In Forex trading, the intricate dance of price movement unveils patterns that can guide your decisions. Among these patterns, support and resistance reign supreme, offering a powerful approach to navigating the ever-evolving market. This comprehensive guide will delve into the intricacies of support and resistance, empowering you with a proven strategy to elevate your Forex trading journey.

Image: vitocejayem.web.fc2.com

What are Support and Resistance Levels?

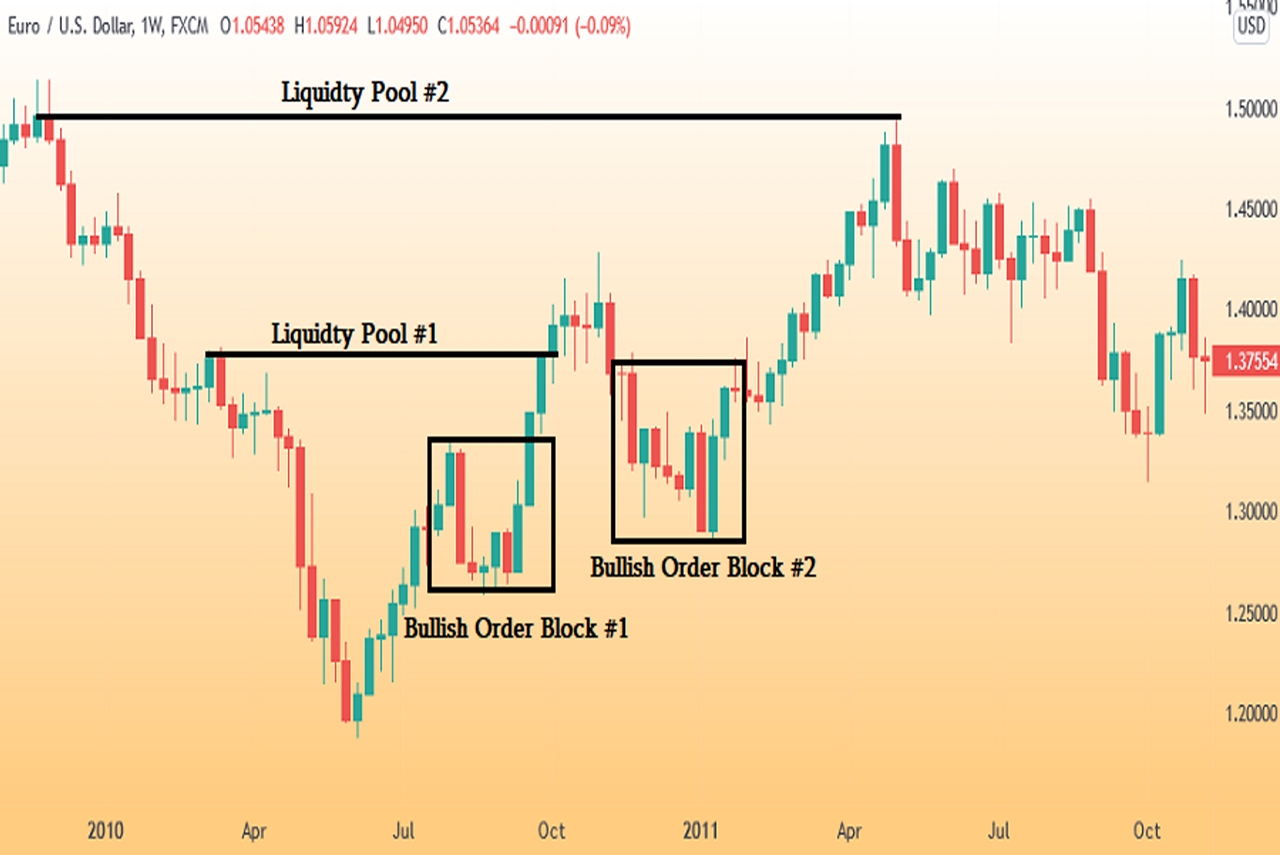

Support and resistance levels represent crucial price points in the market where price tends to bounce or reverse its trajectory. Support marks the floor below which prices struggle to fall, while resistance acts as a ceiling above which prices face difficulty in climbing. These levels are identified by studying historical price charts and observing key areas where price has repeatedly bounced or reversed.

How to Identify Support and Resistance Levels

Identifying support and resistance levels requires a keen eye and an understanding of market dynamics. Here are some common methods:

Horizontal Lines: Draws horizontal lines at significant price points where price has bounced or reversed multiple times.

Trendlines: Connects consecutive highs or lows to create a sloping line, indicating support or resistance along the trend’s direction.

Pivot Points: Calculates mathematically-derived levels based on the previous trading session’s highs, lows, and closing prices.

Trading with Support and Resistance

Once you have identified support and resistance levels, it’s time to leverage them in your trading strategy:

Buy at Support: Enter a buy position when price approaches a support level, anticipating a potential reversal and price increase.

Sell at Resistance: Place a sell order near a resistance level, expecting the price to encounter resistance and decline.

Breakout Trades: Wait for a clear breakout above resistance or below support, signaling a potential trend reversal and offering profitable trading opportunities.

Image: luxtradingfirm.com

Advanced Techniques

To enhance your support and resistance strategy, consider these advanced techniques:

Multiple Time Frame Analysis: Study price charts on various time frames to identify support and resistance levels that align across different horizons.

Fibonacci Levels: Use Fibonacci retracement ratios to identify potential reversal zones within support and resistance areas.

Volume Analysis: Incorporate volume data to confirm the strength of support or resistance levels, as high volume often indicates a strong market response.

Expert Insights

“Understanding support and resistance levels is like having a compass in the Forex jungle. It provides direction and helps you avoid emotional trading decisions.” – Mark Douglas, Trading Psychology Expert

“Breakouts are powerful signals, but only trade them with confidence when multiple levels of support or resistance are broken.” – Kathy Lien, Forex Analyst

Support And Resistance Forex Trading Strategy Pdf

Conclusion

Mastering support and resistance trading is a cornerstone of successful Forex trading. By understanding how to identify and leverage these crucial price points, you can unlock a new level of confidence and profitability in your trading endeavors. Whether you’re a seasoned trader or just starting out, embracing the power of support and resistance will empower you to navigate the Forex markets with greater precision and purpose.