In the fast-paced world of forex trading, where milliseconds can make all the difference, understanding the concept of slippage becomes paramount. This often overlooked but crucial element can have a significant impact on your trading strategy and bottom line. Join us as we delve into the depths of forex slippage, unraveling its complexities and empowering you with the knowledge to navigate market dynamics effectively.

Image: forexrobotexpert.com

Delving into Forex Slippage: A Decoding

Forex slippage, simply put, is the difference between the expected price of a trade and the actual price at which it is executed. This variance occurs due to the inherent latency in order execution caused by various factors, including:

-

Natural Time Lag: Latency arises from the time it takes for electronic signals to travel between trading platforms, brokers, and market makers.

-

Order Overload: During periods of high market volatility or major news events, the influx of orders can overwhelm trading systems, leading to execution delays.

-

Low Liquidity: In thinly traded currency pairs or during off-hours, liquidity may be scarce, making it challenging to execute orders at the intended price.

Understanding the Types of Slippage

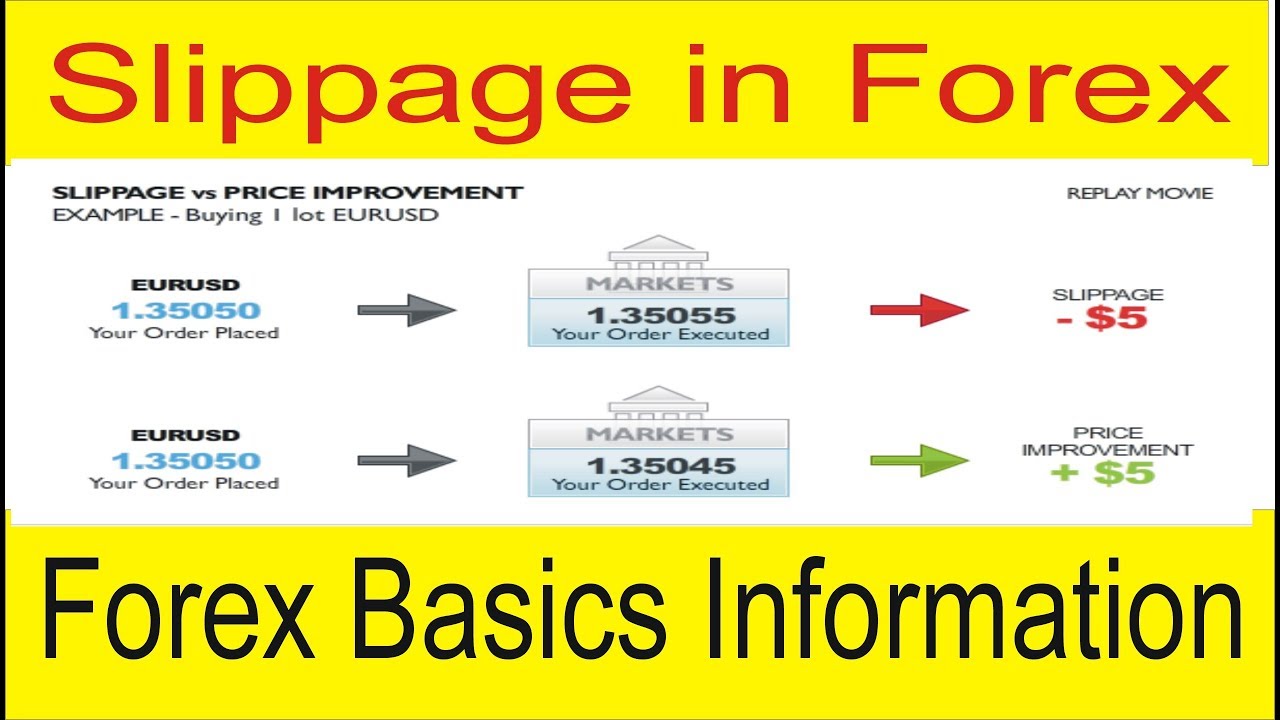

Slippage manifests in two primary forms:

-

Positive Slippage: A favorable outcome where the execution price is better than the quoted price.

-

Negative Slippage: A less desirable outcome where the execution price is worse than the quoted price.

While positive slippage can be a welcome surprise, negative slippage can potentially erode your profits or amplify losses.

The Impact of Slippage on Your Trading Strategy

Slippage can have a substantial impact on your trading strategy:

-

Precision: Slippage introduces an element of uncertainty into your trading decisions, potentially affecting the accuracy of your market analysis.

-

Risk Management: Excessive slippage can widen your stop-loss orders or limit your profit targets, impacting your risk appetite and returns.

-

Emotional Impact: Unanticipated slippage can trigger emotional reactions, hindering your ability to make rational trading decisions. Managing expectations and developing strategies to mitigate slippage can help you stay composed.

Image: www.youtube.com

Harnessing Slippage Mitigation Techniques

While slippage is an unavoidable aspect of forex trading, employing proactive measures can help you minimize its impact:

-

Choose a Reliable Broker: Selecting a well-established broker with proven execution capabilities can reduce latency and minimize slippage occurrences.

-

Monitor Market Liquidity: Keep an eye on market liquidity and avoid trading during illiquid periods or when volatility is particularly high.

-

Use Limit Orders: When placing trades, utilize limit orders instead of market orders. This ensures your trades are executed only at your desired price or better, eliminating negative slippage.

-

Manage Your Expectations: Recognize that slippage is an inherent part of trading and account for it in your risk management strategies. Set realistic profit targets and allow for some flexibility in your trading decisions.

Meaning Of Slippage In Forex

Navigating Slippage for Trading Success

Mastering the nuances of forex slippage is an essential step towards becoming a successful trader. By understanding its causes, types, and impact, you can develop robust strategies that minimize its influence and maximize your trading potential. Remember, slippage is not a barrier to profitability; it’s an opportunity to fine-tune your approach and navigate market dynamics with confidence.