The forex market, a global arena where currencies are traded, has been captivating traders with its tantalizing allure of profit-making potential. Amidst the thrill of speculation and currency fluctuations, however, lies the intricate web of tax regulations that can perplex even seasoned traders. One such enigma is the enigmatic TDS (tax deducted at source), a nuanced concept that beckons for in-depth exploration.

Image: www.luxefinalyzer.com

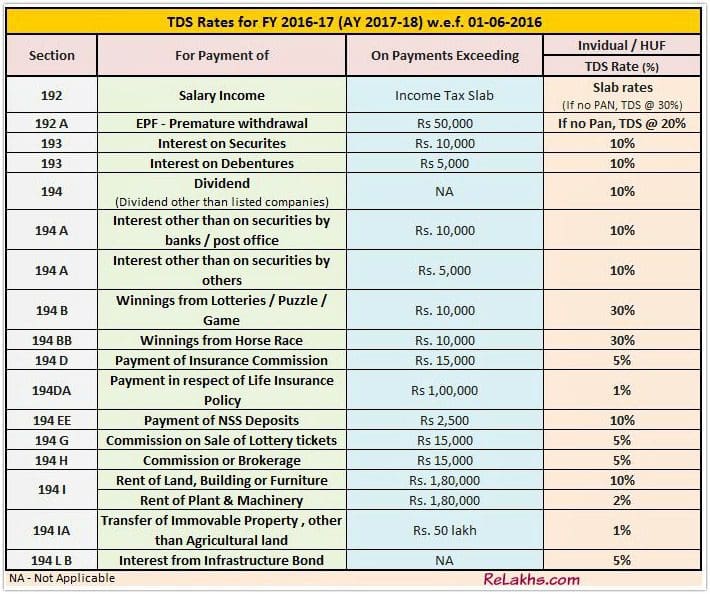

TDS, a cornerstone of India’s tax landscape, requires responsible entities to deduct tax from specific payments made to non-resident individuals or entities. In the realm of forex services, this translates into a reduction of taxable income, effectively impacting the bottom line of the service provider. As we venture deeper into this labyrinthine topic, clarity will emerge, illuminating the path towards informed decision-making.

TDS on Forex Services: A Comprehensive Examination

Forex services encompass a diverse range of financial transactions, including currency exchange, remittances, and other ancillary services tailored to the needs of international trade and investment. Individuals and businesses leveraging these services must be cognizant of the TDS implications, ensuring compliance and avoiding potential penalties.

When a resident Indian entity engages the services of a non-resident forex service provider, the onus falls upon the former to deduct TDS at source. The applicable rate of TDS varies depending on the nature of the service provided and the residency status of the service recipient.

For instance, if a resident Indian company utilizes the services of a non-resident forex broker to facilitate currency exchange, TDS will be deducted at a flat rate of 5%. This deduction serves as an advance payment towards the service recipient’s ultimate tax liability, obviating the need for cumbersome reconciliations and potential tax shortfalls.

Decoding the Nuances of TDS Compliance

To ensure seamless compliance, it is imperative for forex service providers to possess a thorough understanding of their TDS obligations. Besides the aforementioned responsibilities, additional considerations arise in specific scenarios:

-

TDS Exemption: Non-resident forex service providers may qualify for TDS exemption under specific circumstances, such as holding a valid Tax Residency Certificate (TRC) issued by the relevant tax authority in their country of residence. This exemption can significantly reduce the tax burden, translating into increased profitability.

-

TDS Refund: If TDS has been deducted in excess of the actual tax liability, the non-resident service provider can file for a refund by submitting a claim to the Indian Income Tax Department. The process involves substantiating the claim with supporting documentation, such as income tax returns and bank statements.

-

Consequences of Non-Compliance: Failure to comply with TDS regulations can lead to dire consequences, including hefty penalties and interest charges. Ignorance of the law is no excuse, and it is prudent to seek professional guidance to mitigate potential risks.

Image: www.relakhs.com

Tds Applicable On Forex Services

Navigating the Challenges with Strategic Foresight

TDS implications in forex services can present challenges, but with a proactive approach, these obstacles can be effectively surmounted:

-

Due Diligence: Forex service providers should exercise due diligence when onboarding clients, diligently verifying their residency status to avoid inadvertent TDS deductions.

-

Tax Planning: Sound tax planning is crucial for non-resident service providers. Exploring the possibility of obtaining a TRC can pave the path towards TDS exemption, optim