Revolutionizing Forex Transparency for Enhanced Compliance and Financial Accountability

In the labyrinthine realm of global finance, foreign exchange (forex) transactions play a pivotal role. The seamless movement of currencies across borders fuels international trade, investments, and the interconnectedness of our economies. However, with such vast financial flows, it is imperative to ensure transparency and combat illicit activities that may lurk in the shadows. Enter the groundbreaking introduction of new purpose codes for reporting forex transactions – a game-changer in the fight against financial malfeasance and a catalyst for greater accountability.

Image: www.consumerismcommentary.com

Purpose Codes: The Guiding Compass for Forex Reporting

Purpose codes serve as beacons of clarity, guiding the reporting of forex transactions for precise categorization. The introduction of standardized purpose codes brings order to the enigmatic world of forex, enabling financial institutions to articulate the underlying reason for each transaction. No longer will these transactions be shrouded in ambiguity, but rather illuminated with the clarity of purpose. Whether it is for international trade settlements, portfolio management, or cross-border investments, these codes provide a roadmap for regulators and compliance officers to navigate the intricate web of forex activities.

Benefits Galore: The Virtues of Standardized Purpose Codes

The advantages of standardized purpose codes reverberate throughout the financial landscape. They empower regulators with enhanced oversight, enabling them to trace the flow of funds more effectively and identify any suspicious patterns. Financial institutions reap the rewards of reduced operational costs and simplified compliance processes, as the burden of manual coding and subjective interpretation is lifted. Moreover, these codes foster transparency and trust in the financial system, attracting investors and promoting economic growth.

Let us delve into the practical applications of these transformative purpose codes. Suppose a multinational corporation embarks on an ambitious expansion into a foreign market. The company’s forex transactions related to this expansion can now be meticulously recorded and categorized using the appropriate purpose code. This transparent reporting enables the corporation to demonstrate compliance with regulatory requirements, mitigate risks, and streamline its cross-border operations.

Or consider the case of an investment fund actively managing its global portfolio. A clear delineation of purpose codes allows the fund to articulate its investment strategies with precision. Regulators can gain a deeper understanding of the fund’s investment patterns, while investors can make informed decisions based on this enhanced transparency. The purpose codes serve as a compass guiding the navigation of complex investment landscapes.

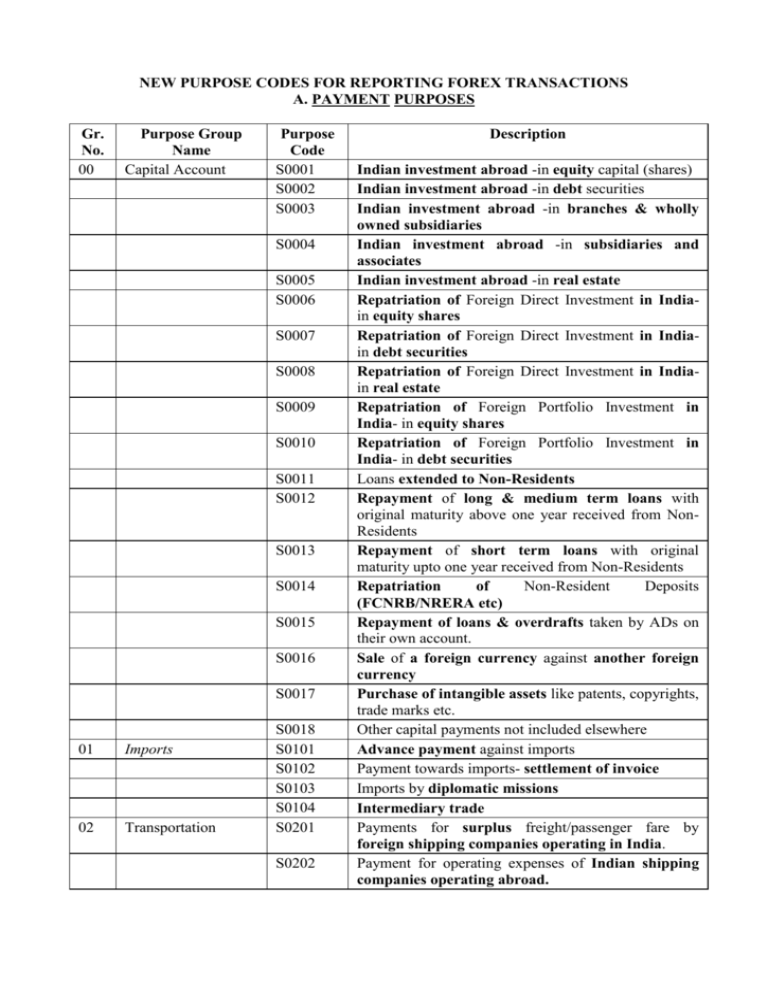

Image: studylib.net

Recent Developments and Future Horizons

The landscape of purpose codes is constantly evolving, reflecting the dynamic nature of forex transactions. Regulatory bodies worldwide are actively collaborating to refine and expand the existing framework. The Financial Action Task Force (FATF), a global standard-setter in anti-money laundering and counter-terrorist financing, has played a prominent role in promoting the adoption of standardized purpose codes. The future holds promise for further innovation, with the potential for real-time reporting and the integration of artificial intelligence (AI) to enhance the efficiency and effectiveness of forex transaction monitoring.

New Purpose Codes For Reporting Forex Transactions Payment Purposes

https://youtube.com/watch?v=dlgNZT1tDAE

Conclusion: Embracing a Brighter Future

The introduction of purpose codes marks a tectonic shift in the world of forex reporting. They illuminate the path towards greater transparency, ease of compliance, and enhanced oversight. These codes are not mere technicalities but potent instruments in the fight against financial crime and the promotion of economic prosperity. As we embrace this new era of transparency, we pave the way for a more accountable and trustworthy financial system that empowers businesses, safeguards investors, and bolsters global economic growth.