Introduction

The fast-paced world of forex trading demands traders to be equipped with a comprehensive understanding of various order types. Among these, the sell stop order stands out as a powerful tool for managing risk and capturing market opportunities. This comprehensive guide will delve into the intricacies of the sell stop order, empowering traders with the knowledge they need to navigate the volatile forex market.

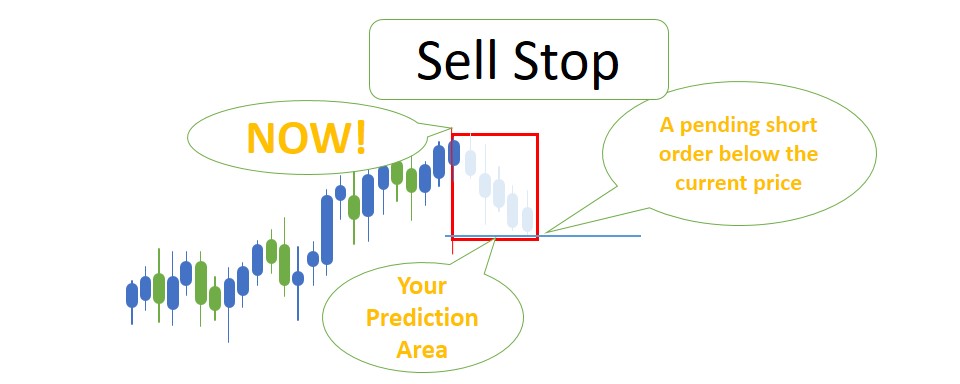

Image: www.forex.academy

Understanding the Sell Stop Order

In its simplest form, a sell stop order is an instruction to sell a currency pair when the market price falls below a predetermined level, known as the stop price. This order is placed below the current market price and remains dormant until the stop price is triggered. Once the market price falls to or below the stop price, the sell order becomes active and is executed in the market.

The primary advantage of using a sell stop order lies in its ability to minimize potential losses. By setting the stop price strategically, traders can define the maximum amount of capital they are willing to risk on a particular trade. When the market turns against their position, the sell stop order automatically executes, preventing further losses beyond the predetermined threshold.

Practical Applications in Forex Trading

Sell stop orders have a wide range of applications in forex trading. Here are a few examples:

- Protecting Profits: When a trader has an open position and the market price is moving in their favor, placing a sell stop order below the current price can protect potential profits. If the market reverses and starts to decline, the sell stop order will execute, securing the trader’s gains.

- Catching Market Swings: Sell stop orders can be employed to enter into trades in the direction of anticipated market declines. By identifying a potential reversal point, traders can place a sell stop order below the current price. If the market does indeed reverse and falls below the stop price, the order will be executed, allowing the trader to profit from the downward move.

- Hedging Positions: Sell stop orders can serve as a form of hedging for open positions. For instance, a trader with a long position may place a sell stop order below the entry price. This way, if the market takes an adverse turn, the sell stop order will be executed, reducing the trader’s overall exposure.

Advanced Strategies with Sell Stop Orders

While basic implementations of sell stop orders are effective, there are advanced strategies that traders can employ to enhance their trading. Here are a few examples:

- Trailing Sell Stops: Trailing sell stops are dynamic versions of sell stop orders that adjust their stop price as the market moves. If the market price rises, the stop price is raised accordingly, ensuring that profits are protected while allowing for further upside.

- Multiple Sell Stops: Some traders opt to use multiple sell stop orders to create more sophisticated trading strategies. For instance, a pair of sell stop orders can be placed above and below the current price, creating a trading range. When the price crosses either of these levels, a sell order is triggered, allowing the trader to capture fluctuations within the range.

- Combining Sell Stops with Other Orders: Sell stop orders can be combined with other order types to create even more intricate trading strategies. For example, a sell stop order can be paired with a limit order to define both the stop price and the desired execution price.

Image: srading.com

Sell Stop Meaning In Forex

Conclusion

Harnessing the power of sell stop orders is essential for effective and responsible forex trading. By comprehending the mechanics, applications, and advanced strategies associated with this order type, traders can empower themselves with the tools necessary to manage risk, seize trading opportunities, and navigate the complexities of the forex market. As always, it is crucial to conduct thorough research, practice with a demo account, and continuously refine trading strategies to maximize profitability and minimize losses.