In the ever-fluctuating world of forex trading, some currency pairs stand out with their exceptional volatility, presenting both opportunities and challenges for traders. Understanding the most volatile pairs allows traders to make informed decisions, manage risk, and potentially maximize their profits.

Image: www.knightsbridgefx.com

Embracing the Roller Coaster of Volatile Forex Pairs

Volatility, measured by the standard deviation of price fluctuations, is a key indicator of a currency pair’s behavior. Highly volatile pairs offer the allure of potentially lucrative profits but also carry the risk of significant losses. Traders who embrace volatility can capitalize on rapid price movements, while those averse to risk may prefer more stable pairs.

Defining Volatility and Its Impact

Volatility, also known as price range, captures the extent of a currency pair’s fluctuations within a given time frame. High volatility indicates significant price swings, opening up opportunities for short-term traders but also increasing the risk of unexpected market movements. Low volatility, on the other hand, implies relatively stable price ranges, favored by long-term traders seeking consistent returns.

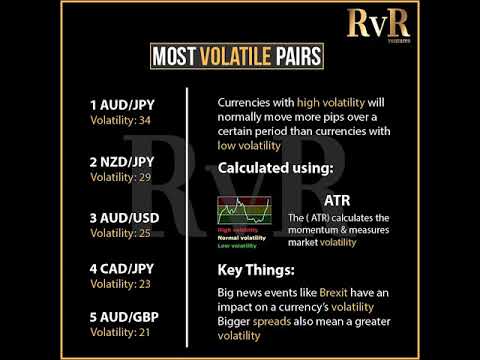

Introducing the Most Volatile Forex Pairs

Among the vast array of currency pairs, several are consistently known for their high volatility. These pairs include:

- USD/JPY

- GBP/JPY

- EUR/JPY

- USD/TRY

- AUD/USD

These pairs exhibit significant price fluctuations driven by various factors, including political events, economic data releases, and market sentiment. Understanding their unique characteristics and price patterns is crucial for successful trading.

Image: www.youtube.com

Tips for Navigating Volatility in Forex

To effectively navigate the volatility of currency pairs, traders can adopt the following strategies:

- Risk Management: Employ strict money management principles, including setting stop-loss and take-profit orders, to minimize potential losses.

- Trade with the Trend: Identify the current market trend and align trading strategies accordingly, increasing the probability of high-probability trades.

Additionally, traders can seek expert advice from experienced professionals and stay abreast of market news and updates to make informed decisions.

FAQ on Volatile Forex Pairs

Q: What causes volatility in currency pairs?

A: Economic data releases, political events, market sentiment, and geopolitical tensions can influence volatility levels.

Q: Which currency pairs are best for volatile trading?

A: USD/JPY, GBP/JPY, EUR/JPY, USD/TRY, and AUD/USD are known for their high volatility, offering potential opportunities for short-term traders.

Q: How can I manage risk when trading volatile pairs?

A: Implement risk management strategies such as stop-loss orders, position sizing, and diversification to minimize potential losses.

Most Volatile Pairs In Forex

Conclusion

Trading the most volatile forex pairs can present both opportunities and challenges, requiring a deep understanding of market dynamics and a solid risk management strategy. Embrace volatility to navigate the complexities of these currency pairs, effectively manage risk, and strive for enhanced profitability.

Are you ready to conquer the volatility of the forex market? Share your trading experiences and strategies in the comments below!