Understanding the Significance of Stop-Loss Orders

In the fast-paced world of foreign exchange (forex) trading, managing risk is paramount to preserving capital and achieving success. Among the essential risk management tools is the stop-loss (SL) order, which plays a crucial role in safeguarding traders from potential losses. This comprehensive guide will delve into the concept of SL in forex trading, exploring its definition, benefits, strategies, and practical implementation.

Image: whatisforextradingstrategies.blogspot.com

Defining Stop-Loss Orders

A stop-loss order is an automated trading instruction that triggers an automatic sale or purchase of a currency pair when the market price reaches a predetermined level. It is designed to limit potential losses by establishing a threshold beyond which the trader is no longer willing to risk. Stop-loss orders can be placed in both live trading and demo accounts, allowing traders to test their strategies without risking real capital.

Why Use Stop-Loss Orders?

The primary purpose of SL orders in forex trading is to protect against substantial losses. By pre-defining an exit point, traders can effectively control their risk exposure and avoid significant drawdowns. Stop-loss orders act as an insurance policy, ensuring that trades are automatically closed when market conditions become unfavorable.

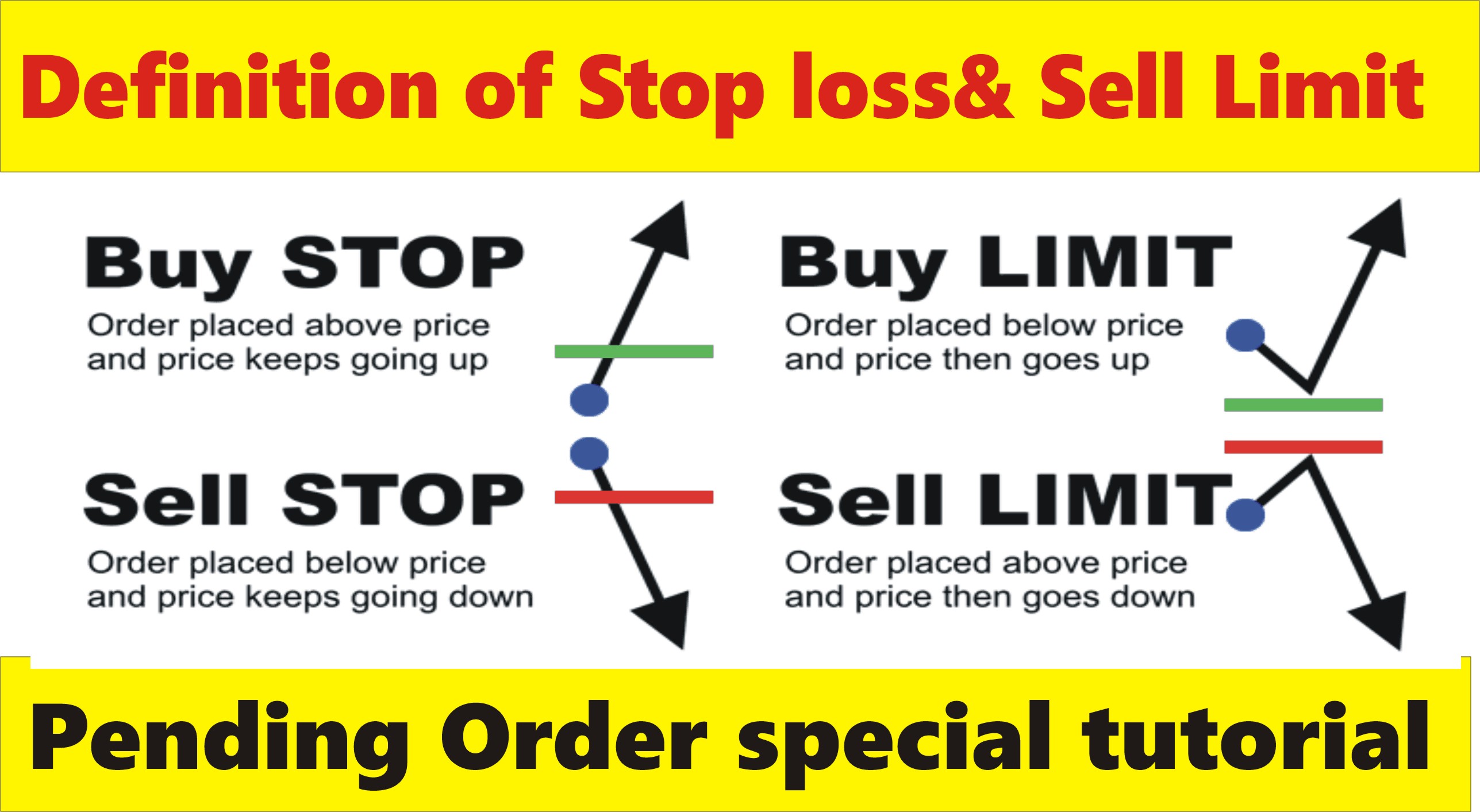

Types of Stop-Loss Orders

Various types of SL orders are available to traders, depending on their risk tolerance and trading style. Common SL order types include:

- Standard Stop-Loss: This is the most basic SL order, which triggers a trade exit when the market price touches the specified level.

- Trailing Stop-Loss: A trailing SL order automatically adjusts its level based on the prevailing market conditions. It typically follows a certain percentage or price distance from the current market price.

- Breakeven Stop-Loss: This SL order is placed at the entry price of the trade, ensuring that the trade is closed without any loss if the market price returns to the initial level.

Image: taniforex.com

Effective Implementation of SL Orders

To effectively implement SL orders in forex trading, traders must consider several key factors:

- Risk Tolerance: The placement of SL orders should be aligned with the trader’s individual risk tolerance. High-risk traders may opt for tighter SLs to minimize potential losses, while conservative traders may prefer wider SLs to allow for greater market fluctuations.

- Market Volatility: The volatility of the underlying currency pair should also be taken into account. SL orders should be adjusted accordingly to accommodate potential market swings and prevent premature trade closures.

- Timing: The timing of SL order placement is crucial. Placing SLs too early may restrict profit potential, while placing them too late may lead to excessive losses.

Expert Advice and Tips for Using SLs

- Set realistic SL levels based on thorough analysis and risk management strategies.

- Avoid using SLs that are too tight or too loose. A balance between risk control and profit potential is essential.

- Monitor SL orders regularly and adjust them as market conditions evolve.

- Use a risk-reward ratio to determine the appropriate SL level. This ratio ensures that potential profits outweigh potential losses.

FAQs on Stop-Loss Orders in Forex Trading

Q1: Is it mandatory to use SL orders in forex trading?

A1: While not mandatory, SL orders are highly recommended as an essential risk management tool.

Q2: What happens if the market gaps beyond the SL level?

A2: If there is a significant market gap, the SL order may not be triggered at the intended level, leading to potential losses.

Q3: How do I calculate the appropriate SL level?

A3: The appropriate SL level varies depending on individual risk tolerance, market volatility, and trading strategies. Technical analysis and market research can aid in determining suitable SL levels.

What Is Sl In Forex Trading

Conclusion

SL orders are an invaluable risk management tool in forex trading, providing traders with peace of mind and protecting their capital from potentially devastating losses. By understanding the concept of SLs, implementing them effectively, and seeking expert advice when necessary, traders can enhance their trading performance and increase their chances of success in the dynamic forex market. Are you ready to elevate your forex trading skills and make the most of SL orders?