Navigating the complex world of forex trading can be a daunting task, especially for beginners. As the market constantly fluctuates, making informed decisions can be challenging. That’s where forex signals come into play, offering guidance and predictions based on technical analysis.

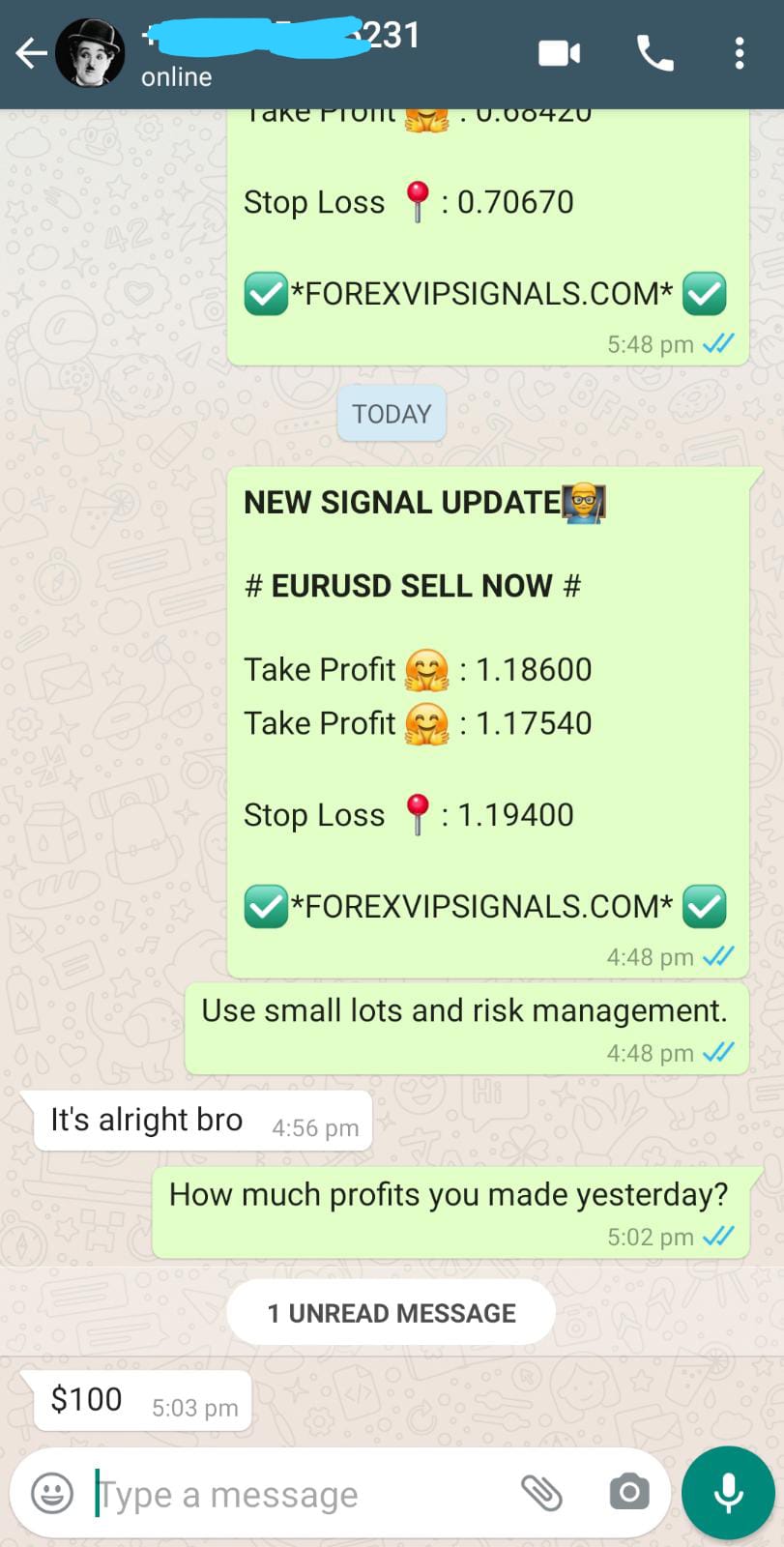

Image: www.forexvipsignals.com

In this comprehensive article, we delve into the realm of forex signals, unraveling their significance and providing expert tips to find the most accurate signals for maximizing your profits. Join us as we embark on a journey to harness the power of forex signals and unlock your trading potential.

The Significance of Forex Signals in Trading

Empowering Informed Decisions

Forex signals play a crucial role in assisting traders to make well-informed decisions. By offering insightful predictions, traders can gain a competitive edge and navigate market volatility with greater confidence. Signals provide guidance on entry and exit points, helping traders identify potential profit-making opportunities.

Navigating Market Complexities

The forex market is renowned for its complexities, influenced by a barrage of factors including economic data releases, political events, and geopolitical changes. Forex signals simplify this landscape by filtering out noise and providing traders with clear and concise trading directions, allowing them to respond swiftly to market shifts.

Image: www.forexvipsignals.com

Unveiling the Mechanics of Forex Signals

Technical Analysis at Its Core

Forex signals are primarily derived from technical analysis, a technique involving the study of historical price movements to predict future price direction. By analyzing charts, patterns, and trends, skilled signal providers identify potential trading opportunities and relay them to traders.

Gaining an Edge with Scalping and Day Trading

Forex signals are particularly valuable for traders employing scalping and day trading strategies. These approaches require quick decision-making and precise entry and exit points. The real-time nature of forex signals empowers traders to capture small but frequent profits, capitalizing on short-term market fluctuations.

Harnessing the Power of Forex Signals

Seeking Accuracy and Consistency

When selecting a forex signal provider, accuracy and consistency should be paramount considerations. Look for providers with a proven track record of success and transparent performance metrics. Scrutinize their methodology and ensure it aligns with your trading style and risk tolerance.

Leveraging Multiple Signals

Diversifying your signal sources can enhance your trading strategy by providing multiple perspectives and mitigating potential biases. Consider subscribing to several reputable providers to gain a broader market outlook and make more informed decisions.

Adapting to the Evolving Forex Landscape

The forex market is constantly evolving, influenced by global events, economic policies, and technological advancements. Signal providers that stay abreast of these changes and adapt their strategies accordingly are more likely to deliver valuable signals in the long run.

Riding the Technological Wave

Technological advancements play a pivotal role in the dissemination of forex signals. Mobile trading apps and Telegram channels have made it easier than ever for traders to access and utilize signals on the go. As technology continues to evolve, we can expect even more innovative ways to leverage forex signals.

Ask Yourself These Questions

- Are you a novice trader eager to gain insights and guidance in the forex market?

- Do you seek a trusted resource to enhance your trading decisions and capitalize on profit-making opportunities?

If your answer to both questions is a resounding yes, then you stand to benefit immensely from incorporating forex signals into your trading strategy. Embark on this journey to empower yourself with knowledge and harness the potential of forex signals for financial success.

Frequently Asked Questions

- Q: What is the average accuracy rate of forex signals?

A: The accuracy rate of forex signals varies depending on the provider and market conditions. However, reputable providers typically aim for an accuracy rate of 70% or higher. - Q: How much capital do I need to start using forex signals?

A: The required capital depends on your trading strategy and risk appetite. However, it’s generally advisable to start with a manageable amount and gradually increase your investment as you gain experience. - Q: Can I rely solely on forex signals for my trading decisions?

A: While forex signals can be a valuable resource, it’s important to remember that they are not foolproof. Combine signals with your own analysis and risk management strategies for optimal decision-making.

Most Accurate Forex Signals App

Call to Action

Unlock the potential of forex signals today and elevate your trading journey to new heights. Explore reputable signal providers, leverage our expert tips, and seize the opportunities presented by the dynamic forex market. With knowledge and guidance at your disposal, you can navigate market volatility with confidence and maximize your profitability.