Introduction

In the labyrinthine world of finance, the adage “price is everything” reverberates as an enduring mantra, a guiding principle that shapes the very fabric of markets. This seemingly straightforward statement, however, belies a complex and multifaceted reality that has captivated traders and investors for centuries. Understanding the dynamics of price movement and its profound implications can empower individuals with a formidable edge in the competitive arena of currency trading.

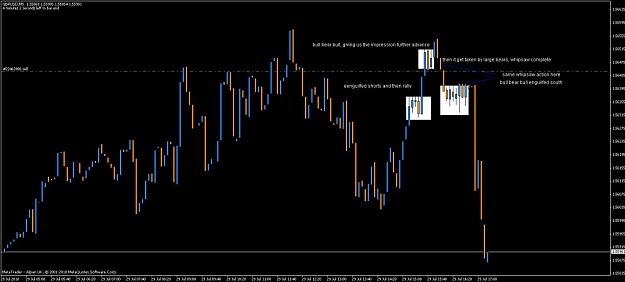

Image: www.forexfactory.com

The concept of price encapsulates a myriad of factors, ranging from the fundamental value of an asset to the interplay of supply and demand. It serves as a barometer of market sentiment, reflecting the collective perceptions of traders and investors regarding the future trajectory of an asset’s value.

Decoding the Enigmatic Nature of Price Movement

The movement of prices in the foreign exchange (forex) market is a spectacle of constant flux, influenced by an intricate web of macroeconomic and geopolitical events, as well as the psychological undercurrents of market participants. Central bank policy decisions, economic data releases, and global headlines can all trigger seismic shifts in currency valuations.

Understanding the drivers of price movement requires a deep dive into the underlying economic fundamentals, including interest rates, inflation, and gross domestic product (GDP) growth. However, the complexities of human behavior and the unpredictable nature of market sentiment add an element of uncertainty that defies precise forecasting.

Fundamental Analysis: The Bedrock of Price Evaluation

Fundamental analysis, a cornerstone of financial analysis, seeks to determine the intrinsic value of an asset by scrutinizing its underlying economic factors. This approach involves assessing a country’s economic outlook, monetary policy stance, and geopolitical stability to gauge the potential value of its currency.

By analyzing macroeconomic indicators, such as trade balance, employment data, and consumer spending, fundamental analysts strive to identify mismatches between market prices and the true worth of currencies. This knowledge can provide invaluable insights into potential market inefficiencies and opportunities for profitable trading.

Technical Analysis: Unveiling Hidden Patterns

While fundamental analysis focuses on external factors, technical analysis delves into the realm of historical market data to uncover patterns and predict future price movements. Technical analysts utilize a diverse array of charting techniques and mathematical indicators to identify trends, support and resistance levels, and potential reversal points.

Although technical analysis does not directly assess an asset’s intrinsic value, it offers a valuable perspective on market psychology and momentum. By observing past price action, traders can often anticipate future market behavior and make informed trading decisions.

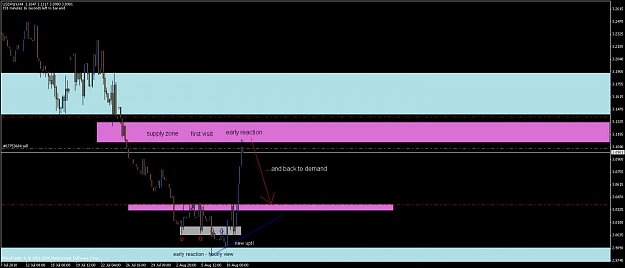

Image: www.forexfactory.com

The Psychology of Markets: A Force to be Reckoned With

The human psyche plays an undeniable role in price formation, adding a layer of unpredictability to the already complex dynamics of market movement. Fear, greed, optimism, and pessimism can all impact the decision-making processes of traders and investors, leading to irrational market behavior and sudden price swings.

Understanding market psychology can help traders anticipate potential market sentiment shifts and adjust their trading strategies accordingly. By recognizing the psychological biases that can influence market behavior, traders can gain a competitive advantage in navigating the ever-changing landscape of the forex market.

The Art of Masterful Price Analysis

Mastering the “price is everything” axiom requires a combination of technical proficiency and astute judgment. Traders who seek to uncover hidden trading opportunities must possess the ability to synthesize fundamental and technical analysis, while also remaining attuned to the psychological underpinnings of market behavior.

By continuously honing their analytical skills, traders can develop a deep understanding of the factors that drive market movement and enhance their ability to forecast future price trends. This knowledge, coupled with a disciplined trading plan and robust risk management strategies, can empower them to navigate the treacherous waters of the forex market with confidence and precision.

Price Is Everything Forex Factory

Conclusion

The “price is everything” principle serves as an unwavering compass in the volatile realm of currency trading. By delving into the intricate tapestry of price movement and mastering the art of technical and fundamental analysis, traders can uncover hidden opportunities, anticipate market shifts, and position themselves for success.

Remember, the journey towards becoming a proficient trader is an ongoing pursuit of knowledge, experience, and self-improvement. By embracing this perpetual learning mindset and honing your analytical prowess, you can unlock the transformative power of the “price is everything” axiom and emerge as a formidable force in the dynamic arena of currency trading.