Unleash the Power of Price Action in Forex Markets

Imagine yourself as a seasoned forex trader, effortlessly identifying market trends and making profitable trades. The key to your success lies in deciphering the intricate dance of price action, where support and resistance levels emerge as your guiding stars.

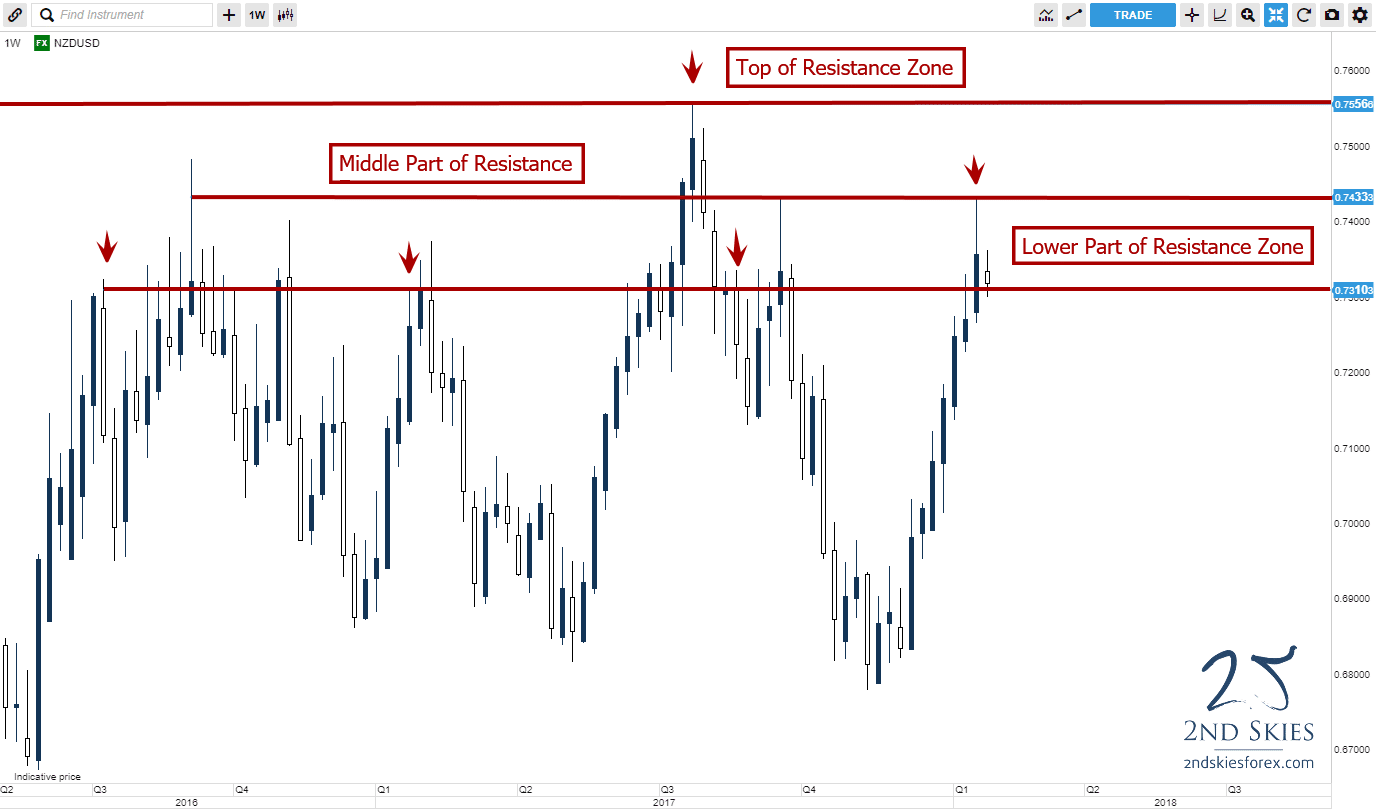

Image: 2ndskiesforex.com

In this comprehensive guide, we’ll embark on an illuminating journey into the world of support and resistance levels, unlocking their secrets and empowering you with the knowledge to conquer the forex markets.

Unveiling the Essence of Support and Resistance

Support and resistance levels represent crucial price boundaries that price tends to bounce off. Support levels are psychological price thresholds below the current market price that prevent it from falling further. Conversely, resistance levels act as ceilings above the current market price, impeding its upward momentum.

These levels form when there is a significant imbalance between supply and demand. When supply exceeds demand, prices decline and find support at a level where buyers step in to absorb the selling pressure. When demand outweighs supply, prices rise and encounter resistance at a level where sellers enter the market to capitalize on the upward momentum.

Defining Support Levels

Support levels are established when price falls to a specific level and fails to break below it multiple times. This indicates that there is a cluster of buyers at that level who are willing to purchase the asset at that price, preventing it from declining further.

Recognizing Resistance Levels

Resistance levels are formed when price rises to a certain level and is consistently rejected below it. This suggests that there is a concentration of sellers at that level who are ready to offload their holdings at that price, restricting the market’s upward movement.

Image: cilywadojup.web.fc2.com

The Impact of Historical Data on Support and Resistance

Technical analysts rely heavily on historical price data to identify potential support and resistance levels. They examine past price movements and look for areas where the market has consistently encountered obstacles or bounced back. These historical levels often serve as reliable indicators of future price action.

By studying market history, traders can make informed decisions about the likelihood of price reaching or bouncing off a particular level, equipping them with a distinct advantage in navigating the ever-fluctuating forex markets.

Exploiting Support and Resistance Levels in Trading

Seasoned forex traders recognize that support and resistance levels provide valuable trading opportunities. When price approaches a support level, savvy traders may anticipate a potential bounce and consider placing buy orders in anticipation of a reversal. Conversely, when price nears a resistance level, traders might foresee a pullback and contemplate opening sell positions.

However, it’s crucial to remember that support and resistance levels are not foolproof indicators and should be used in conjunction with other technical analysis tools, such as moving averages, trendlines, and candlestick patterns, to enhance trading accuracy.

Tips for Enhancing Trading Performance

Embrace the power of multiple timeframes: Analyzing support and resistance levels across different timeframes, from daily to intraday charts, can provide a comprehensive view of market trends and help identify trading opportunities.

Pay attention to volume: High trading volume accompanying support or resistance breaches often signals a stronger trend and increases the likelihood of a sustained move. Consider incorporating volume indicators into your analysis.

Frequently Asked Questions (FAQs)

**Q: How do I identify support and resistance levels effectively?**

**A:** Examine price action history and locate areas where the market has consistently reversed or stalled. Multiple touches at a particular level often indicate the presence of support or resistance.

**Q: Can support and resistance levels change over time?**

**A:** Yes, support and resistance levels are dynamic and can shift as market conditions evolve. They should be constantly monitored and adjusted to stay aligned with changing price action.

**Q: How do I know if a support or resistance level is likely to hold?**

**A:** Assess the strength of support or resistance by considering factors such as market sentiment, economic news, and the volume of trading at that level. A more significant number of touches and high trading volume enhance the reliability of a support or resistance level.

Support And Resistance Levels Forex

Conclusion

Mastering the concept of support and resistance levels empowers forex traders with a potent weapon in their arsenal. By deciphering these price boundaries, traders can identify potential trading opportunities, optimize entry and exit points, and enhance their overall trading strategy.

Embark on your trading journey armed with this invaluable knowledge and elevate your forex trading prowess. Remember, the markets are constantly evolving, and continuous learning is key to unlocking its infinite possibilities.

Are you ready to conquer the forex markets with the guidance of support and resistance levels?