Navigating the dynamic world of forex trading demands a comprehensive grasp of technical analysis. One fundamental concept central to price action trading is resistance, the level at which an asset’s upward price movement encounters significant selling pressure, halting or reversing its trajectory. Comprehending resistance is crucial for traders seeking to identify potential selling opportunities and protect their profits.

Image: elitecurrensea.com

Forex resistance represents price ceilings where buyers and sellers clash, creating a temporary barricade to an asset’s ascent. Identifying resistance levels empowers traders to anticipate areas where the asset’s price surge may wane, facilitating informed trading decisions. Moreover, traders can position their stop-loss orders below resistance levels, safeguarding their trades against potential losses.

Identifying Resistance Levels: A Step-by-Step Guide

Discerning resistance levels requires a keen eye for price patterns and historical data. Traders employ various techniques to pinpoint these crucial levels, including:

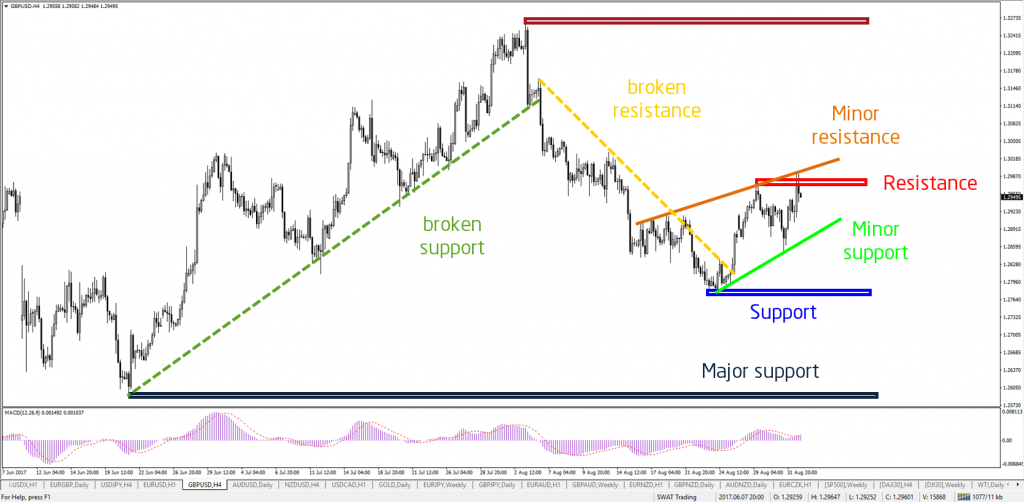

- Horizontal Lines: Drawing horizontal lines across price highs that have stalled an asset’s upward momentum aids in identifying support and resistance levels.

- Chart Patterns: Analyzing chart patterns such as double tops and triple tops, where prices reach a peak and retrace twice or thrice, can unveil significant resistance levels.

- Moving Averages: Identifying moving averages that have served as barriers to price increases can provide valuable insights into resistance levels.

- Fibonacci Retracement: Utilizing Fibonacci retracement levels, traders can determine potential areas where the asset’s price may encounter resistance during an upward trend.

Significance of Resistance in Forex Trading

Understanding resistance is paramount for successful forex trading, as it offers several strategic advantages:

- Identifying Selling Opportunities: When the price of an asset approaches a resistance level, traders anticipate a potential price reversal or consolidation. Identifying these levels allows them to seize selling opportunities, securing profits or limiting losses.

- Risk Management: Utilizing resistance levels as a reference point, traders can effectively position their stop-loss orders below these levels, mitigating the risk of significant losses should the price fall.

- Trend Confirmation: Resistance levels serve as essential indicators of a prevailing price trend. When an asset repeatedly fails to breach a resistance level, it strengthens the likelihood of a downtrend. Conversely, persistent breaks above resistance indicate a potential uptrend.

- Price Targets: Identifying resistance levels enables traders to estimate potential price targets for an asset. By observing the historical behavior of an asset at resistance levels, traders can anticipate its future trajectory.

Image: easyforexpips.com

What Is Resistance In Forex

Conclusion

In the competitive realm of forex trading, understanding resistance is an indispensable skill. Traders armed with this knowledge can navigate market fluctuations, identify selling opportunities, manage risks, and make informed trading decisions. By incorporating resistance analysis into their trading strategy, traders enhance their prospects for success and increase their earning potential in this dynamic market.