Introducing Bollinger Bands: A Powerful Technical Analysis Tool

Bollinger Bands emerged in the trading world crafted by John Bollinger as a technical analysis tool designed to determine market volatility and price behavior. Anchored around a central moving average line, Bollinger Bands consist of two outlying bands that define overbought and oversold conditions in the market. Strategically applied, these bands empower traders to identify potential trading opportunities in the ever-changing Forex market.

Image: www.dailyfx.com

Defining Standard Deviations

Bollinger Bands’ central line embodies an exponential moving average (EMA) of a security’s price. The outer bands, positioned at set standard deviations (typically two) away from the central line, serve as dynamic support and resistance levels. During periods of limited price fluctuation, these bands draw closer, compressing together. However, they broaden outwards during volatile markets, signaling anticipated market fluctuations.

Properties and Interpretations

Bollinger Bands offer a unique perspective on the Forex market:

- Bollinger squeeze: Concurrence of Bollinger Bands with narrow compression suggests that a significant price movement may occur, representing an approaching market breakout.

- Crossovers: When the price crosses above the upper Bolliger band, it signals potential overbought conditions, implying a possible subsequent drop in price. Conversely, if the price plunges below the lower Bollinger band, it suggests oversold conditions, predicting a potential rise in price.

- Band Width: The gap between the upper and lower Bollinger bands represents market volatility. Wider bands signify higher volatility, while closer bands signal lower volatility.

Tactical Application for Trading

Bollinger Bands empower traders to confidently execute well-informed trades:

- Trading breakouts: Identifying the constriction of Bollinger Bands can indicate a breakout. Placing long trades above the upper band and short trades beneath the lower band can maximize profit.

- Trade reversals: Trading reversals are identified when prices reach the Bollinger Bands’ extremes and revert. Understanding these contrarian patterns allows for strategic buying or selling based on price movement.

- Confirmation techniques: Combining Bollinger Bands with trend indicators (like RSI or MACD) can refine signals, facilitating better decision-making. Convergence of signals between indicators validates opportunities.

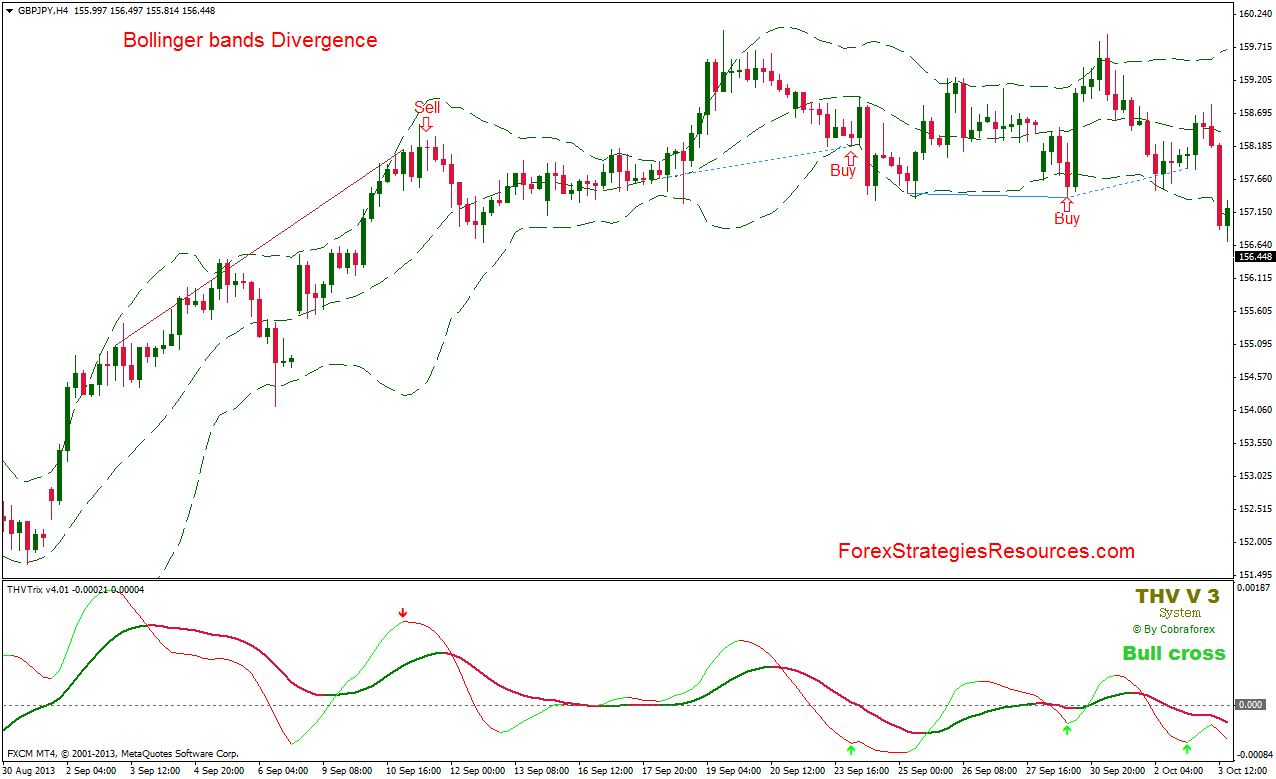

Image: www.forexstrategiesresources.com

Frequently Asked Questions

Q: Are Bollinger Bands suitable for all trading styles?

A: Bollinger Bands prove most beneficial for short-term to swing traders due to their fluidity with market volatility.

Q: Can Bollinger Bands predict future price movements accurately?

A: While Bollinger Bands provide guidance on market behavior, anticipating future prices remains uncertain.

What Is Bollinger Bands In Forex

https://youtube.com/watch?v=BCNiZE5uCzk

Conclusion

Bollinger Bands have revolutionized Forex trading, enabling traders to make informed decisions. Understanding their properties and applications is crucial for exploiting trading opportunities and navigating market volatility. Although no technical analysis tool guarantees absolute accuracy, Bollinger Bands, when applied aptly, provide invaluable insights, facilitating informed trading choices.

Embark on your Forex trading journey with confidence, empowered by the power of Bollinger Bands. Are you ready to unlock the secrets to unlocking trading success?