Stepping into the fast-paced world of foreign exchange (forex) trading can be intimidating, especially with the perceived high barriers to entry. Traditionally, forex trading required substantial capital, often deterring aspiring traders. However, the advent of managed forex accounts with low minimums has transformed this landscape, leveling the playing field for traders of all experience levels and financial backgrounds.

Image: www.youtube.com

Managed forex accounts emerged as a solution to the capital-intensive nature of traditional forex trading. By pooling funds from multiple investors, these accounts enable individuals to access the forex market with just a fraction of the typical minimum investment. This breakthrough has unlocked the doors for countless new traders, allowing them to participate in the global financial market without the burden of large initial deposits.

Managed Forex Accounts: Empowering Traders with Flexibility

Managed forex accounts not only reduce the financial barrier to entry but also provide a host of other benefits. Foremost among these is flexibility. Traders can customize their accounts to align with their specific investment goals and risk tolerance. This customization includes adjusting the leverage, choosing a preferred trading strategy, and selecting a qualified money manager to oversee the account.

The ability to choose a money manager is crucial, as it delegates the trading decisions to a professional with expertise and experience. This feature is particularly valuable for novice traders who may not possess the necessary knowledge or time to manage their accounts independently. By entrusting their funds to a qualified manager, traders can benefit from informed decision-making, risk management strategies, and the potential for higher returns.

A Comprehensive Overview of Managed Forex Accounts

Managed forex accounts operate on a performance-based fee structure, ensuring that the interests of both the investor and the money manager are aligned. This fee structure incentivizes managers to generate consistent returns for investors, as their compensation is directly tied to the account’s performance.

The success of a managed forex account hinges on the selection of a reputable and experienced money manager. Investors should conduct thorough research, examining the manager’s track record, trading history, and investment philosophy. It is also advisable to consult with industry experts or seek recommendations from trusted sources to identify qualified managers.

Navigating the Latest Trends in Managed Forex Accounts

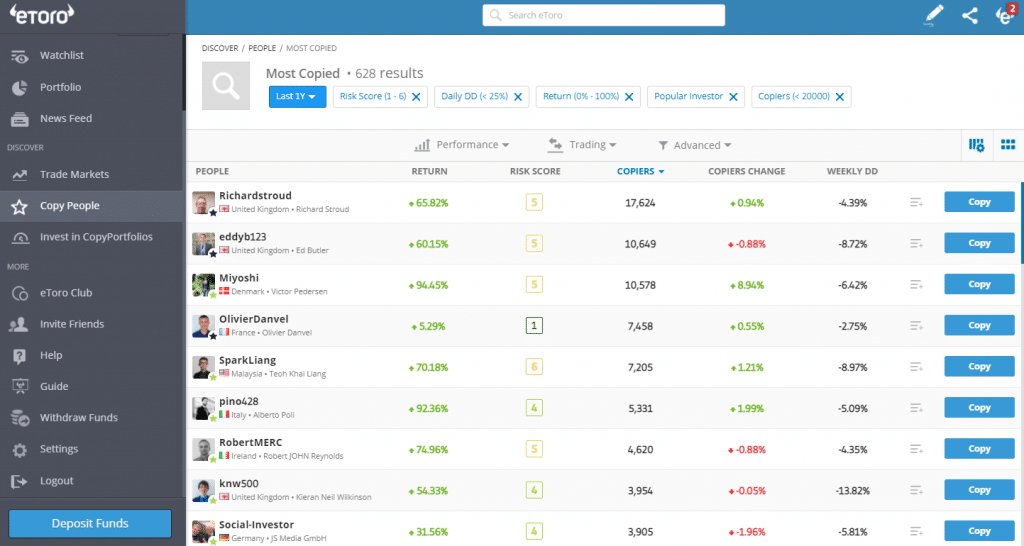

The forex market is constantly evolving, and managed forex accounts are no exception. Recent trends in the industry include the increasing popularity of mobile trading platforms, the proliferation of social and copy trading, and the emergence of artificial intelligence (AI) in trading algorithms.

Mobile trading platforms empower traders with the ability to monitor and manage their accounts from anywhere with an internet connection. This newfound mobility enhances flexibility and allows traders to seize trading opportunities even when away from their desks. Social and copy trading platforms, on the other hand, enable traders to connect with and follow the strategies of successful money managers, mimicking their trades in their own accounts.

AI is gradually making its mark in the world of forex trading, powering algorithmic trading systems that analyze market data and execute trades based on predefined parameters. These systems offer the potential for improved accuracy, reduced human error, and around-the-clock monitoring.

Image: www.forexcrunch.com

Expert Advice for Successful Managed Forex Trading

To maximize their success in managed forex trading, investors are wise to heed the following expert advice:

1. **Set Realistic Expectations:** Recognize that forex trading involves risks, and avoid unrealistic expectations of high and consistent returns. Remember, the potential for profits comes hand in hand with the potential for losses.

2. **Embrace Risk Management:** Forex trading carries inherent risks, and effective risk management strategies are essential. This includes setting stop-loss orders, diversifying investments, and understanding the potential impact of leverage.

3. **Continuous Education:** The financial markets are complex and ever-changing. Traders must prioritize continuous education to stay abreast of market developments, trading strategies, and industry best practices.

Managed Forex Accounts Low Minimum

Frequently Asked Questions about Managed Forex Accounts with Low Minimums

- Q: How do I choose a reputable money manager?

**A:** Research managers’ track records, trading histories, and investment philosophies. Consult industry experts and seek recommendations from trusted sources.

- Q: Are managed forex accounts suitable for beginners?

**A:** Yes, managed forex accounts are accessible for traders of all experience levels. Beginners can entrust their funds to experienced money managers, benefiting from their expertise and risk management strategies.

- Q: What are the fees associated with managed forex accounts?

**A:** Managed forex accounts typically operate on a performance-based fee structure, aligning the interests of investors and money managers.