If you’re new to forex trading, you may have come across the term “margin percentage.” Margin is a critical concept in forex trading, and it’s crucial to understand how it works before you start trading. In this article, we’ll explain what margin percentage is, how it’s calculated, and how it affects your trading.

Image: payehuvyva.web.fc2.com

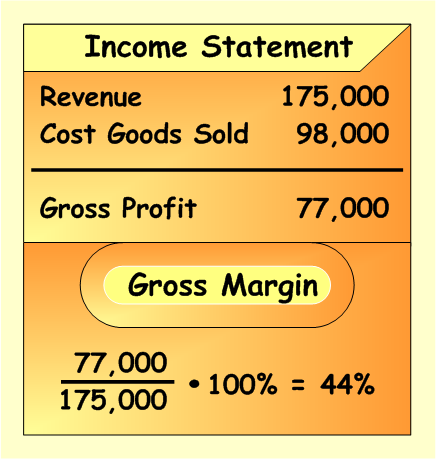

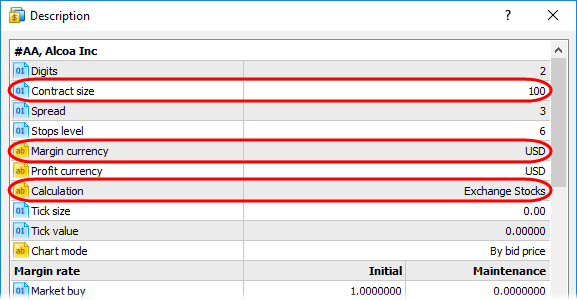

Margin in forex is a deposit you make with your broker to cover potential losses. When you open a forex trading account, you’ll be required to deposit a certain amount of money, which will serve as your margin. The amount of margin you need to deposit will vary depending on your broker and the size of your trades. The margin percentage is a measure of how much of your account balance is being used as margin. For example, if you have a $1,000 account balance and you deposit $200 as margin, your margin percentage would be 20%.

Understanding Margin Percentage

Margin percentage is a critical factor to consider when trading forex because it affects the amount of leverage you have. Leverage is the ability to trade with more money than you have in your account. The higher your margin percentage, the more leverage you have. For example, if you have a margin percentage of 20%, you can trade with up to $5,000 in total, even if you only have $1,000 in your account.

Leverage is a powerful tool that can help you increase your profits, but it also comes with increased risk. If the market moves against you, you could lose more money than you deposited as margin. As a result, it’s crucial to carefully consider your risk tolerance before trading with high leverage. A general rule of thumb in Forex trading is to only trade with margin that you can afford to lose due to the high risk involved.

Tips for Managing Margin Percentage

There are several things you can do to manage your margin percentage and reduce your risk:

- Deposit only the amount of money you can afford to lose. Margin trading can amplify your losses, so it’s crucial to only trade with money that you can afford to lose.

- Use stop-loss orders. A stop-loss order is an order to sell your position automatically if the market price falls to a certain level. This can help you limit your potential losses.

- Monitor your account regularly. Keep an eye on your margin percentage and make sure it doesn’t get too high. If it does, you may need to reduce your trading size or deposit more money into your account.

Conclusion

Margin percentage is an essential concept to understand for any forex trader. By understanding how margin percentage works, you can use it to your advantage to manage your risk and increase your profits. However, it’s crucial to remember that margin trading is a high-risk activity, so it’s essential to only trade with money that you can afford to lose.

Are you interested in learning more about margin percentage in forex? If so, I encourage you to do some additional research online or speak with a financial advisor. Forex trading can be a rewarding experience, but it’s important to educate yourself before you get started.

Image: forextradingyields.blogspot.com

What Is Margin Percentage In Forex

FAQs

Q: What is margin percentage in forex?

A: Margin percentage in forex is the amount of your account balance that is being used as margin.

Q: What are the benefits of using margin?

A: Margin can help you increase your profits by allowing you to trade with more money than you have in your account.

Q: What are the risks of using margin?

A: Margin trading is a high-risk activity, and you could lose more money than you deposited as margin.

Q: How can I manage my margin percentage?

A: There are several things you can do to manage your margin percentage, such as depositing only the amount of money you can afford to lose, using stop-loss orders, and monitoring your account regularly.