In the realm of finance, the allure of financial freedom and wealth creation through trading games has captured the imaginations of countless individuals. From the bustling lanes of forex markets to the hallowed halls of stock exchanges, the pursuit of profit has fueled the ambitions of traders for generations. In this article, we delve into the intricacies of forex and stock market investing, empowering you with the knowledge and strategies necessary to navigate these dynamic financial landscapes.

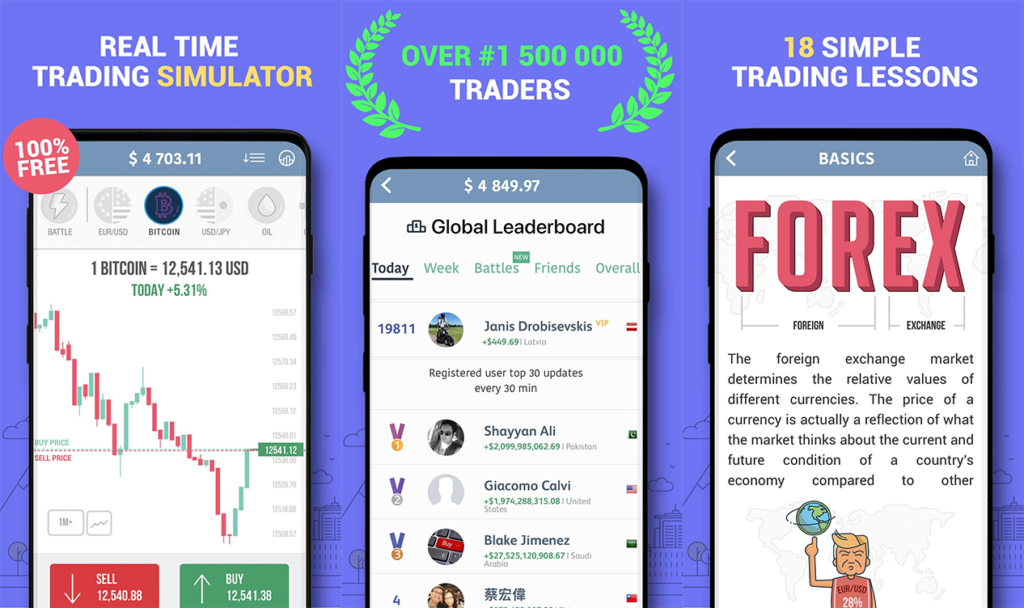

Image: financeillustrated.com

A Glimpse into the Trading Arena

Trading games encompass a diverse range of financial instruments, including currencies, stocks, and commodities. Forex trading, a global marketplace where currencies are exchanged, offers opportunities for speculation and short-term profit. Stock market investing, on the other hand, grants investors ownership in publicly traded companies, providing the potential for long-term capital gains and dividend income.

The world of trading is a captivating blend of excitement and risk. Successful traders possess a keen understanding of market dynamics, risk management techniques, and the ability to make informed decisions under pressure. While the potential rewards can be substantial, it is essential to approach these markets with a sound understanding of the inherent risks and a willingness to continuously learn and adapt.

Unveiling the Art of Forex Trading

Forex trading, a 24-hour market, involves the buying and selling of currency pairs. Its decentralized nature and high leverage make it an enticing haven for both experienced traders and those seeking short-term gains. However, navigating the forex market requires a deep comprehension of currency fluctuations, economic indicators, and geopolitical events that influence currency valuations.

Successful forex traders typically employ a combination of technical analysis, utilizing charts and indicators to predict price movements, and fundamental analysis, assessing economic factors that impact currency values. Risk management is paramount in forex trading, as unanticipated price swings can result in significant losses. The use of stop-loss orders and strict adherence to trading plans are crucial to mitigate risks.

Exploring the Stock Market’s Dynamics

Stock market investing offers a fundamentally different approach to wealth creation. By purchasing shares in publicly listed companies, investors become partial owners of those businesses. Over time, as companies grow and expand, the value of their shares may appreciate, leading to capital gains. Additionally, many companies distribute a portion of their profits to shareholders in the form of dividends, providing stockholders with a steady stream of income.

Investing in the stock market is a long-term strategy that requires a keen eye for identifying undervalued companies with promising growth prospects. Contrary to the fast-paced nature of forex trading, successful stock market investors adopt a more patient approach, allowing their investments to compound over time. Diversification across various sectors and asset classes plays a vital role in managing risk and enhancing returns.

Image: forextraininggroup.com

Harnessing the Wisdom of Seasoned Traders

Venturing into the trading game requires a commitment to continuous learning and the ability to adapt to ever-changing market conditions. Tapping into the wisdom of experienced traders through online forums, social media platforms, and educational resources can provide invaluable insights into market trends, risk management techniques, and trading strategies.

Seeking mentorship from successful traders can accelerate one’s learning curve and provide access to real-time insights and guidance. Attentive traders stay abreast of industry news and updates to remain current on market developments and emerging opportunities. The ability to synthesize information and make informed decisions is a hallmark of proficient traders.

FAQ: Unraveling Common Trading Queries

- Q: What is the difference between forex trading and stock market investing?

A: Forex trading involves buying and selling currencies, while stock market investing focuses on purchasing shares in publicly traded companies. - Q: What is risk management in trading?

A: Risk management involves employing strategies to minimize potential losses, such as using stop-loss orders and diversifying portfolios. - Q: How do I get started with forex trading?

A: Open a trading account with a reputable broker and acquire a thorough understanding of currency markets through education and practice. - Q: Is stock market investing suitable for everyone?

A: While stock market investing offers growth potential, it is crucial to understand and tolerate the inherent risks before investing.

Trading Game Forex & Stock Market Investing

Conclusion: Embarking on Your Trading Journey

The trading arena, encompassing forex and stock market investing, offers an unparalleled opportunity for financial freedom and wealth creation. However, it demands a deep understanding of market dynamics, risk management principles, and the ability to make informed decisions under pressure. By embracing continuous learning, seeking guidance from experienced mentors, and implementing sound trading strategies, aspiring traders can navigate these markets and harness their potential for profit.

Ask yourself: Are you ready to step into the trading game and unlock the financial possibilities that await you? The journey to financial freedom begins with a courageous heart and a commitment to knowledge and discipline. Embark on this adventure with newfound determination, and let the markets be your witness to your financial triumph.