In the world of finance, understanding the concepts of margin and leverage is crucial for success in the dynamic foreign exchange (forex) market. These tools can amplify both profits and risks, so it’s essential to navigate them with knowledge and caution. Embark on a transformative journey as we delve into the intricacies of margin and leverage, empowering you to make informed decisions and unlock the full potential of forex trading.

Image: www.forexkarma.com

Unveiling the Essence of Margin

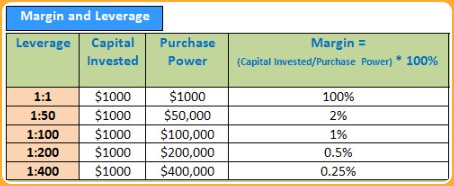

In the realm of forex trading, the concept of margin is fundamental. It refers to the amount of capital you pledge to hold as collateral to open a position. Unlike stock markets where full payment is required, forex trading allows you to access a greater amount of capital through leverage, leveraging the power of borrowed funds. Essentially, margin acts as a safety net, mitigating potential losses from adverse market movements.

Leverage: A Double-Edged Sword

Leverage, the second pillar of our exploration, is a magnifying glass that enhances your trading potential. By utilizing leverage, you can control a larger position size with a smaller initial investment. This can exponentially increase your profits if the market moves in your favor. However, leverage is a double-edged sword, as it magnifies both profits and losses. It’s crucial to proceed with prudence, understanding that higher leverage also amplifies the risks.

Navigating the Forex Landscape

Understanding margin and leverage is paramount to navigate the intricate forex landscape. Here’s how these concepts intertwine in practice:

-

Margin Call: When market movements deplete your margin to a critical level, a margin call may be issued. This serves as a warning to deposit additional funds or face the closure of your position.

-

Stop-Loss Orders: These protective orders automatically close your position if it reaches a predetermined loss threshold. They act as a buffer against excessive losses, safeguarding your capital.

-

Maximum Leverage: Forex brokers establish maximum leverage limits to manage their risk exposure. These limits vary based on the broker, the currency pair being traded, and your own experience level.

Image: www.forex.academy

Mastering Leverage: A Path to Success

Leverage can be a powerful ally, but harnessing its potential requires prudence and discipline. Consider these tips for leveraging leverage effectively:

-

Start Small: Begin with a low leverage ratio, gradually increasing it as your experience and understanding grow.

-

Set Realistic Expectations: Understand that leverage amplifies both profits and losses. Avoid chasing exorbitant returns and set realistic financial goals.

-

Embrace Risk Management: Implement robust risk management strategies such as stop-loss orders, position sizing, and profit-taking techniques.

-

Continuous Learning: Stay abreast of market trends, economic indicators, and trading strategies. Continuous education is key to staying ahead in the ever-evolving world of forex trading.

What Is Margin And Leverage In Forex

Conclusion: A Gateway to Financial Empowerment

Margin and leverage are indispensable concepts in forex trading, offering both opportunities and risks. By comprehending their intricacies, traders can harness the power of leverage while managing the inherent risks. Remember, financial success in forex trading is not solely about chasing profits but understanding market dynamics, embracing risk management, and maintaining a disciplined approach. Embark on this journey with determination and a thirst for knowledge, and let margin and leverage be the wings that elevate you to financial freedom.