In the fast-paced and often lucrative world of foreign exchange (forex) trading, leverage has become an integral tool for traders seeking to amplify their profits. However, when used excessively, leverage can transform into a double-edged sword, leading to severe financial losses and potentially catastrophic consequences. Understanding the risks associated with overleveraging in forex is paramount for any trader aspiring to mitigate these pitfalls.

Image: www.forexkarma.com

The Perils of Overleveraging: A cautionary tale

Picture this: A novice trader, enticed by the allure of quick and substantial gains, plunges headfirst into the forex market. Armed with limited trading knowledge, they succumb to the temptation of excessive leverage, lured by the promise of exponential profits. With each successful trade, their confidence swells, driving them to raise their leverage further. However, fate had a cruel twist in store. A sudden market reversal swiftly wipes out their newfound wealth, leaving them with a mountain of debt and a valuable lesson etched into their memory.

Leverage: A double-edged sword

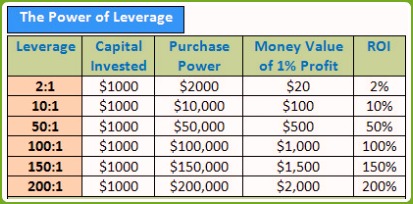

In essence, leverage allows traders to control a larger trading position with a relatively small amount of capital. This magnifying effect can significantly amplify profits when market movements align with their predictions. However, it can also exacerbate losses at an alarming rate when markets turn unfavorable. Overleveraging occurs when traders employ leverage levels that exceed their risk tolerance and financial capacity, exposing themselves to potentially catastrophic losses.

Overleveraging in Forex: A comprehensive guide

To fully grasp the concept of overleveraging in forex, it is essential to delve into its definition, mechanics, and implications. Leverage is expressed as a ratio, such as 1:100 or 1:500. This ratio indicates the amount of capital borrowed from a broker relative to the trader’s own funds. A higher leverage ratio signifies greater borrowing power and, consequently, a higher potential for both profits and losses.

While leverage can enhance profit potential, it also magnifies risk exposure. When overleveraged traders enter a trade, they are effectively betting a substantial amount of capital – potentially more than they can afford to lose – on the accuracy of their market predictions. If the market moves against them, their losses may swiftly deplete their trading account balance.

Overleveraging can arise from several factors, including: Unrealistic expectations: Aspiring traders often enter the market with inflated expectations, believing they can generate substantial profits without the necessary experience or knowledge.

Inadequate risk management: Failure to establish appropriate stop-loss levels or manage risk effectively can lead to severe losses.

Emotional trading: Allowing emotions, such as fear or greed, to influence trading decisions can result in irrational and potentially disastrous trades.

Misuse of margin calls: Margin calls are alerts issued by brokers when an account balance falls below a certain level, requiring the trader to deposit additional funds or close out losing positions. Ignoring margin calls can lead to forced liquidation of positions at unfavorable prices.

Image: www.pinterest.com

Tips and expert advice to avoid overleveraging

Navigating the treacherous waters of overleveraging requires a prudent approach and adherence to sound trading practices. Seasoned traders and financial experts unanimously recommend the following:

Determine your risk tolerance: Before engaging in forex trading, it is crucial to assess your risk tolerance and align your trading strategy accordingly. Understand the amount of capital you are willing to risk and never exceed these limits.

Choose appropriate leverage levels: Select leverage levels commensurate with your trading experience, risk tolerance, and financial situation. Lower leverage ratios, such as 1:10 or 1:20, offer greater protection against substantial losses.

Implement strict risk management strategies: Employ meticulous risk management strategies, including stop-loss orders, position sizing, and hedging techniques, to mitigate potential losses.

Educate yourself: Continuously expand your knowledge of forex trading, technical analysis, and risk management. Attend webinars, workshops, and read reputable trading literature.

Maintain discipline: Adhere strictly to your trading plan and avoid deviating from it due to emotions or external influences.

Seek professional guidance: If necessary, consider seeking advice from a qualified financial advisor or experienced forex trader to tailor a trading strategy that aligns with your unique circumstances.

FAQs on overleveraging

Q: What are the signs of overleveraging?

A: Common indicators include frequent margin calls, rapidly fluctuating account balance, and a feeling of excessive risk exposure.

Q: What are the consequences of overleveraging?

A: Severe financial losses, emotional distress, and damage to reputation.

Q: How can I prevent overleveraging?

A: Determine your risk tolerance, choose appropriate leverage levels, implement sound risk management strategies, and seek professional guidance when needed.

What Is Over Leveraging In Forex

Conclusion

Overleveraging in forex can be a perilous venture that undermines financial stability and trading aspirations. By understanding its pitfalls and employing prudent risk management practices, traders can harness the benefits of leverage while mitigating the associated risks. Remember, the path to successful trading lies in responsible decision-making, education, and a deep understanding of the intricacies of forex markets. Nevertheless, if you are interested in getting started in forex trading, familiarizing yourself with the concept of overleveraging is essential.