In the dynamic world of forex trading, currency pairs serve as the lifeblood of profitability. Among the myriad of available pairs, major and minor pairings stand out as the most traded and offer unique opportunities for savvy investors.

Image: www.forexnewsnow.com

What are Major and Minor Forex Pairs?

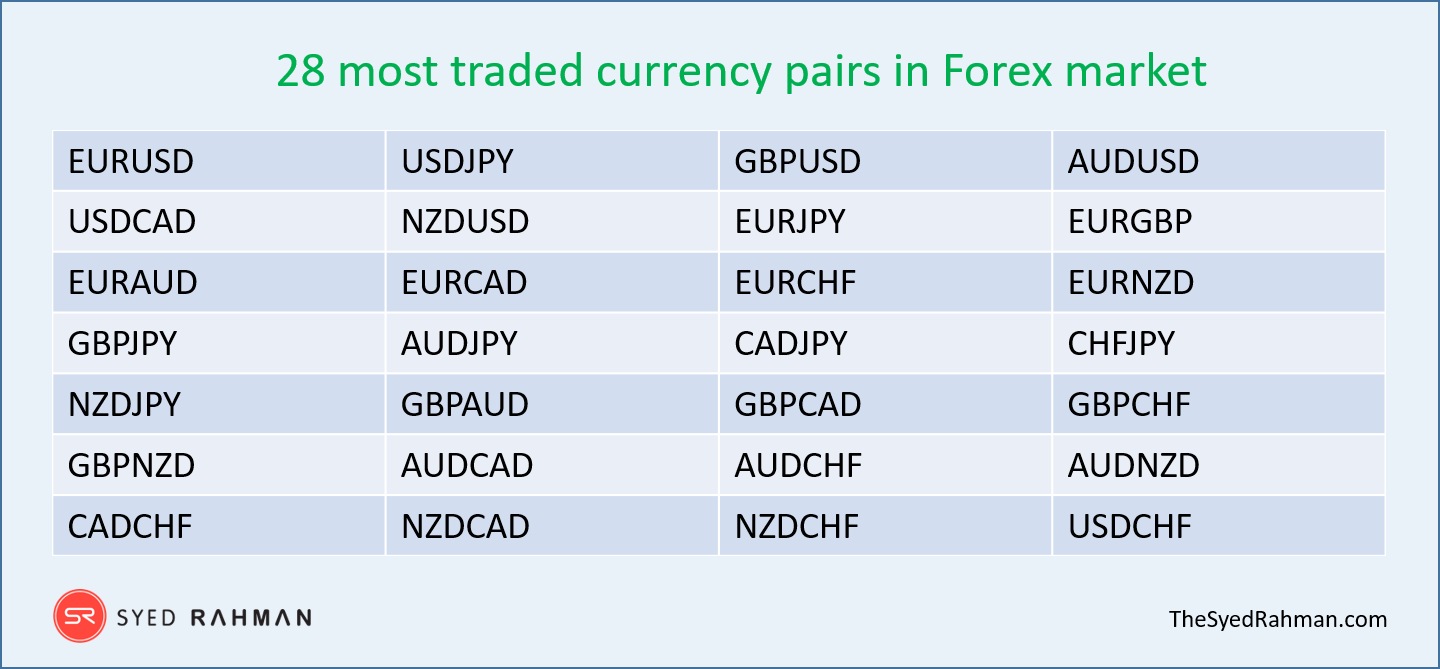

Major forex pairs consist of the world’s most traded currencies, including the US Dollar (USD), Euro (EUR), Japanese Yen (JPY), British Pound (GBP), and Swiss Franc (CHF). They account for over 80% of global forex trading volume, offering high liquidity, tight spreads, and substantial trading opportunities.

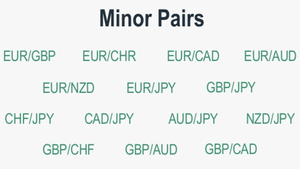

Minor forex pairs, on the other hand, involve less traded currencies from emerging markets or smaller economies. Examples include the Australian Dollar (AUD), Canadian Dollar (CAD), New Zealand Dollar (NZD), and Mexican Peso (MXN). While they typically offer higher volatility and wider spreads than majors, they can also present lucrative trading opportunities.

Benefits of Trading Major Forex Pairs:

-

High Liquidity: Major pairs boast incredible liquidity, enabling swift execution of trades at competitive prices. This liquidity minimizes slippage and guarantees a consistent inflow of buyers and sellers.

-

Stable Volatility: Compared to minor pairs, majors exhibit relatively stable volatility, offering steadier returns and reduced risk. This stability attracts long-term investors and reduces price fluctuations.

-

Greater Accessibility: Major pairs are easily accessible to retail traders through a wide range of brokers and platforms. Their popularity ensures that market data, analysis, and trading tools are readily available.

Opportunities with Minor Forex Pairs:

-

Higher Volatility: Minor pairs tend to fluctuate more than majors, presenting opportunities for short-term trading strategies. By capitalizing on their price movements, traders can potentially generate significant profits.

-

Diversification Benefits: Incorporating minor pairs into a trading strategy can diversify risk and enhance returns. Correlation between currencies can vary, so minor pairs provide exposure to different economic factors.

-

Emerging Markets Exposure: Minor pairs offer insights into the health and growth of emerging markets. By understanding these economies and their currencies, traders can capitalize on opportunities in developing regions.

Factors to Consider when Trading:

When delving into the world of major or minor forex pairs trading, several crucial factors demand consideration:

-

Central Banks: Central banks play a pivotal role in setting monetary policies that influence currency values. Traders must monitor announcements and rate decisions to anticipate market movements.

-

Economic Data: Economic indicators such as GDP, inflation, and unemployment can significantly impact currency valuations. Staying abreast of these data releases is essential for informed trading.

-

Gepolitical Events: Unexpected events, such as political unrest or natural disasters, can trigger market volatility and affect currency pairings. Traders must remain aware of global events and their potential impact.

-

Risk Management: As with any investment, risk management is paramount. Managing position size, setting stop-loss levels, and utilizing appropriate leverage strategies are crucial components of successful trading.

Conclusion:

The world of major and minor forex pairs offers a vast and exciting landscape for traders of all levels. By understanding the unique characteristics and opportunities of each pairing, traders can harness the power of currency combinations and reap the rewards of profitable trading. However, it is essential to approach trading with a well-informed strategy, robust risk management, and unwavering dedication.

Image: forexoctavesystemreview.blogspot.com

Major And Minor Forex Pairs