Imagine stepping into the captivating world of foreign exchange (forex) trading, where savvy traders navigate the ever-fluctuating currency landscapes to harness the potential for financial gain. Among the myriad strategies employed in this dynamic arena, positive swaps hold a special allure, offering a compelling avenue for traders to generate additional streams of income.

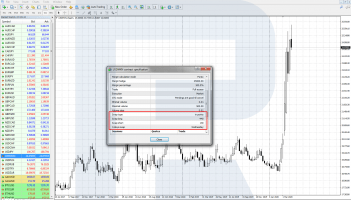

Image: blog.roboforex.com

Understanding the Essence of a Positive Swap

In the forex market, currency pairs are traded on a global scale, with each pair comprising a base currency and a quote currency. When trading a currency pair, traders speculate on the future value of one currency relative to another. As currencies are traded in pairs, transactions are not a mere exchange of one currency for another, but also involve borrowing one currency and simultaneously lending another.

Positive swaps arise when the interest rate differential between the two currencies in a currency pair favors the base currency, resulting in a positive return for the trader. This interest rate differential stems from varying economic conditions, monetary policies, and inflation rates between the countries represented by the respective currencies.

Benefits of Exploiting Positive Swaps

The allure of positive swaps lies in their potential to enhance a trader’s overall profitability. By holding a currency pair with a positive swap rate, traders effectively earn an overnight return, akin to accruing interest on a positive-yielding investment. This steady drip of income can significantly augment a trader’s returns, especially over the long term.

Compounding this benefit, positive swaps can serve as a valuable cash flow management tool. By opting for currency pairs with favorable interest rate differentials, traders can generate consistent returns even during periods of market volatility or sideways price action. This added layer of stability can enhance a trader’s peace of mind and provide a buffer against potential losses.

Leveraging Positive Swaps: A Step-by-Step Guide

Embracing the opportunities presented by positive swaps requires a methodical approach. Here’s a practical guide to help you harness their potential:

-

Identify High-Yielding Currency Pairs: Conduct thorough research to determine currency pairs offering compelling interest rate differentials. Utilize reputable sources and economic calendars to stay abreast of shifting rates and market trends.

-

Adopt a Sound Trading Strategy: Tailor your trading strategy to capitalize on the benefits of positive swaps. Consider a carry trade or income trading approach, which involves holding currency pairs with high swap rates over longer time frames to accumulate interest.

-

Manage Risk: As with all financial instruments, positive swaps come with inherent risks. Always implement robust risk management strategies, including using stop-loss orders and managing your leverage appropriately.

-

Stay Vigilant and Monitor: Monitor market conditions and economic data to stay informed about shifting interest rate differentials. Adjust your strategy as necessary to adapt to changing dynamics.

Expert Insights and Success Stories

Numerous seasoned forex traders have successfully integrated positive swaps into their trading arsenals. “Positive swaps have been a game-changer for me,” shares veteran trader Mark Elliott. “By focusing on currency pairs with favorable swap rates, I’ve been able to generate a consistent stream of income, which has significantly boosted my overall profitability.”

Another trader, Sarah Williams, highlights the importance of patience and discipline. “While positive swaps offer the potential for substantial returns, they require patience,” she says. “By adopting a long-term approach and carefully managing risk, traders can maximize the benefits of positive swaps without falling prey to impatience.”

Conclusion

Positive swaps offer an intriguing opportunity for forex traders to enhance their income streams and combat market volatility. By leveraging the insights and strategies outlined in this article, traders can harness the power of positive swaps to navigate the dynamic currency market with greater confidence and financial success.

Image: capital.com

What Is Positive Swap In Forex