In the realm of global finance, the ability to seamlessly transfer funds across borders is paramount. For individuals with an HDFC Forex Card, the question of how to transfer money back to a bank account often arises. This article aims to provide a comprehensive guide to this process, empowering you to effortlessly manage your finances while abroad or upon your return.

Image: forexautorobotdownload.blogspot.com

Understanding the HDFC Forex Card

An HDFC Forex Card is a prepaid card that allows you to store multiple currencies and make purchases overseas. It offers several advantages, including competitive exchange rates, no transaction charges in foreign currencies, and the convenience of carrying multiple currencies on a single card.

Steps to Transfer Money from HDFC Forex Card to Bank Account

- Activate Your Card: Ensure that your HDFC Forex Card is activated by calling the HDFC Bank Customer Care helpline or visiting their nearest branch.

- Check Your Balance: Determine the available balance on your Forex Card through NetBanking, Mobile Banking, or the HDFC Bank Customer Care helpline.

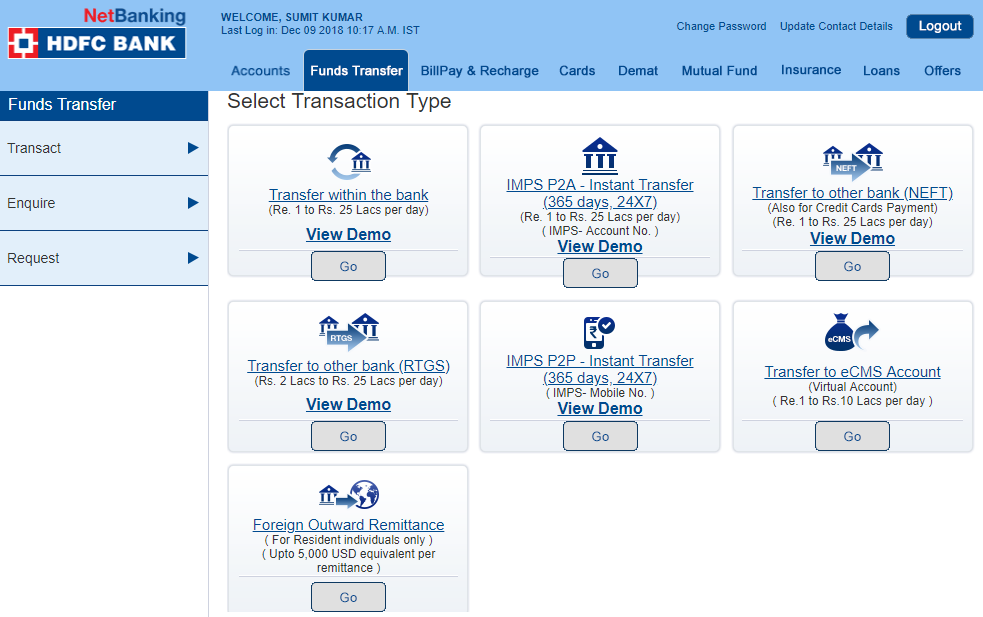

- Log in to NetBanking: Visit the HDFC Bank NetBanking website and log in using your credentials.

- Select “Forex Card” Transfer: Navigate to the “Forex Card” section and click on the “Transfer to Account” option.

- Enter Recipient Details: Provide the account number and IFSC code of the bank account you wish to transfer the funds to.

- Enter Transfer Amount: Specify the amount you want to transfer from your Forex Card in the designated field.

- Review and Confirm: Carefully review the transfer details and ensure the accuracy of the information.

- Submit Request: Once all details are verified, submit your transfer request by clicking on the “Submit” button.

- Transaction Processing: HDFC Bank will process your transfer request, which typically takes 1-2 business days to complete.

Fees and Charges

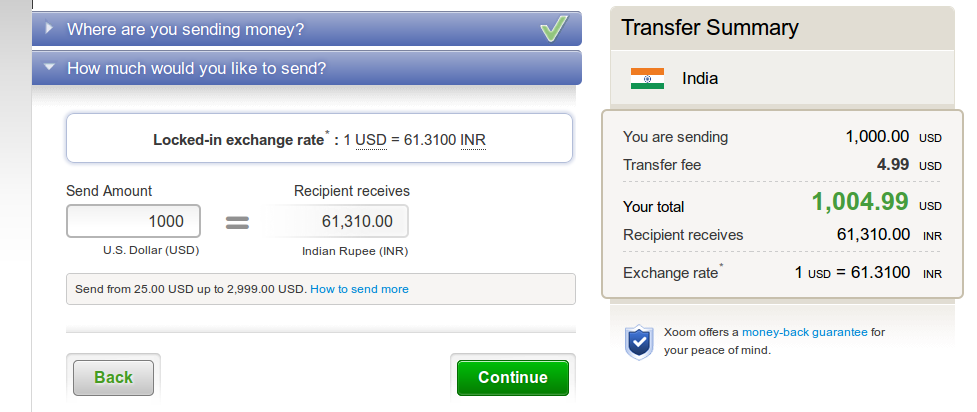

HDFC Bank charges a nominal fee for transferring money from a Forex Card to a bank account. The fee varies depending on the amount transferred and the destination bank. It is advisable to check with HDFC Bank for the latest fee structure.

Image: akowedananipa.web.fc2.com

Benefits of Transferring from HDFC Forex Card to Bank Account

- Convenience: The online transfer facility allows you to transfer funds anytime and anywhere, eliminating the need for physical visits to the bank.

- Security: HDFC Bank’s NetBanking platform utilizes industry-leading security measures to ensure the safety and privacy of your transactions.

- Exchange Rate Optimization: When transferring funds, you can take advantage of HDFC Bank’s competitive exchange rates to maximize the amount you receive in your bank account.

Transfer Money From Hdfc Forex Card To Bank Account

Conclusion

Transferring money from an HDFC Forex Card to a bank account is a straightforward and convenient process that empowers you to manage your finances effortlessly. By following the steps outlined in this guide, you can ensure the timely and secure transfer of funds, enabling you to optimize your financial well-being. Whether you are concluding your travels or simply managing your currency holdings, the HDFC Forex Card offers an efficient and reliable solution for your international fund transfer needs.