In the bustling world of forex trading, you’ll often encounter terms like “bid” and “ask.” These concepts are fundamental to understanding how forex markets operate, and they play a crucial role in your trading decisions. So, let’s dive into what bid and ask mean in forex.

Image: www.flowbank.com

Imagine walking into a fish market. You notice two prices displayed for the same type of fish: one labeled “Buy Now” and another labeled “Sell Now.” The “Buy Now” price represents the highest price someone is willing to pay for the fish (known as the bid price), while the “Sell Now” price is the lowest price someone is willing to sell it for (known as the ask price). Similarly, in forex trading, bid and ask represent the best prices at which you can buy or sell a currency pair.

The Bid and Ask Spread

The difference between the bid and ask prices is known as the spread. It represents the profit margin for market makers who facilitate trades between buyers and sellers. A tight spread implies a more competitive market, while a wide spread indicates less competition.

The spread is influenced by various factors, including:

- Currency pair liquidity

- Market conditions

- Brokerage fees

Determining the Bid and Ask Prices

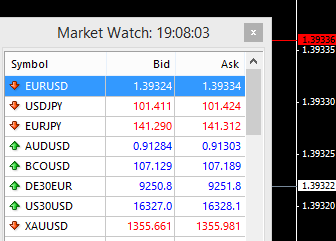

Bid and ask prices are continuously changing, reflecting real-time supply and demand. Traders can access these prices through trading platforms provided by brokers. The bid price is always lower than the ask price, indicating that traders need to pay a premium to enter a buy position.

The Importance of Bid and Ask Prices

Understanding bid and ask prices is crucial for effective forex trading. They provide actionable information about the current market sentiment and help you make informed trading decisions. They also influence:

- Trading strategies

- Order execution

- Risk management

Image: www.forexfactory.com

Expert Tips and Advice

To enhance your knowledge further, here are some expert tips and advice to consider:

- Trade with reputable brokers that offer competitive spreads.

- Understand the factors that influence bid and ask spreads.

- Monitor market trends and news events to anticipate price movements.

- Practice risk management techniques to manage潜在损失.

By incorporating these recommendations into your trading plan, you can make more informed decisions and improve your overall trading performance.

Frequently Asked Questions

To further enhance your understanding, let’s address some commonly asked questions about bid and ask prices:

- Q: What is the difference between bid and ask prices?

- A: The bid price is the price you can sell at, while the ask price is the price you can buy at.

- Q: Who sets bid and ask prices?

- A: Market makers determine the bid and ask prices based on supply and demand.

- Q: Why do bid and ask prices change constantly?

- A: Bid and ask prices change due to fluctuations in supply and demand, influenced by economic and political factors.

- Q: How can I use bid and ask prices in trading?

- A: Bid and ask prices provide insights into market sentiment, helping you make informed decisions about buy and sell orders.

What Does Bid And Ask Mean In Forex

https://youtube.com/watch?v=a-y2LvXGiaA

Conclusion

Understanding bid and ask prices is an essential foundation for successful forex trading. By grasping these concepts, you can decipher market sentiment, optimize order execution, and navigate the forex markets with greater confidence. So, keep an eye on those bid and ask prices—they hold the key to unlocking the lucrative world of forex trading.

Is there any topic about bid and ask in forex trading you are interested in?