Are you eager to elevate your forex trading prowess and conquer the market’s enigmatic trends? If so, delve into the world of Parabolic SAR, a technical indicator renowned for its exceptional finesse in identifying trend reversals and guiding traders toward profitable opportunities. Join us as we uncover the history, fundamental principles, and practical applications of this formidable trading tool in the ever-evolving forex realm.

Image: www.incomementorbox.com

What is Parabolic SAR?

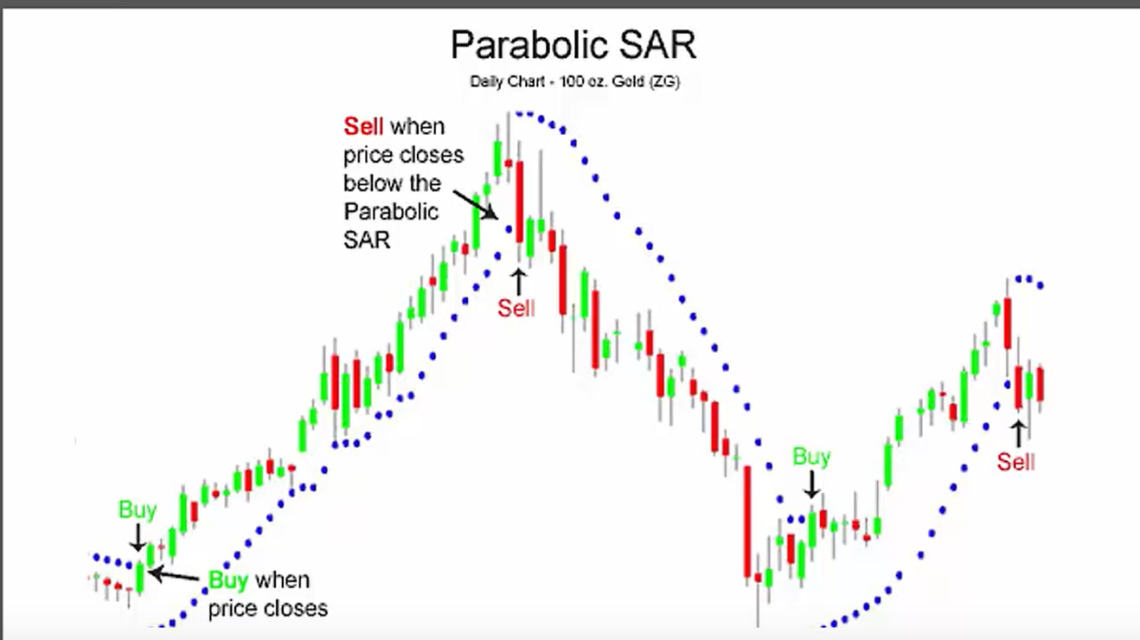

Parabolic SAR, an acronym for Parabolic Stop and Reverse System, was conceived by the legendary J. Welles Wilder, a pioneer in the field of technical analysis. This dynamic indicator is depicted on a price chart as a series of dots, strategically plotted either above or below the current price action. The positioning of these dots imparts valuable insights into the prevailing trend, offering traders a distinct edge in decision-making.

How to Calculate Parabolic SAR

To grasp the essence of Parabolic SAR, it is imperative to understand its intricate calculation. The formula incorporates several vital components:

- Extremum Point: The highest (in an uptrend) or lowest (in a downtrend) price point reached since the initiation of the current parabolic trend segment.

- Acceleration Factor (AF): Initially set to 0.02, the AF gradually increases as the trend intensifies, reaching a maximum of 0.20.

- Step: Calculated by multiplying the AF by the distance between the SAR point and the trailing extremum point.

Armed with these parameters, the calculation proceeds as follows:

- Uptrend: SAR = Previous SAR + Step (For down moves)

- Downtrend: SAR = Previous SAR – Step (For up moves)

As the trend persists, the AF accelerates, resulting in a progressively steeper parabolic trajectory of the SAR dots. This dynamic adjustment underscores the indicator’s adaptability to evolving market conditions.

Trading with Parabolic SAR

The strategic application of Parabolic SAR revolves around discerning trend reversals and exploiting emerging trading opportunities. When the indicator dots pivot and cross below the price action in an uptrend or above the price action in a downtrend, it signals a potential trend reversal. Here’s how to interpret these crucial signals:

- SAR Dots Above Price (Downtrend): Time to go long; buy orders are recommended as the downtrend has reversed.

- SAR Dots Below Price (Uptrend): Sell orders are advised, indicating a reversal from an uptrend to a downtrend.

- SAR Dots and Price Cross: A temporary pause in the trend or a possible ranging period; exercise caution and monitor future SAR behavior.

Image: forexnewseafree.blogspot.com

Advantages of Using Parabolic SAR

- Trend Identification: Parabolic SAR excels at identifying prevailing trends, empowering traders to align their trades with the market’s momentum.

- Trend Reversal Alerts: By anticipating potential trend reversals, traders can take timely actions to adjust their positions, mitigating risks and maximizing profits.

- Trailing Stop: The SAR dots act as a dynamic trailing stop, safeguarding profits in trending markets and minimizing losses in case of adverse price movements.

- Simplicity and Versatility: Parabolic SAR’s intuitive concept and straightforward application make it accessible to both novice and experienced traders, adaptable to diverse trading strategies and time frames.

Limitations of Parabolic SAR

- Lagging Indicator: As with most technical indicators, Parabolic SAR is retrospective, indicating past trends rather than predicting future price action.

- False Signals: Trend reversal signals can occasionally be misleading, leading to premature entries or exits from trades.

- Parameter Optimization: Determining optimal parameters for specific market conditions requires empirical testing and ongoing adjustments.

What Is Parabolic Sar In Forex

Conclusion

Embracing Parabolic SAR as a valuable addition to your forex trading arsenal can elevate your decision-making capabilities and enhance your profitability. While it is essential to acknowledge its limitations, the indicator’s exceptional trend-following and trend reversal detection qualities make it a formidable ally in the ever-changing forex markets.