Currencies held by central banks and other monetary authorities for various purposes are known as forex reserves. These reserves play a critical role in international finance and the stability of global economies.

Image: www.theindianwire.com

Forex reserves represent a country’s foreign exchange liquidity and serve as a vital buffer against economic shocks. They include various currencies, gold, and other financial instruments that can be used to settle international transactions and meet external obligations.

Understanding Forex Reserves and their Composition

Forex reserves are primarily composed of the following components:

- Foreign currencies: This includes major currencies like the US dollar, euro, and Japanese yen. Central banks hold these currencies to facilitate global trade, make intervention in foreign exchange markets, and support their own currencies.

- Gold: Gold is a traditional and valuable asset that is often held as a part of forex reserves. It provides diversification and serves as a safe haven during economic uncertainty.

- Special Drawing Rights (SDRs): SDRs are international reserve assets created by the International Monetary Fund (IMF). They are based on a weighted average of several major currencies and are used as a supplemental reserve asset.

- Reserve position in the IMF: This represents a country’s claim on foreign currencies held by the IMF. It can be used to draw on IMF resources in times of need.

The composition of forex reserves varies across countries, depending on their economic policies and financial conditions.

The Importance of Forex Reserves

Forex reserves serve numerous important purposes, including:

- International transaction settlement: Forex reserves are essential for settling international trade and financial transactions. They provide the means for countries to make payments for imports and other external obligations.

- Maintenance of exchange rate stability: Central banks use forex reserves to intervene in currency markets and stabilize exchange rates. By buying or selling foreign currencies, they can influence the value of their own currency.

- Provision of liquidity during economic shocks: Forex reserves can serve as a buffer against external shocks. In times of financial crisis or economic turmoil, countries can draw on their forex reserves to meet foreign currency obligations and support their economies.

- Enhancing investor confidence: Ample forex reserves boost investor confidence in a country’s economy and its ability to meet financial commitments.

- Facilitating foreign exchange market liquidity: Forex reserves contribute to the liquidity of foreign exchange markets by providing a stable supply of foreign currencies.

Recent Trends and Developments in Forex Reserves

The global forex reserve landscape is constantly evolving. Some of the recent trends and developments include:

- Rise in diversification: Central banks are increasingly diversifying their forex reserves by holding a wider range of currencies and financial instruments.

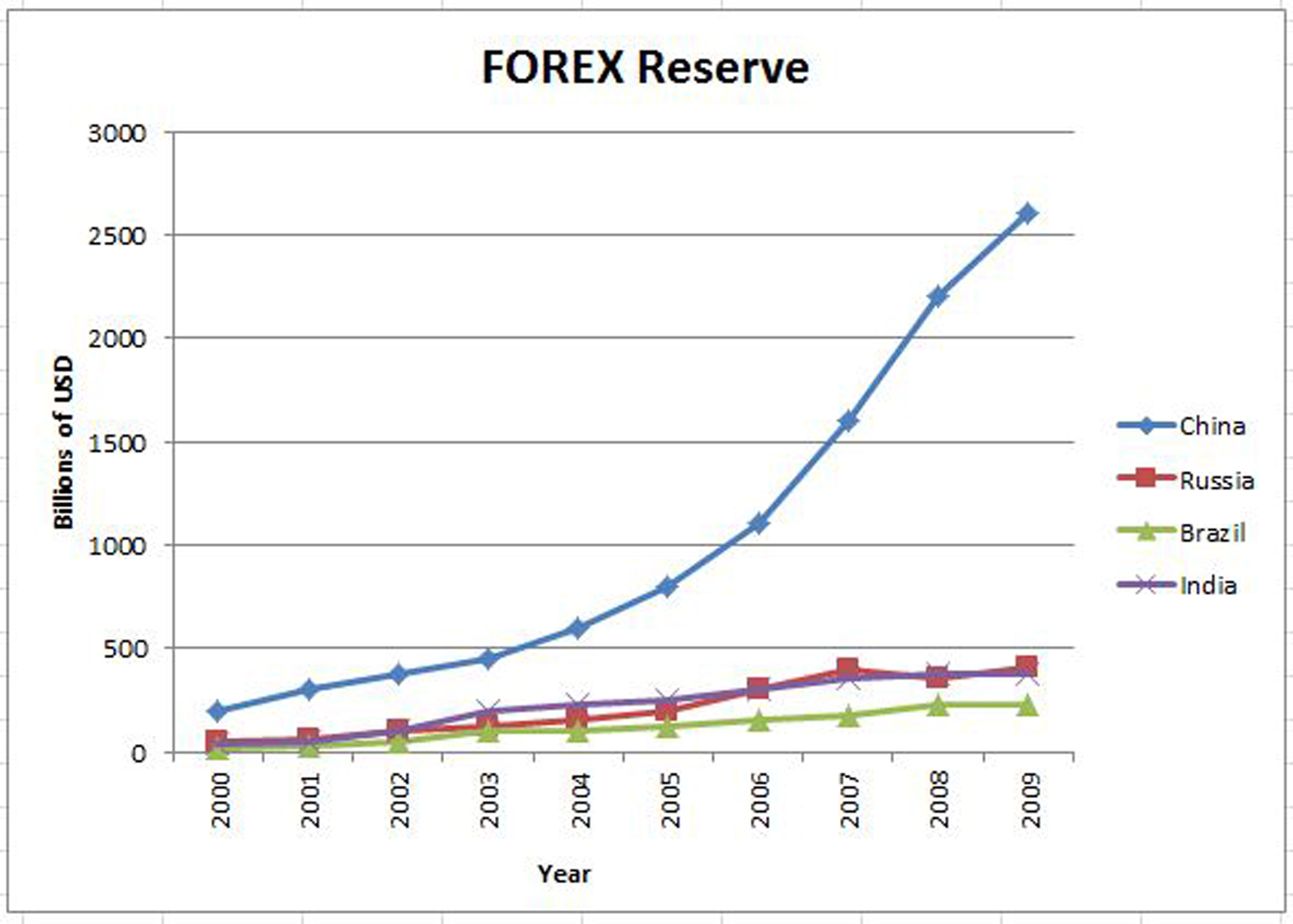

- Emergence of new reserve currencies: The Chinese yuan, Indian rupee, and others are gaining prominence as global reserve currencies.

- Increased use of SDRs: SDRs are becoming a more widely accepted reserve asset, particularly among emerging market economies.

- Impact of geopolitical events: Political and economic tensions can influence the demand for and supply of forex reserves.

- Digitalization of forex reserves: New technologies are being explored to enhance the management and usage of forex reserves.

Image: apekmulay.com

Tips and Expert Advice for Managing Forex Reserves

Based on insights from experienced economists and financial analysts, here are some tips and expert advice for managing forex reserves:

- Diversify your holdings: Reduce risk by holding a mix of currencies, gold, and other financial instruments in your forex reserves.

- Monitor market trends: Stay informed about global economic and financial developments that could impact forex markets.

- Maintain adequate liquidity: Ensure your forex reserves are sufficient to meet potential foreign currency demands.

- Use intervention strategies cautiously: Currency intervention can be a powerful tool, but it should be used judiciously and with a clear understanding of potential consequences.

- Cooperate with other central banks: Collaboration with other central banks can enhance the effectiveness of forex reserve management.

By following these tips and seeking guidance from experts in the field, policymakers can effectively manage forex reserves to promote economic stability and financial resilience.

FAQs on Forex Reserves

Q: What are the main purposes of forex reserves?

A: Forex reserves are primarily used for international transaction settlement, exchange rate stability maintenance, liquidity provision, investor confidence enhancement, and foreign exchange market liquidity facilitation.

Q: What is the ideal level of forex reserves?

A: The optimal level of forex reserves varies depending on a country’s specific economic circumstances and risk profile. There is no universally agreed-upon threshold, but a comfortable level is typically considered as enough to cover several months’ worth of imports.

Q: How are forex reserves managed?

A: Forex reserves are managed by central banks and other monetary authorities. They monitor economic conditions, analyze market trends, and implement intervention strategies to maintain exchange rate stability and ensure adequate liquidity.

What Is A Forex Reserve

Conclusion

Forex reserves are an essential component of a country’s economic and financial infrastructure. By understanding their composition, importance, trends, and best management practices, policymakers and financial experts can harness the power of forex reserves to promote economic stability, protect against external shocks, and enhance global financial resilience.

Are you interested in learning more about the intricacies of forex reserves and their role in international finance? Share your queries and insights in the comments below, and let’s delve into this fascinating topic together.