The world of forex trading offers a plethora of opportunities for financial gain. However, the key to unlocking its true potential lies in understanding the concept of leverage, a double-edged sword that can both amplify your profits and magnify your risks. This comprehensive guide will unravel the intricacies of leverage in forex, empowering you with the knowledge to navigate this financial terrain with confidence and prudence.

Image: fxtechlab.com

Demystifying Leverage: A Metaphorical Explanation

Imagine yourself as a construction worker tasked with lifting a heavy beam. While your own strength may be limited, utilizing a lever, a simple yet ingenious tool, can dramatically increase your lifting capacity. Similarly, in forex trading, leverage acts as a financial lever, enabling you to control a substantial amount of capital with a relatively small investment.

Leverage in Forex: A Technical Definition

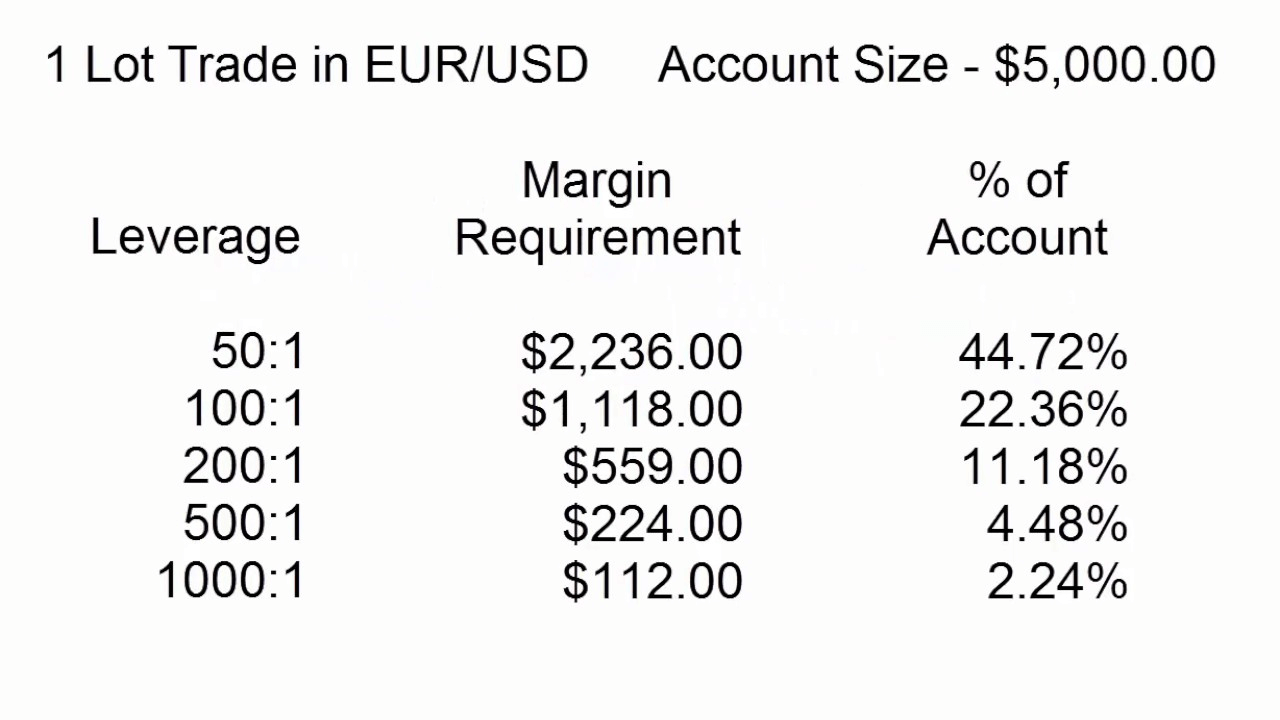

Leverage, expressed as a ratio, represents the magnitude of the trader’s borrowed funds relative to their own capital. For instance, a leverage of 100:1 implies that for every $1 deposited, the trader can control $100 worth of currency. This seemingly miraculous amplification of trading power comes with both immense potential and inherent risks.

The Spectrum of Leverage: A Balancing Act

The complexities of forex trading necessitate a diverse range of leverage options. Seasoned traders may opt for higher leverage, such as 100:1 or even 200:1, to magnify their profit potential. However, beginners are strongly advised to exercise caution and prudence by employing lower leverage ratios, such as 10:1 or 20:1, until they gain sufficient experience and risk management skills.

Image: jesuschester.blogspot.com

Harnessing Leverage: A Path to Profitable Trading

Mastering leverage is paramount for maximizing profitability in forex trading. By carefully calculating position sizes and managing risk exposure, traders can leverage the power of this financial magnifier to their advantage. Disciplined risk management strategies, such as setting stop-loss orders and continuously monitoring market conditions, become even more crucial when utilizing higher leverage.

Mitigating Risks: The Other Side of Leverage

While leverage can amplify gains, it can also exacerbate losses. The higher the leverage employed, the greater the potential for both profits and losses. Overleveraging, often driven by greed or excessive risk-taking, can lead to catastrophic consequences, even wiping out the trader’s entire account balance. It is crucial to approach leverage with a pragmatic mindset, always considering both the potential rewards and inherent risks.

Finding the Leverage Sweet Spot: A Tailored Approach

Determining the optimal leverage for your forex trading endeavors requires a nuanced understanding of your risk tolerance, trading experience, and financial circumstances. While higher leverage can magnify profits, it also amplifies risks; hence, finding the right balance is essential. Begin with a conservative leverage ratio and gradually adjust it based on your trading performance and evolving risk management capabilities.

What Is Meant By Leverage In Forex

Conclusion: A Path to Forex Success

Understanding the complexities of leverage is the cornerstone of profitable forex trading. By judiciously utilizing this financial lever while adhering to prudent risk management practices, you can harness its power to amplify your profits. Remember, leverage can be a double-edged sword; wield it wisely to achieve consistent success in the dynamic world of forex trading. Embark on your trading journey with a comprehensive understanding of leverage, and you will be well-equipped to capture market opportunities while mitigating potential risks.