Introduction

In the ever-changing landscape of forex trading, technical indicators have emerged as indispensable tools for navigating market fluctuations. Among these, moving averages (MAs) stand out as a cornerstone strategy, providing traders with valuable insights into price trends and potential trading opportunities. Join us as we dive into the realm of profitable moving average forex strategies, empowering you with a comprehensive guide to harness their power and maximize your trading potential.

Image: www.pinterest.com

Demystifying Moving Averages

A moving average (MA) is a technical indicator that gauges the average price of an asset over a specified period. This smoothed-out representation of price action helps identify trends, support and resistance levels, and potential trading signals. By averaging out short-term price fluctuations, MAs provide a clearer picture of the underlying momentum in the market.

Types of Moving Averages

Various types of MAs exist, each with its unique characteristics:

-

Simple Moving Average (SMA): A straightforward MA calculated by summing the closing prices over a specified period and dividing by the number of periods.

-

Exponential Moving Average (EMA): An SMA that gives more weight to recent prices, making it more responsive to price changes.

-

Weighted Moving Average (WMA): An MA that assigns greater weight to prices closer to the present, enhancing the significance of more recent data points.

Interpreting Moving Average Signals

MAs can generate valuable trading signals when analyzed in conjunction with price movements:

-

Crossovers: When a shorter-term MA crosses above or below a longer-term MA, it can indicate a potential trend reversal or confirmation.

-

Sloping: An upward-sloping MA suggests an uptrend, while a downward-sloping MA indicates a downtrend.

-

Convergence and Divergence: When the price action converges with or diverges from the MA, it can signify a potential trend change or continuation.

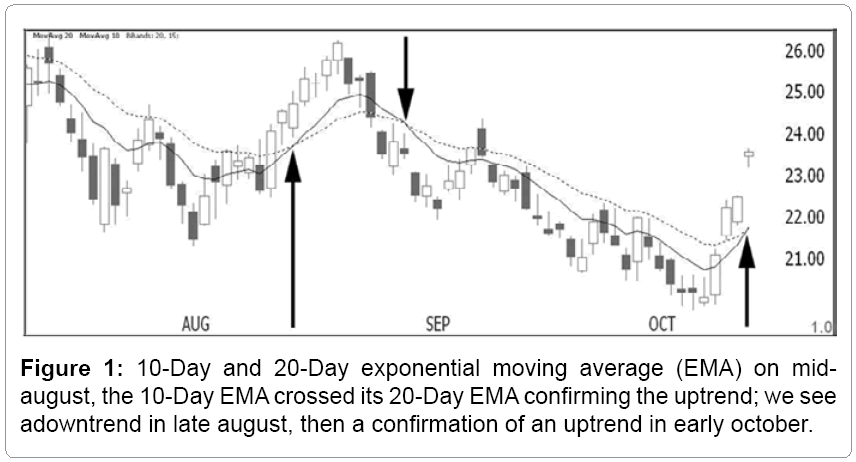

Image: www.longdom.org

Profitable Moving Average Trading Strategies

Harnessing the insights provided by MAs, traders can employ various profitable trading strategies:

-

Trend Following: Using longer-term MAs to identify overall market trends and capitalize on momentum.

-

Counter-Trend Trading: Utilizing shorter-term MAs to identify potential trend reversals and trade against the prevailing trend.

-

Range Trading: Identifying support and resistance levels using MAs to trade within a defined price range.

Expert Insights

“Moving averages provide a powerful foundation for understanding market trends and making informed trading decisions,” says renowned forex analyst Mark Jenkins. “By leveraging the insights they offer, traders can enhance their ability to navigate complex market conditions profitably.”

Actionable Tips

-

Choose the right MA type based on your trading style and market conditions.

-

Combine MAs with other technical indicators for comprehensive analysis.

-

Manage risk effectively by setting appropriate stop-loss and take-profit levels.

Profitable Moving Average Forex Strategies

Embracing the Power of Moving Averages

Moving average forex strategies offer traders a robust toolkit for analyzing market trends, identifying trading opportunities, and maximizing profits. By embracing their power and applying the insights presented in this guide, you can empower yourself with the knowledge and confidence to navigate the forex markets with greater success.