The foreign exchange (forex) market is the world’s largest, most liquid financial market, where trillions of dollars are traded daily. To navigate this dynamic market successfully, traders rely on a range of technical analysis tools, one of the most powerful being the Volume Profile indicator. Specifically, the Volume Profile Indicator available in MetaTrader 4 (MT4) empowers traders with valuable insights into market behavior. This article will delve into the concept, application, and significance of the Volume Profile Indicator in MT4, providing a comprehensive guide to unlock its potential for informed and profitable forex trading decisions.

Image: indicatorchart.com

Volume Profile Indicator: A Definition and Its Importance

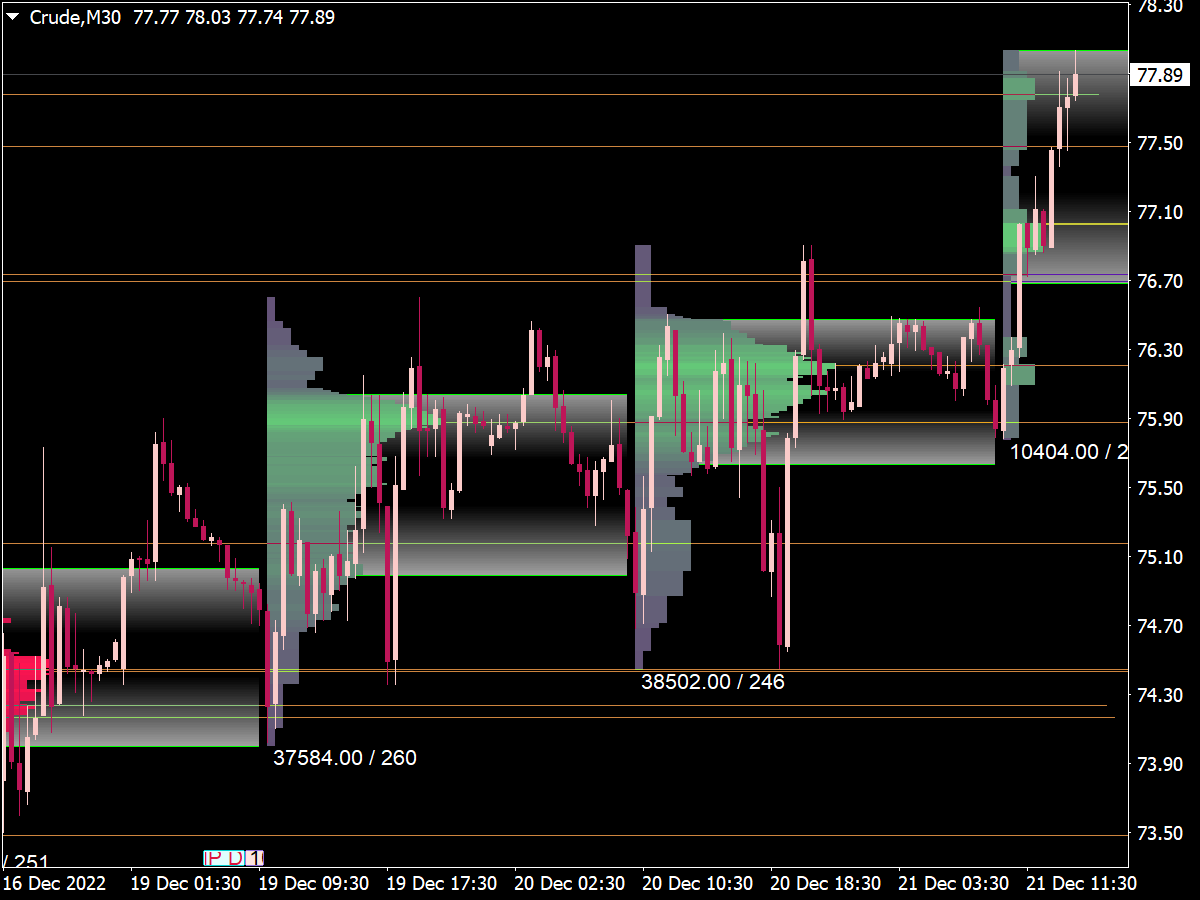

The Volume Profile Indicator is a technical analysis tool that visually represents the distribution of trading activity at specific price levels. It is based on the premise that price action tends to cluster around certain levels, influenced by factors such as support and resistance, trendlines, and psychological barriers. The indicator identifies these value areas, known as “volume nodes,” and portrays them graphically on the price chart.

Understanding volume distribution is crucial for forex traders. By identifying volume nodes, traders can make informed decisions about potential price movements. These volume nodes can act as support or resistance zones, indicating areas where price may bounce off or reverse. Moreover, analyzing volume profiles enables traders to gauge market sentiment and identify areas of potential trading opportunities.

Exploring the Volume Profile Indicator in MT4: Comprehensive Analysis

The Volume Profile Indicator in MT4 offers a comprehensive set of features to assist traders in analyzing market behavior. It can be customized to display information over a user-defined range, from a few bars to multiple days or weeks. Additionally, traders can adjust the height of the volume profile, allowing them to focus on specific price ranges or identify larger market trends.

To effectively utilize the Volume Profile Indicator, traders should focus on identifying volume nodes. A simple understanding of support and resistance levels can guide this process. Volume nodes that coincide with price support or resistance areas gain greater significance. Moreover, the height of each volume node represents the number of trades executed at that price level, indicating the market’s preference or clustering of trades at those values.

The Volume Profile Indicator in MT4 also facilitates the recognition of “point of control.” This is a price level that represents the highest volume traded over a specific timeframe, often indicating a potential support or resistance level. By analyzing point of control in conjunction with volume nodes, traders can enhance their understanding of price action and identify potential trading opportunities.

Applying the Volume Profile Indicator: Strategies and Techniques

Incorporating the Volume Profile Indicator into forex trading strategies can enhance decision-making and improve profitability. One popular strategy involves using volume nodes as a basis for entry and exit points. Trades can be initiated in the direction of the prevailing trend, with volume nodes serving as price targets for profit-taking or stop-loss placement.

Traders can also employ the Volume Profile Indicator to identify potential reversals or trend changes. A shift in the point of control can indicate a change in market sentiment, signaling a potential trend reversal. Furthermore, traders can use the Volume Profile Indicator to assess the strength or weakness of price reactions at support and resistance levels.

Image: www.best-metatrader-indicators.com

Volume Profile Indicator Mt4 Forex Factory

Conclusion: Empowering Forex Traders with the Volume Profile Indicator

The Volume Profile Indicator in MT4 is an indispensable tool for forex traders seeking to unravel the intricacies of market behavior. By comprehending volume distribution and identifying value areas, traders can gain an edge in navigating market fluctuations and making profitable trading decisions. The ability to identify volume nodes, point of control, and support and resistance levels empowers traders with a clear understanding of price action, leading to well-informed and potentially rewarding trades.

For those new to volume profile analysis or eager to delve deeper into its functionalities, exploring online forums and educational resources can be immensely beneficial. Seasoned forex traders and financial analysts often share valuable insights, strategies, and trading ideas, expanding the knowledge and capabilities of aspiring traders. By embracing the Volume Profile Indicator and integrating it into their trading strategies, forex traders can elevate their decision-making and embrace the path to trading success.