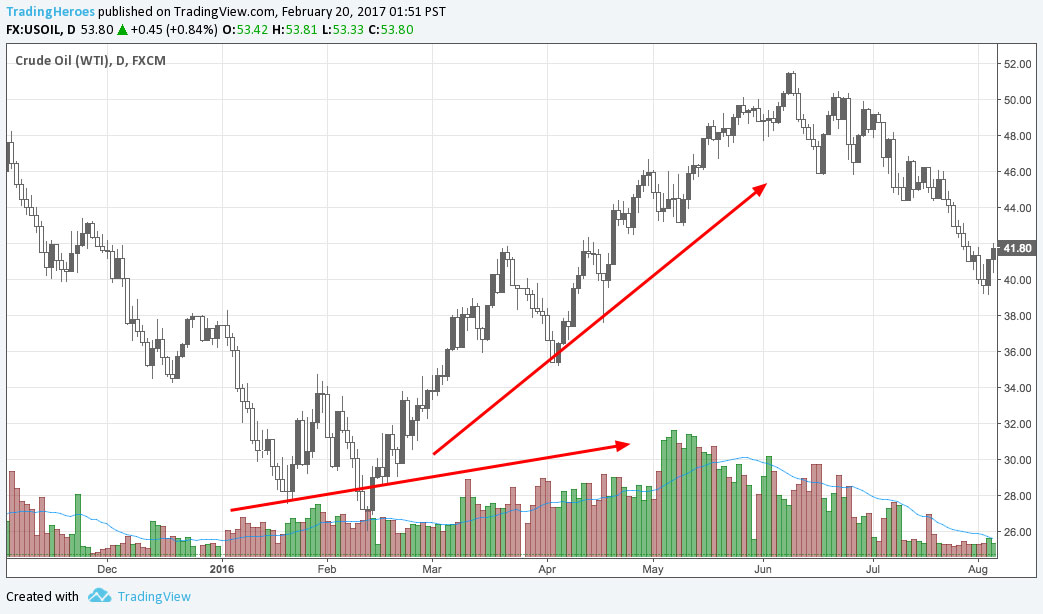

Trend Identification: Rising volume in the direction of a trend indicates momentum and reinforces the trend’s continuation. On the flip side, declining volume may signal a potential trend exhaustion or reversal.

-

Support and Resistance Levels: Volume can help identify support and resistance levels. Areas with historically high volume often act as psychological barriers, influencing price action.

-

Market Manipulations: Volume spikes can sometimes indicate market manipulation or the presence of large orders. Traders should be cautious when interpreting unusual volume fluctuations.

-

Time Frames: Volume data should be analyzed in conjunction with relevant time frames. Intraday volume patterns may differ from long-term volume trends, providing diverse insights into market behavior.

How to Utilize Volume in Your Trading:

Understanding volume’s significance is one aspect, but applying it effectively in your trading is another. Here are some actionable tips:

-

Trend Analysis: Use volume to confirm or negate trend signals. High volume supporting a trend indicates strong momentum, while low volume suggests weakness.

-

Volume Breakouts: Volume surges can signal potential breakouts of support or resistance levels, providing early entry or exit opportunities.

-

Volume Divergence: When price action diverges from volume indications, it may hint at a market reversal or a false signal.

-

Limit Orders: Placing limit orders near areas of high volume can improve order execution and reduce slippage.

-

Position Sizing: Adjust the size of your positions based on volume. Higher volume typically warrants larger positions, while lower volume may necessitate smaller positions.

Conclusion:

Mastering volume in forex trading is a transformative skill that can significantly enhance your trading decisions. By understanding its significance and implementing practical applications, you can harness the power of volume to identify market trends, confirm trading signals, and mitigate risks. Remember, the key to successful forex trading lies in continuous learning and adaptation. Embrace the insights provided in this article, and your path towards trading supremacy will undoubtedly be filled with greater confidence and profitability.

Image: howtotradeonforex.github.io

What Is Volume In Forex