In today’s globalized economy, understanding foreign exchange (forex) rates is crucial for anyone dealing in international currencies. As a leading provider of banking services, Standard Chartered Bank offers competitive forex rates for a wide range of currencies.

Image: eduvark.com

In this article, we will delve into the Standard Chartered Bank forex exchange rate today and provide insights into the latest trends and developments in the forex market. We will also share tips and expert advice to help you make informed decisions when exchanging currencies.

Standard Chartered Bank: A Trusted Leader in Forex Exchange

Standard Chartered is a multinational banking and financial services company headquartered in London, UK. It has a strong presence in Asia, Africa, the Middle East, and Europe, with a network of over 1,000 branches and outlets in more than 60 countries.

The bank’s extensive global presence and expertise in currency markets make it a reliable source for competitive forex exchange rates. Standard Chartered offers a wide range of services related to forex exchange, including:

- Spot Forex Trading: Immediate exchange of currencies at the prevailing market rate.

- Forward Forex Contracts: Contracts that allow you to lock in an exchange rate for a future date.

- Currency Options: Options contracts that give you the right, but not the obligation, to exchange currencies at a predetermined rate on a specified date.

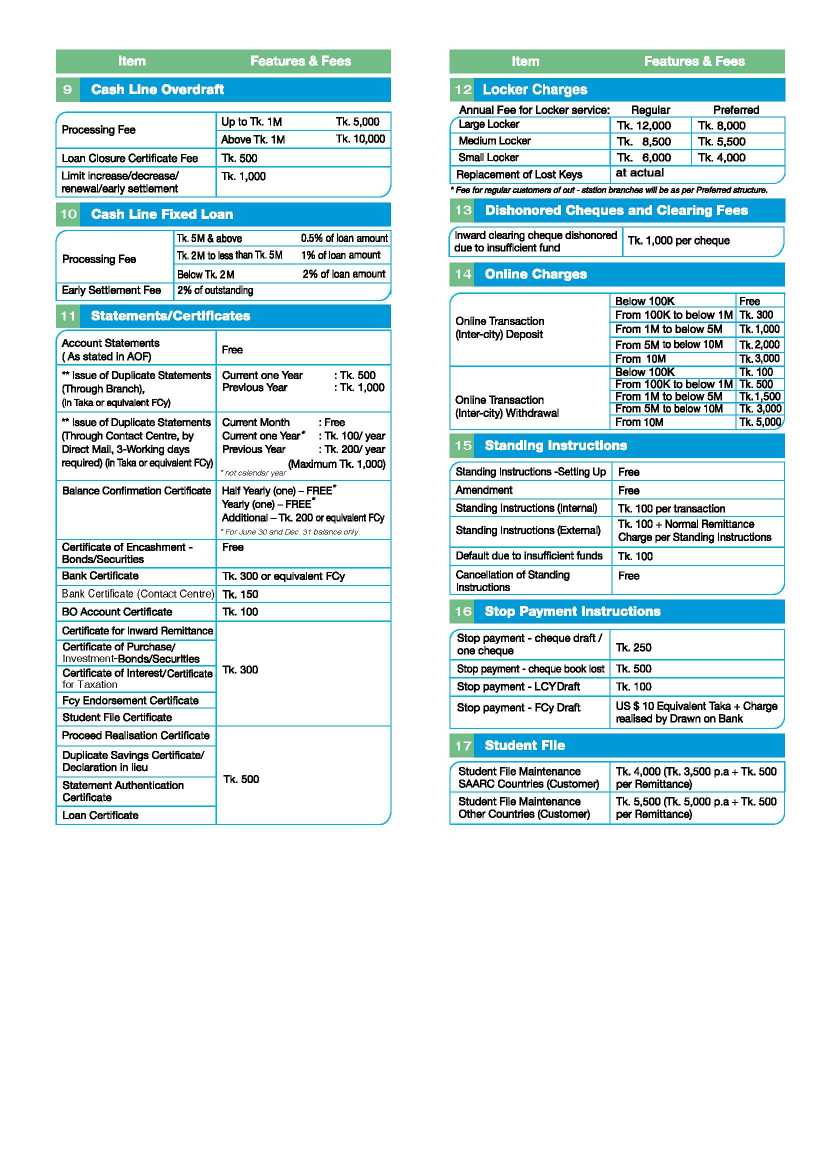

Interactive Forex Rates Table

[Include a table here with the following columns: “Currency”, “Buy Rate”, “Sell Rate”, “Spread”]

Understanding Forex Exchange Rates

Forex exchange rates represent the value of one currency relative to another. They are constantly fluctuating due to various economic factors, including:

- Interest rates

- Inflation

- Economic growth

- Political stability

- Government policies

When exchanging currencies, it is important to consider the following:

- The bid price: The price at which the bank is willing to buy a currency.

- The ask price: The price at which the bank is willing to sell a currency.

- The spread: The difference between the bid and ask price, which represents the bank’s commission.

Image: forexstrategiesrsi.blogspot.com

Tips for Getting Favorable Forex Exchange Rates

- Compare rates from multiple banks: Don’t limit yourself to just one bank. Compare rates from several banks to ensure you’re getting the best deal.

- Negotiate with the bank: For large currency exchanges, it may be possible to negotiate a better rate.

- Use online currency exchange platforms: Online platforms can often offer more competitive rates than traditional banks.

- Avoid tourist traps: Exchange rates at airports and tourist areas are often less favorable.

- Consider timing: Forex rates fluctuate throughout the day. Monitor the rates and exchange when they are most favorable.

FAQs on Standard Chartered Bank Forex Rates

Q: What factors influence Standard Chartered Bank’s forex rates?

A: Standard Chartered’s forex rates are influenced by global economic conditions, economic data releases, political events, and market sentiment.

Q: Can I get a guaranteed rate from Standard Chartered Bank?

A: Yes, you can secure a guaranteed rate by entering into a forward contract with Standard Chartered Bank.

Q: Are there any fees associated with forex exchange at Standard Chartered Bank?

A: Standard Chartered Bank typically charges a spread, which is the difference between the bid and ask prices, on all forex transactions.

Standard Chartered Bank Forex Exchange Rate Today

Conclusion

Standard Chartered Bank offers competitive forex exchange rates and a comprehensive suite of forex services. By understanding the factors that influence forex rates, using our tips for getting favorable rates, and staying informed about the latest market trends, you can make informed decisions when exchanging currencies.

Are you interested in knowing more about Standard Chartered Bank’s forex exchange rates? Visit their website or contact your local branch for personalized assistance.