In the fast-paced world of forex trading, every pip counts. That’s why choosing a broker with low spreads is crucial for maximizing your profits. Spreads, the difference between the bid and ask prices, can eat into your earnings, especially if you’re scalping or day trading. To help you make an informed decision, we’ve put together a comprehensive comparison of the lowest spread forex brokers.

Image: www.audacitycapital.co.uk

The Importance of Spreads in Forex Trading

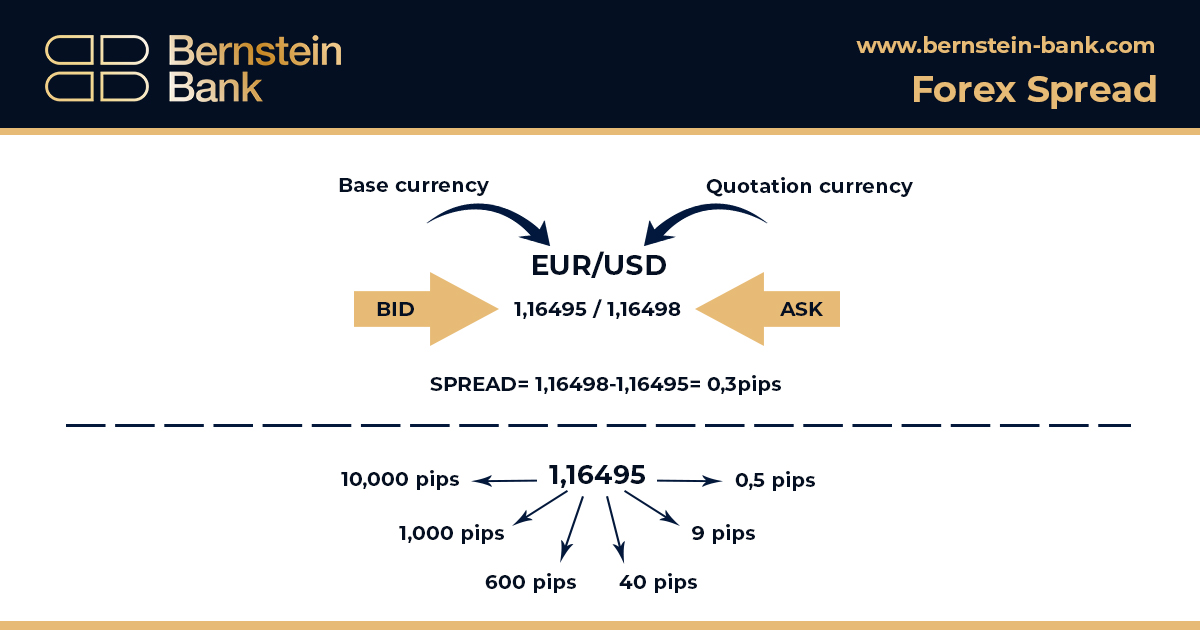

Spreads are like a commission that you pay to your broker for facilitating each trade. The lower the spread, the more of your profit you keep. Brokers typically quote spreads in pips, which represent the smallest price increment for a given currency pair. For instance, a spread of 1 pip on EUR/USD means that you’ll pay 1 cent for every €1,000 you trade.

Over time, even small spreads can add up. If you trade frequently, a broker with consistently low spreads can make a significant difference to your bottom line. For example, if you trade 10 micro lots (0.01 lot) of EUR/USD per day and your broker charges a spread of 2 pips, you’ll incur $2 in trading costs. But if you switch to a broker with a spread of 1 pip, you’ll save $1 per day, or $250 per month.

Comparing the Best Low Spread Forex Brokers

Several brokers offer low spreads, but not all are created equal. To help you find the best broker for your needs, we’ve compared the spreads of several top-rated forex brokers:

- XM Global: XM Global consistently offers some of the lowest spreads in the industry, with an average spread of 0.6 pips on major currency pairs. They also provide excellent trading conditions, including no minimum deposit and leverage up to 888:1.

- IC Markets: IC Markets is another reputable broker known for its tight spreads. They offer an average spread of 0.8 pips on major currency pairs and support a wide range of trading platforms.

- Pepperstone: Pepperstone is a top choice for traders who demand high execution speeds and low latency. They offer an average spread of 1.0 pip on major currency pairs and provide access to the powerful MT5 trading platform.

- FXTM: FXTM offers a range of account types to suit different traders’ needs. Their Standard Cent account has an average spread of 1.3 pips on major currency pairs, while their ECN Zero account offers spreads as low as 0.1 pips.

- Oanda: Oanda is a long-established broker with a reputation for transparency and reliability. They offer an average spread of 1.2 pips on major currency pairs and provide a user-friendly platform.

Other Factors to Consider When Choosing a Low Spread Forex Broker

While spreads are an important consideration, they’re not the only factor to consider when choosing a forex broker. Here are some other factors to keep in mind:

- Regulation: Choose a broker that is regulated by a reputable financial authority to ensure the safety of your funds.

- Trading platform: Consider the trading platform offerings of different brokers. Some platforms are more user-friendly than others, and some offer more advanced features.

- Customer support: You should be able to get help when you need it. Look for a broker that provides 24/7 customer support.

- Additional fees: Some brokers charge additional fees, such as inactivity fees or withdrawal fees. Make sure you understand all the fees before signing up with a broker.

Image: bernstein-bank.com

Lowest Spread Forex Broker Comparison

Conclusion

Choosing the right low spread forex broker can significantly impact your trading profits. By considering the spread, regulation, trading platform, customer support, and additional fees, you can find a broker that meets your needs and helps you maximize your trading potential. Whether you’re a beginner or a seasoned trader, comparing the lowest spread forex brokers is essential for making an informed decision.