Introduction:

In the bustling metropolis of Forex trading, two fundamental pillars stand tall: support and resistance. These invisible yet influential lines define the boundaries within which price oscillations occur, providing invaluable insights into market dynamics. Mastering the art of identifying and trading support and resistance levels is a key skill that elevates Forex traders from the realm of novices to seasoned veterans.

Image: excellenceassured.com

Navigating the turbulent waters of the Forex market requires a deep understanding of the forces that govern price movements. Support and resistance levels serve as indispensable guideposts, allowing traders to anticipate price reversals and profit from the ebb and flow of the market. Embark on this comprehensive exploration of urban Forex support and resistance, a journey that will empower you to conquer the financial jungle with confidence and precision.

Understanding Support and Resistance: The Foundation of Technical Analysis

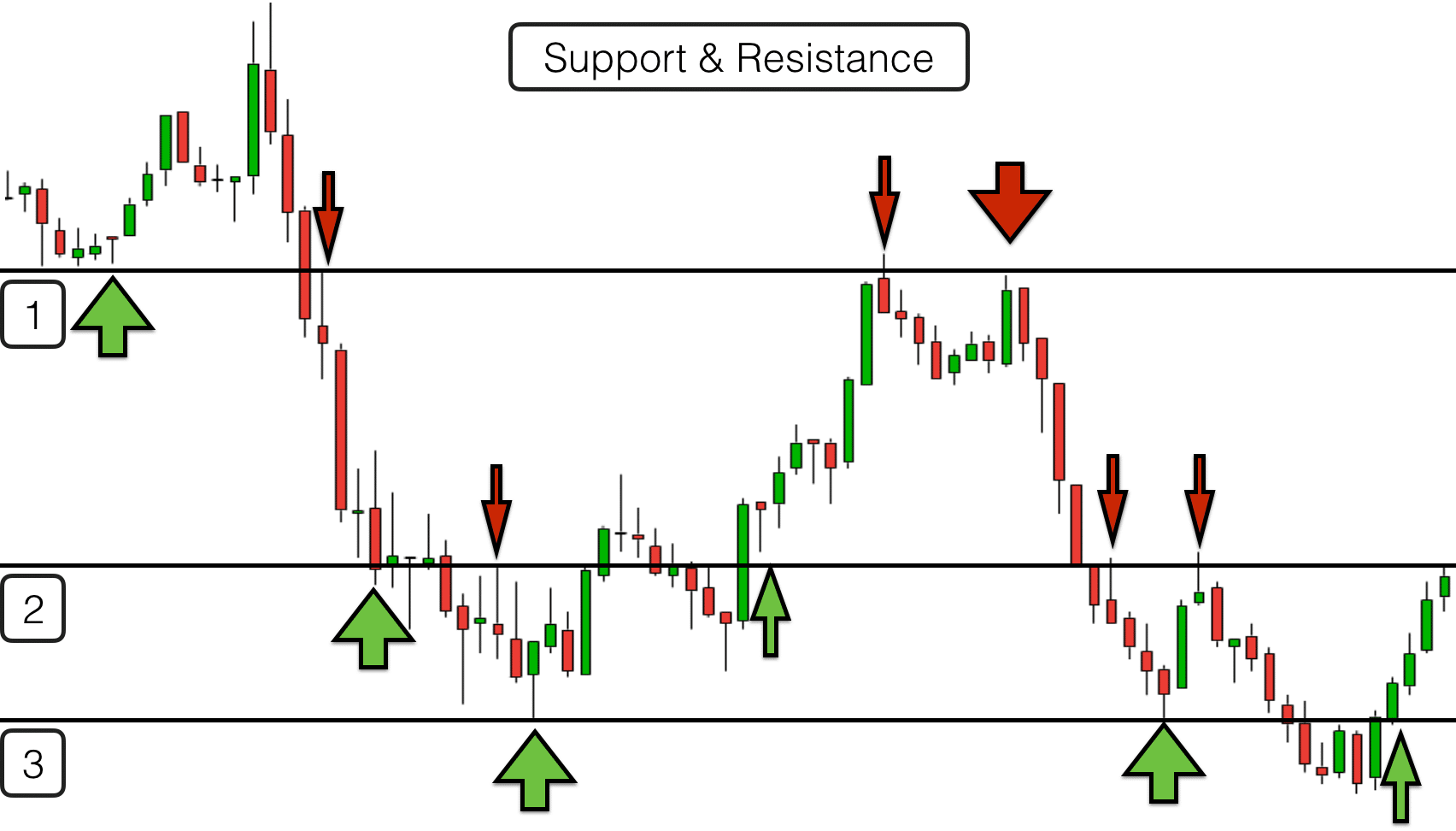

Support refers to the price level at which demand for a currency pair overwhelms supply, preventing further price declines. Resistance, on the other hand, marks the level at which supply exceeds demand, forming an invisible ceiling. Prices tend to bounce off these levels, creating a predictable pattern of price fluctuations. Identifying these crucial levels empowers traders to make informed decisions, capitalize on market reversals, and minimize losses.

The concept of support and resistance has its roots in the Dow Theory, a cornerstone of technical analysis. This theory postulates that market trends unfold in recurring patterns, and that these patterns can be identified and exploited by studying price action. Support and resistance levels are key components of technical analysis, providing a systematic framework for interpreting market behavior and making profitable trades.

Types of Support and Resistance Levels: A Taxonomy of Market Delimitations

The Forex market presents a diverse landscape of support and resistance levels, each with its own unique characteristics and trading implications. Some of the most prevalent types include:

- Horizontal Support and Resistance: These levels manifest as flat lines on a price chart, indicating price levels where there has been a consistent imbalance between demand and supply.

- Trendline Support and Resistance: These levels form diagonal lines connecting a series of swing highs and swing lows, representing areas where the market has consistently respected an underlying trend.

- Fibonacci Support and Resistance: These levels are derived from the Fibonacci sequence, a series of numbers discovered by the Italian mathematician Leonardo Fibonacci. Fibonacci levels have been observed to align with key turning points in market trends.

- Moving Average Support and Resistance: These levels are calculated by averaging price data over a specified period, creating dynamic lines that provide support and resistance zones. Moving averages can be simple, exponential, or weighted, each with its own distinct characteristics.

Identifying Support and Resistance Levels: A Trader’s Toolkit

Mastering the art of identifying support and resistance levels is paramount for successful Forex trading. Here’s a comprehensive toolkit to enhance your precision:

- Price Action: Price action refers to the raw, unfiltered movement of prices on a chart. By observing historical price patterns, traders can identify areas where support and resistance levels have formed.

- Volume Analysis: Analyzing trading volume alongside price action can provide additional confirmation for support and resistance levels. High volume at a particular price level suggests increased market activity, reinforcing the strength of that level.

- Technical Indicators: Numerous technical indicators have been developed to assist traders in identifying support and resistance levels. These indicators include moving averages, Bollinger Bands, and Ichimoku clouds, among others.

Image: forexspringboard.com

Trading Strategies Utilizing Support and Resistance: Harvesting Market Opportunities

Armed with the ability to identify support and resistance levels, traders can execute a range of effective trading strategies to capitalize on market movements:

- Bounce Trading: This strategy involves buying at support levels in anticipation of a price rebound. Conversely, traders can sell at resistance levels, expecting a price reversal.

- Breakout Trading: This strategy entails entering trades when prices break through support or resistance levels. Breakouts signal a potential shift in market sentiment, creating opportunities for substantial profits.

- Range Trading: When prices consolidate within defined support and resistance levels, traders can employ range trading strategies. This involves buying near support and selling near resistance, profiting from the predictable price movements within the established range.

The Evolving Landscape of Support and Resistance: A Dynamic Market Environment

It’s imperative to recognize that support and resistance levels are not static entities but rather dynamic concepts that adapt to changing market conditions. Here are some factors that can influence the validity and effectiveness of these levels:

- Time: Support and resistance levels can weaken over time as market conditions evolve. Traders must constantly reassess these levels to maintain accuracy.

- News and Events: Major news events and economic releases can cause significant shifts in market sentiment, impacting the validity of existing support and resistance levels.

- Market Psychology: The behavior of market participants, influenced by factors such as fear, greed, and optimism, can affect the strength and duration of support and resistance levels.

Urban Forex Support And Resistance

Conclusion: Mastering Support and Resistance – The Path to Forex Mastery

Understanding and utilizing support and resistance levels is an indispensable skill for Forex traders who aspire to achieve consistent profitability. By embracing the principles outlined in this comprehensive guide, traders can transform from passive market observers into astute strategists capable of navigating the complexities of the Forex market with confidence. Remember, the path to Forex mastery is paved with a deep understanding of market dynamics and the ability to identify and exploit support and resistance levels. So, embrace the challenge, sharpen your analytical skills, and conquer the urban jungle of Forex trading.