Introduction

The Reserve Bank of India (RBI) is the apex regulatory body responsible for overseeing the Indian foreign exchange market. In a bid to streamline and provide clarity on regulations governing foreign exchange (forex) transactions, the RBI introduced the Master Circular on Forex in July 2018. This comprehensive document consolidates various regulations and serves as a single source of reference for entities dealing in foreign exchange.

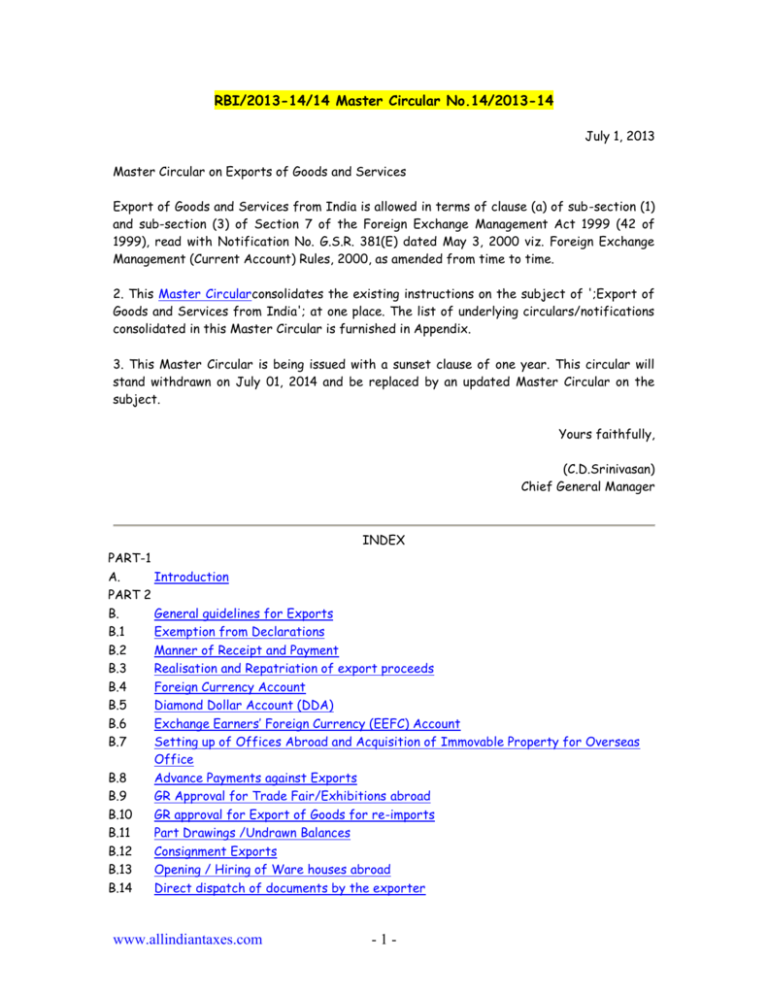

Image: studylib.net

Understanding the Master Circular on Forex is vital for businesses, individuals, and financial institutions involved in international trade and cross-border transactions. Failure to comply with these regulations can lead to penalties and legal consequences. This article aims to provide a thorough explanation of the key aspects of the Master Circular, guiding readers through the complexities of the Indian forex market.

Key Definitions and Concepts

Foreign Exchange: Foreign exchange refers to the buying and selling of currencies between different countries. It facilitates international trade and payments.

Authorized Dealers: The RBI authorizes certain banks and financial institutions as Authorized Dealers (ADs) to carry out forex transactions on behalf of their clients.

Foreign Currency Accounts (FCAs): FCAs allow individuals and businesses to hold and transact in foreign currencies.

Foreign Exchange Dealers Association of India (FEDAI): FEDAI is a self-regulatory organization that sets ethical and professional standards for the forex industry in India.

Inward Remittances and Outward Payments

The Master Circular provides detailed guidelines for inward remittances and outward payments. Inward remittances refer to foreign currency received from abroad, while outward payments are payments made to foreign entities.

Inward remittances can be received for various purposes such as exports, services rendered, or gifts from relatives. Authorized Dealers must verify the purpose and ensure compliance with the Foreign Exchange Management Act (FEMA) regulations.

Outward payments are permitted for legitimate purposes such as imports, travel expenses, and remittances for education or medical treatment abroad. Proper documentation and regulatory approvals are required for outward remittances.

Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI)

The Master Circular outlines the framework for Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI) in India. FDI involves direct investment by foreign entities in Indian companies, while FPI refers to investment in Indian financial assets such as stocks and bonds.

The RBI regulates FDI and FPI to promote economic growth while ensuring compliance with national security and economic stability concerns. The Circular specifies the sectors and investment limits for FDI and FPI, along with reporting and registration requirements.

Image: taxguru.in

Foreign Exchange Market Regulations

The Master Circular focuses on maintaining orderly and transparent foreign exchange market practices. It prohibits unauthorized forex trading and regulates the activities of Authorized Dealers and foreign exchange brokers.

The RBI monitors forex market activity to prevent speculation and ensure fair and competitive market conditions. Entities involved in forex transactions must adhere to ethical guidelines and avoid any manipulative or unfair practices.

Compliance and Enforcement

Compliance with the Master Circular on Forex is mandatory for all entities engaged in foreign exchange transactions in India. Non-compliance can result in penalties, suspension of operations, or even prosecution under FEMA.

The RBI conducts regular inspections and audits to ensure compliance. ADs are responsible for verifying the authenticity and purpose of forex transactions and adhering to prescribed limits and regulations.

Rbi Master Circular On Forex

Conclusion

The RBI’s Master Circular on Forex provides a comprehensive framework for regulating foreign exchange transactions in India. Understanding this document is crucial for businesses and individuals engaged in international trade and cross-border transactions.

By following the guidelines outlined in the Master Circular, entities can ensure compliance with FEMA regulations, avoid legal liabilities, and contribute to the orderly and transparent functioning of the foreign exchange market in India.