What is the Best Leverage in Forex: A Guide to Maximizing Profits and Minimizing Risks

Image: www.javafx.news

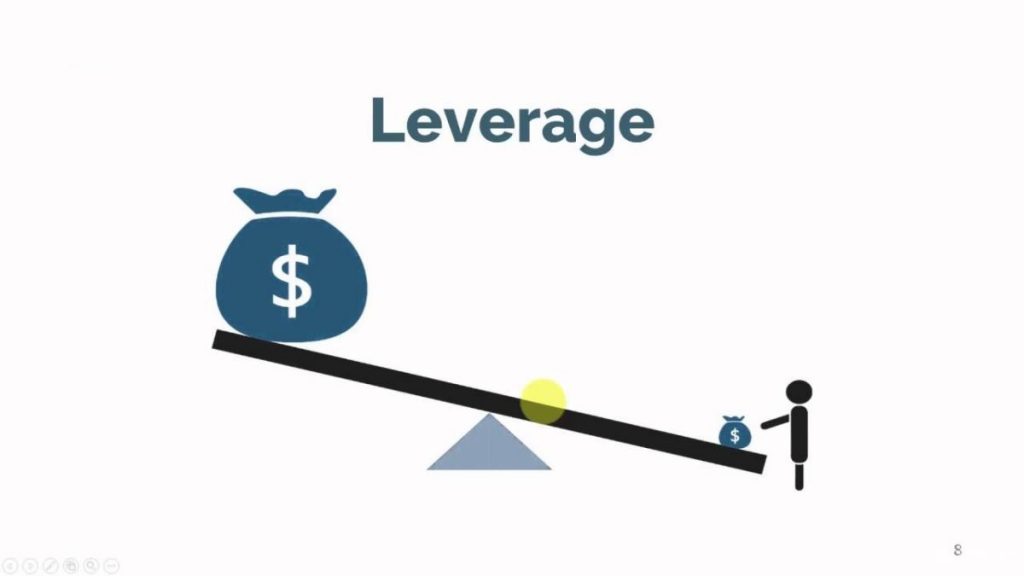

In the ever-evolving world of forex trading, leverage is a double-edged sword that can amplify both profits and risks. Understanding the optimal leverage ratio is paramount for maximizing gains while mitigating potential losses. Let’s embark on a comprehensive journey to unveil the secrets of choosing the best leverage in forex, empowering you to make informed decisions that fuel your trading success.

The Essence of Forex Leverage: A Catalyst for Exponential Returns

Forex leverage, expressed as a ratio, allows traders to control a larger position size with a smaller account balance. For instance, a leverage of 100:1 enables you to trade with $100,000 while only having $1,000 in your account. This amplified trading power has the potential to yield significant profits, but it comes with inherent risks that must be prudently assessed.

The Leverage Equation: Balancing Profit Potential and Risk Exposure

To determine the ideal leverage ratio, consider your trading experience, risk tolerance, and overall financial situation. While higher leverage offers amplified gains, it can also lead to substantial losses. Conversely, lower leverage provides a more conservative approach but may limit potential returns. The optimal balance lies in finding a leverage ratio that maximizes profit potential while mitigating excessive risk.

Image: sureshotfx.com

Risk Assessment: A Foundation for Leverage Determination

Before venturing into the world of leveraged trading, it’s imperative to conduct a thorough risk assessment. Assess your tolerance for potential losses, accounting for your financial circumstances, emotional resilience, and experience level. Remember, higher leverage magnifies not only profits but also losses.

Enhancing Profits with Leverage: A Skillful Trader’s Edge

Leverage can be a powerful tool in the hands of skilled traders who possess a strong understanding of market dynamics and sound risk management principles. By implementing a disciplined trading plan, employing prudent risk-reward ratios, and continuously honing their skills, traders can harness the power of leverage to maximize their profits.

Expert Insights: Wisdom from Seasoned Traders

Recognized forex experts emphasize the importance of aligning leverage with trading strategy and personal circumstances. They advocate for responsible leverage usage, advising traders to start with conservative ratios and gradually increase them as they gain experience and confidence.

Actionable Tips for Wise Leverage Utilization

- Craft a Comprehensive Trading Plan: Outline your trading goals, strategies, and risk management protocols to guide your leverage decisions.

- Practice Discipline: Adhere to your trading plan and avoid emotional decision-making that can lead to excessive leverage and increased risk.

- Monitor Market Conditions: Stay up-to-date with market news and economic events that may impact currency fluctuations and necessitate leverage adjustments.

What Is The Best Leverage In Forex

Conclusion: Harnessing the Power of Leverage

Forex leverage is a powerful tool that can amplify profits and enhance trading experiences. By understanding the optimal leverage ratio, traders can mitigate risks, maximize returns, and achieve their trading goals. Armed with the insights and tips provided in this comprehensive guide, you can confidently embark on your forex trading journey, leveraging the power of leverage to unlock your financial potential.