Introduction

In the realm of forex trading, where market dynamics constantly fluctuate, traders seek every edge they can find to navigate the complexities of the financial landscape. Among the most valuable tools at their disposal is the art of technical analysis, which allows them to interpret historical price data to make informed trading decisions. Within this realm, candlestick patterns stand out as a powerful technique that provides valuable insights into market sentiment and price movements.

Image: larochethenting.blogspot.com

Candlesticks originated centuries ago in Japan as a method for tracking rice prices. Today, they are widely used by forex traders worldwide, offering a visual representation of price action over a specified period. Unlike traditional bar charts, candlesticks provide a more comprehensive view of price fluctuations, including the open, close, high, and low values within each time interval. This granular level of detail empowers traders to identify potential trading opportunities and make more accurate predictions about future price movements.

Navigating Candlestick Anatomy

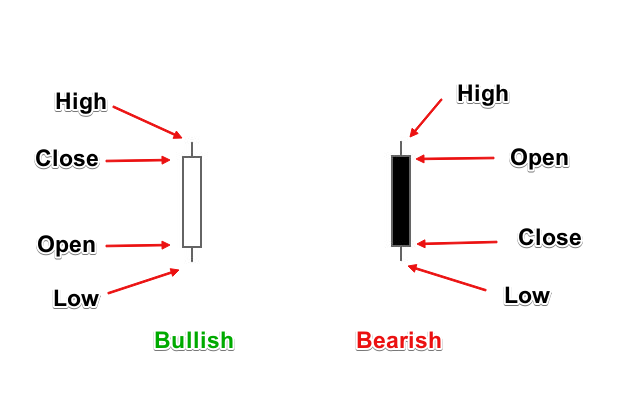

Understanding the anatomy of a candlestick is fundamental to harnessing its power in forex trading. Candlesticks have three main components:

The Body

The body of a candlestick represents the range between the open and close prices. A filled body denotes a bearish candle (red or black), indicating that the close is lower than the open price. Conversely, a hollow body signifies a bullish candle (green or white), suggesting that the close is higher than the open.

The Wick

The wick, also known as “the shadow,” extends from the top of the body to the highest price reached during the period and from the bottom of the body to the lowest price. Upper wicks represent an attempt by buyers to push prices higher, while lower wicks indicate the pressure from sellers.

Image: forextraininggroup.com

The Open and Close Prices

The horizontal lines on either side of the body represent the open and close prices. The open price is the first price of the period, while the close price is the last price. In an uptrend, the close price is typically above the open, forming a bullish candle. In a downtrend, the close price is usually below the open, resulting in a bearish candle.

Types of Candlestick Patterns

Candlestick patterns are categorized into two main types:

Reversal Patterns

Reversal patterns signal a potential change in the current trend. They are formed when prices move in one direction and then abruptly reverse course, often indicating a shift in market sentiment. Common reversal patterns include:

- Bullish Engulfing: A bullish candlestick with a long hollow body that engulfs the entire body of the preceding bearish candle.

- Bearish Engulfing: A bearish candlestick with a long filled body that engulfs the entire body of the preceding bullish candle.

- Hammer: A bullish candlestick with a small body, long lower wick, and no or short upper wick, resembling a hammer.

- Hanging Man: A bearish candlestick similar to the hammer, but with the upper wick longer than the lower wick, signaling potential weakness.

Continuation Patterns

Continuation patterns suggest that the current trend is likely to persist. They are formed when prices move in one direction and then pause before continuing in the same direction. Typical continuation patterns include:

- Bullish Rising Three Methods: Three consecutive bullish candlesticks with each close higher than the close of the previous candle, signaling a bullish trend.

- Bearish Falling Three Methods: Three consecutive bearish candlesticks with each close lower than the close of the previous candle, indicating a bearish trend.

- Bullish Harami: A small bullish candlestick completely contained within the body of the preceding bearish candle, suggesting a temporary pause in the downtrend.

- Bearish Harami: A small bearish candlestick fully contained within the body of the preceding bullish candle, indicating a potential reversal in the uptrend.

Applying Candlestick Patterns in Forex Trading

Candlestick patterns can provide traders with valuable insights into market dynamics, enabling them to make more informed trading decisions. However, it is crucial to remember that no pattern is infallible, and considering multiple indicators is always prudent. Here are some tips for using candlesticks effectively in forex trading:

- Look for confirmation: Do not rely on a single candlestick pattern. Look for multiple patterns that reinforce each other to increase the probability of success.

- Consider the trend: Candlestick patterns can signal reversal or continuation, so always consider the overall trend of the market before making a trade.

- Manage risk: Use stop-loss orders to limit potential losses. Candlestick patterns are not always accurate, so it is essential to protect your capital.

- Practice: Practice using candlestick patterns in a demo account to gain experience before trading with real money. Mastering technical analysis requires time and dedication.

What Is Candlestick In Forex

Conclusion

Candlestick patterns are an integral part of any forex trader’s toolkit. They provide valuable insights into market sentiment and price movements. By understanding their anatomy, types, and applications, traders can enhance their decision-making, increase their potential for profitability, and navigate the treacherous waters of foreign exchange with greater confidence. Remember, candlestick trading is an art that requires patience, practice, and a commitment to continuous learning.