The foreign exchange market (forex) is a global, decentralized marketplace where currencies are traded. Standard Bank, one of Africa’s largest financial institutions, plays a significant role in the forex market, offering competitive exchange rates and a robust platform for currency trading. Throughout history, Standard Bank’s forex rates have been influenced by various factors, reflecting the evolving global economic landscape and the bank’s strategic positioning.

Image: downloadpremiumfxscalperforexindic1.blogspot.com

Early History: Establishing a Local Exchange

Standard Bank’s forex trading roots can be traced back to the early 20th century. In 1901, the bank established itself in South Africa and quickly became a major player in the domestic forex market. As South Africa’s economy grew, the demand for foreign exchange increased, and Standard Bank positioned itself as a reliable provider of currency exchange services. Its forex rates during this period were largely determined by local economic conditions, the availability of foreign currency, and the bank’s own operating costs.

Post-Independence Era: Navigating Economic Turmoil

South Africa’s political independence in 1961 marked a significant turning point for both the country and Standard Bank. The transition to a new economic order brought challenges and opportunities for the forex market. Standard Bank’s forex rates became subject to the influence of international currency fluctuations and the implementation of government exchange controls. The bank adapted by developing innovative strategies to manage currency risk and maintain competitive exchange rates for its customers.

Globalization and Market Liberalization

The global economic landscape was transformed by the liberalization of trade and investment in the 1980s and 1990s. Standard Bank embraced these changes by expanding its international reach and diversifying its forex offerings. The bank’s forex rates became increasingly influenced by global macroeconomic factors, such as interest rates, inflation, and economic growth in major currency trading centers. Standard Bank also established partnerships with international banks and leveraged technology to enhance its forex trading capabilities.

Image: forexstrategyforea.blogspot.com

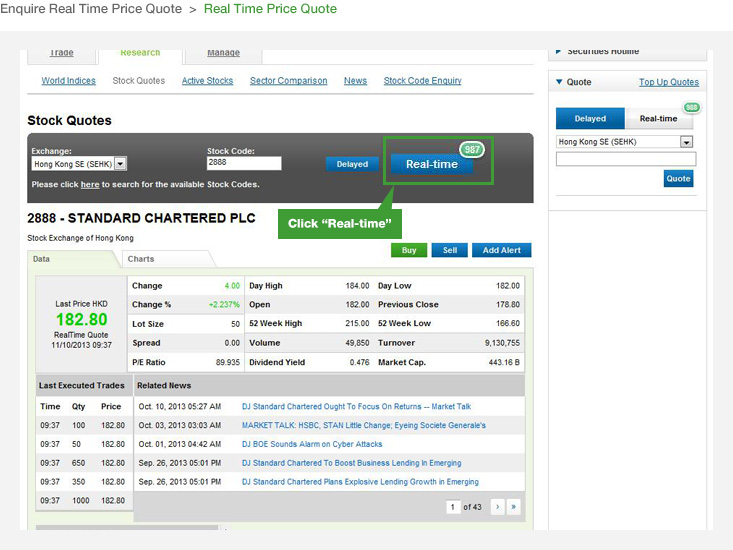

Rise of Electronic Trading: The Digital Revolution

The introduction of electronic trading platforms in the early 2000s revolutionized the forex market. Standard Bank was at the forefront of adopting these technologies, offering its customers access to real-time forex rates and seamless trading execution. Electronic trading brought greater transparency, efficiency, and liquidity to the market, further solidifying Standard Bank’s position as a leading forex provider.

Recent Trends and the Influence of Technology

In recent years, the forex market has continued to evolve, driven by technological advancements and geopolitical events. Standard Bank’s forex rates have responded to these changes by incorporating predictive analytics, machine learning, and other data-driven approaches to enhance its currency forecasting capabilities. The bank’s ongoing investment in technology has enabled it to optimize its forex operations, improve execution speeds, and provide customized solutions for its clients.

Standard Bank Forex Rates History

Conclusion

Standard Bank’s forex rates have evolved in tandem with the dynamic global economic and financial landscape. From its humble beginnings in South Africa to its current position as an international forex powerhouse, the bank has consistently adapted to changing conditions and invested in innovation. Standard Bank’s forex rates are a reflection of its commitment to providing competitive exchange rates, superior trading technology, and personalized service to its customers around the world. As the forex market continues to evolve, Standard Bank is well-positioned to navigate the challenges and opportunities ahead, remaining a trusted provider of forex solutions for businesses and individuals alike.